This is the second, in a series of posts (see here), about HIE’s mismanagement of Cairn Gorm based on their latest response to my questions about the procurement process which led to CairnGorm Mountain Ltd being outsourced to “Natural Retreats”.

In 2013 Highlands and Islands Enterprise excluded Cairngorms Snowsports, a sound local company with a great deal of relevant experience, from the tender process to operate Cairn Gorm because it did not meet the minimum £500k turnover threshold they had set (see here). The paper approved by the HIE Board in February 2014 shows that Natural Retreats UK also FAILED the financial standing test set by HIE (see above). This shreds HIE’s argument that their failure to evaluate Natural Assets Investment Ltd, the company to which they sold CML, did not matter as they had evaluated Natural Retreats UK:

As part of the evaluation of tenders, HIE evaluated the economic and financial standing of those organisations which bid to HIE to assume overall operational responsibility for operations at Cairngorm Mountain. As noted above, it was NRUK, rather than NAIL, which was the company which bid to HIE to assume responsibility for operations at Cairngorm Mountain. Although it was agreed that CML would be acquired by NAIL, NAIL did not have any day-to-day operational responsibility for CML. Accordingly, in evaluating the proposals for future operation of Cairngorm Mountain, HIE evaluated the economic and financial standing (including turnover) of NRUK rather than NAIL.

(Email from HIE to Mike Shepherd, former Managing Director of Cairngorm Snowsports, 24/2/19 (see here))

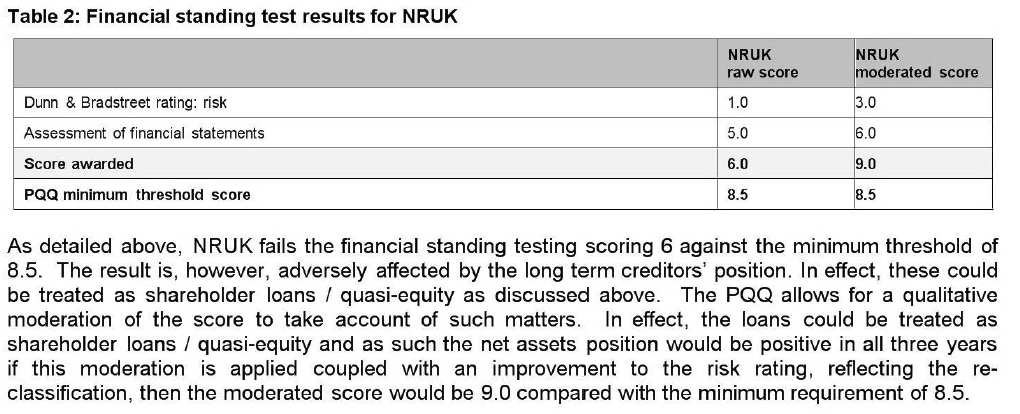

While there is still a question about whether HIE was right to evaluate one company, Natural Retreats, and then appoint another, NAIL, what the FOI response shows is that NRUK failed the financial standing test scoring 6, well below the minimum of 8.5. HIE, however, then manipulated the result by “moderating the score” and arguing that the loan (£3,434,406 March 2013) from one of the owners, David Michael Gorton should be treated as quasi-equity. That brought the score up to 9, a pass. That provides clear evidence that HIE broke their own rules to allow NRUK through.

This was corrupt. There is a clear difference between debt and equity as is shown by what has happened since CML was put into administration. Had NAIL invested in CML in the form of equity, NAIL would have LOST all they had invested. However, by LENDING CML money, they are likely to end up getting back a significant proportion of what they lent (see here) as one of the main creditors of the company.

How did this happen?

The information on Natural Retreats’ financial standing is not in the sections of the Board Report which deal with the Procurement Process or overview of bids received which stated (wrongly) that:

NR passed all the pass/fail questions, and achieved a score of 71 out of 100 which exceeded HIE’s

minimum threshold score and was the higher scoring bidder. On this basis it is recommended that NR is appointed Preferred Bidder and the project team seek to finalise the contractual arrangements with NR.

Instead, later on in the Board Paper is a section headed “Basis of Contracting with Natural Retreats” that includes a section on the Financial Standing Test. One sentence in this says it all and should have been a red light to the Board:

NRUK continues to exhibit weak trading performance, owing largely to its high administrative expenses. It has net liabilities of circa (£1.9m) and similar to NAIL appears fully reliant on the financial support of D Gorton for its immediate future.

No explanation was given about WHY Natural Retreats administrative expenses so high. Had this been investigated HIE might have stopped money being siphoned out of CML for the last four years.

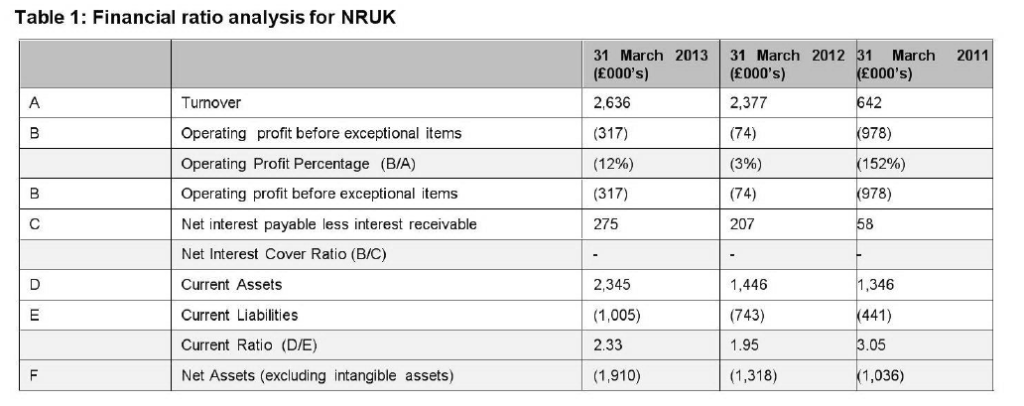

The first table gave the HIE Board every reason they needed NOT to approve Natural Retreats:

This was a company that was effectively bankrupt. Procurement advice is consistent on one point, you don’t contract with bankrupt companies and yet that is what the HIE Board did.

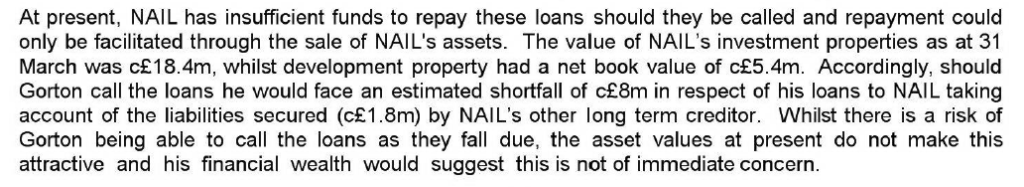

NAIL to whom the HIE Board agreed to sell CML was even more bankrupt. The Board paper reveals that they were made fully aware of this:

“Financial Standing Test

EY has re−performed the financial standing test on NRUK and the key issue remains that this company and NAIL and its subsidiaries are fully reliant on the support of Gorton to continue operations. The ability of the group to continue is therefore fully contingent on the ability and intention of Gorton to fund these businesses.

Comment: correct! So why, despite the very high risks, did EY recommend the appointment of NRUK/NAIL? As we now know those risks had very real consequences for the public purse when Gorton decided to cease “funding” CML last October (despite just a few weeks before having certified in the Annual Accounts that he would support the business for another year).

The message to the Board, however, appears to have been, disregard what the figures are telling you and trust the hedge fund manager.

This was an extraordinary failure in critical oversight and governance. It was led by Charlotte Wright , who is now Chief Executive of HIE, on the advice of Ernst Young, one of the big four accountants “. Unfortunately, the publicly available Minute of the Board Meeting (see here) – at which interestingly the then Cabinet Secretary for Finance John Swinney was in attendance – contains NO record of the key governance issues. It does not indicate whether there was any discussion about either the validity of the procurement exercise or the risks of contracting with companies which appeared effectively bankrupt.

What’s gone wrong

The best that can be said about the procurement exercise which led to CML being sold off is that it was pockled and the HIE Board hid behind their staff, who had no basic procurement expertise, while their staff in turn hid behind Ernst and Young, who had very little procurement expertise either. The Paper to the HIE Board recommending the appointment of “Natural Retreats” could best be described as designed to cover backs. To the people involved the £368k EY charged for their “work” was no doubt a small cost.

This type of governance failure is all too prevalent in neo-liberal Britain – it easily leads to much greater corruption – and is well explained by Atul Shah, in a recent article on the Competition and Markets Authority report on the big four accountants:

The other major contributor to audit failure is the UK’s system of corporate governance. My research into the 2008 collapse of HBOS, the largest corporate failure in British history, shows that the bank’s board and audit committee failed to adequately question the business strategy and risk-taking or to police the quality and conduct of audits.

Most non-executive directors rarely challenge the executives they ostensibly oversee. Instead, they have become habituated to rely on auditors to provide them comfort, and the auditors have in turn relied on management.

(Extract from Financial Times)

I will come back to this failure in further posts. The revelation, however, that Natural Retreats as well as NAIL failed HIE’s financial standing test should give the Scottish Parliament every reason they need to set up an investigation into what has gone wrong at Cairn Gorm.

Not a lot to argue with in all that other than if Cairngorm Snowsports had won the contract then CML would have led them to be belly up in very short order. They should count themselves lucky.

CML will always lose money and if skiing is to continue that needs to be recognised and everyone can move on.

> CML will always lose money

Disagree – That is inherently flawed assumption.

Snowsports can generate massive profit in a good year, but is not reliable…. How else do the other 4 Scottish ski areas survive ? The key is a year round plan which allows facilities to generate revenue during the 8 months of summer.

The fundamental problem at Cairngorm is their main attraction for much of the year (funicular) was unable to generate repeat summer customers – partly due to the VMP which doesn’t allow customers to exit the top station. Arguably the public subsidy was used to diversify away from skiing (removal of ciste uplift and other tows) which lead to the current downfall.

As aside : there is a valid argument to provide public subsidy to Scottish ski area. Mainly because it boosts tourist numbers to the highlands at the quietest time of year. i,e it can provide good return on investment.

Hi parkwatch just two say

On bank holiday Monday the police were turning away car drivers from going two Balmah because of a full carpark again

The truth is people were leaving the carpark on a daily basis ,as one car left one move in. Many people had their day spoiled ,what kind of tourism do wee have in Scotland. Pity council’s dont turn away our council TAX

EY will do their best not to make decisions – instead seeing themselves as supporting the decision making. This is an HIE procurement failure, as you conclude, with oversight now emerging as the issue. Full marks for taking the time to research and report on these matters. It’s interesting that, in 2017, there were Scottish Government proposals to disband the HIE board and centrally control it more (to coordinate enterprise investment better across the various organisations involved). These were voted down “to retain local control of strategic direction”. Hmm. Cairngorm is good evidence of where more objective strategic control might actually be justified. The ski industry in general is an example of how a national strategy of investment would probably be more appropriate. A cynic might conclude that the HIE board at the time this debacle started were keen to demonstrate the importance of their local decision making…

Yes, quite a few comments on an excellent appraisal of the appalling mistakes and maladministration made by HIE in appointing Natural Retreats back in 2014, but I think most of the comments are missing the point. There is NO evidence that HIE, far less the Scottish Government, has learnt any lessons from not just one but two failures of Cairn Gorm Mountain operators. That is why an independent investigation is needed to bring the persons involved to account and force changes before yet another plan doomed to failure is hatched – spending (wasting) yet more public money.

HIE’s past record is surrounding itself with over priced consultants (of arguably dubious pedigree) who tell it what it wants to hear. In this way, it can say that it took the ‘best’ advice available and consequently cannot be blamed …. for its incompetence. From the crumbs of evidence leaking out they seem yet again intent on building on past failures, instead of objectively reviewing and learning from what has gone wrong, and why the other 4 main ski centres in Scotland who have been given only a tiny fraction of public support continue to be financially successful.

Lastly, why is the Scottish Government not investigating the ridiculously high administrative expenses paid to Natural Retreats and the very high payments to directors? Is it because they don’t want to admit that the contract conditions were incompetently drafted, enabling the syphoning off of the positive cash flow from season tickets etc.?