The posts on parkswatch last week by Graham Garfoot (see here) and Alan Brattey (see here) coincided with the excellent coverage from the BBC about Highland and Islands Enterprise’s disastrous management of Cairn Gorm. This appeared on both radio and TV and while I had been interviewed for the story a few weeks ago I did not know when it would appear. The written version, titled “Cairn Gorm Mountain: Where did the money go?” (see here) is well worth reading and should provide a reference point for further investigations into how HIE has operated the Cairn Gorm estate.

The BBC coverage has resulted in a number of politicians nationally, as well as local MSPs, calling for further investigations. The Green MSP Andy Wightman supported the call for a parliamentary inquiry and Tory MSP Murdo Fraser referred to the previous inquiry into the funicular by the then Public Accounts Committee. That is welcome. This post takes a further look at the flawed procurement process which led to the appointment of Natural Retreats in the light of the BBC coverage. It argues this process has contributed to the whole disaster and that it alone merits a parliamentary investigation.

What qualifications did Natural Retreats have to run Cairngorm?

The BBC coverage revealed that Natural Retreats has just rebranded itself as “Together Travel” – this is an “organisation” that morphs so often its hard to keep up.

“Natural Retreats”, the organisation that HIE put its faith in to run Cairngorm for 25 years has now, for all intents and purposes, disappeared, its identity “refreshed”. The company Natural Retreats UK Ltd was renamed the UK Great Travel Company in 2017 and now, if you do a web search, you will be directed to Natural Retreats in the US (or to old parkswatch posts!).

The Travel Together website confirms that “Natural Retreats” was only ever a holiday lettings company, no more. That raises some important questions about the procurement process and how HIE decided that a fairly new holiday lettings company could achieve the goals it had set:

The purpose of this project is to appoint a suitably qualified and experienced operator to operate the Cairngorm funicular railway and resort operating facilities and to maintain assets on Cairngorm Mountain. This would include all aspects of managing, operating, maintaining and investing in a significant and diverse asset base, including compliance with the regulatory requirements associated with operating a funicular railway and ski-tows. The scope of operations are summarised below.

(Extract from pre-qualification questionaire from tender documents)

- How did a holiday lettings company decide it was worth responding to HIE’s tender in 2013 to run the highly complex and challenging operation that is Cairn Gorm?

- And more specifically, to what extent if any was Natural Retreats encouraged to respond to the tender because of the business relationships they had established with HIE over elsewhere in the Highlands, for example at John O’ Groats?

- How did HIE decide that a holiday lettings company was a “suitably qualified and experienced operator” fit to operate Cairngorm Mountain Ltd?

- And more specifically, why did HIE officials later portray Natural Retreats as having more experience than they appear to have had?

“With over 100 years of relevant international and regional leisure and tourism experience, Natural Retreats’ senior management in both Europe and the US bring a wealth of expertise to the Resort. The UK’s largest and busiest skiing destination will be led by Natural Retreats’ market-leading operational team, who have over 65 years of experience within Ski Resorts worldwide. The brand currently operates in close proximity to four world-renowned US ski destinations and Cairngorm Mountain is the perfect addition to their portfolio.” (Extract from HIE news release 6/4/14)

Natural Retreats US describes itself (see here) as a luxury vacation rental management company which happens to manage property in a number of ski resorts. Thomson and Crystal may run excellent package ski holidays but no-one would suggest this would qualify them to operate the lift infrastructure and pistes in Les Trois Vallees or the Espace Killy. So just what “international experience” did Natural Retreats have which was relevant to Cairn Gorm? And why did HIE select them IN PREFERENCE TO a local company, Cairngorm Snowsports, which had a fine track record of running a successful business at Cairn Gorm?

The contract that never was

Parkswatch has previously asked how HIE could have sold Cairngorm Mountain Ltd to Natural Assets Investment Ltd, in breach of the selection criteria set out in the tender documents (see here). NAIL’s turnover at the time was lower than the £500k threshold set by HIE and significantly less than that of Cairngorms Snowsports, which was excluded from the tender process for this very reason.

HIE’s explanation is that they evaluated Natural Retreats UK NOT NAIL against the selection criteria (and NRUK’s turnover was over £2.5 million in the year to March 2013 so well over the threshold):

As part of the evaluation of tenders, HIE evaluated the economic and financial standing of those organisations which bid to HIE to assume overall operational responsibility for operations at Cairngorm Mountain. As noted above, it was NRUK, rather than NAIL, which was the company which bid to HIE to assume responsibility for operations at Cairngorm Mountain. Although it was agreed that CML would be acquired by NAIL, NAIL did not have any day-to-day operational responsibility for CML. Accordingly, in evaluating the proposals for future operation of Cairngorm Mountain, HIE evaluated the economic and financial standing (including turnover) of NRUK rather than NAIL.

(Email from HIE to Mike Shepherd, former Managing Director of Cairngorm Snowsports, 24/2/19)

This fits with the Contract Award Notice which was published on the Public Contracts Scotland portal and is just what one would expect for an organisation that had successfully negotiated its way through the tender process.

The issue, however, is that despite announcing that NRUK had been awarded the contract HIE never entered into any contract with them. Instead, HIE sold Cairngorm Mountain Ltd to a separate company which, although it had shared directors, had completely different owners. That company, NAIL, did NOT meet the pre-qualification criteria. Moreover, having said in the Contract Award Notice that that the contract would not be “sub-contracted” that is in effect what happened – NAIL subcontracted the running of CML back to Natural Retreats UK

What’s even more extraordinary is that since last year, HIE have been claiming that that contract was nothing to do with them:

“HIE has not asked to see a contract between UKGTC [the new company name for NRUK) and CML as this is a commercial arrangement.” (email from Charlotte Wright, Chief Executive of HIE, to author)

“The contractual arrangements which CML put in place with NRUK to ensure that CML met its obligations to HIE under the operating agreement were a matter for CML and NRUK.” (email from HIE to Mike Shepherd 2nd March)

As Project Manager who oversaw the outscourcing of CairnGorm Mountain Ms Wright must have authorised the Contract Award Notice stating that the contract had been awarded to NRUK. Four years later, as Chief Executive, she has been claiming that any contract NRUK had to operate Cairn Gorm was not HIE’s business.

The BBC’s investigation suggests that those claims are not true because HIE told them they had agreed a management fee with NRUK:

“It [the Administrator’s Report] said that there was a monthly “management fee” paid from the operating company CairnGorm Mountain Limited to Natural Retreats of £40,000.

When we asked HIE about that they confirmed that had been negotiated at the point of handover and represented an industry standard level of fee.”

In effect it appears HIE agreed NRUK could charge a fee for services amounting to almost £500k a year without knowing what those services would be (because the contract was a “commercial matter”). That’s extraordinary! Just what services HIE thought a holiday lettings company could offer that would provide value for money is not clear but is central to what has gone wrong. Cairn Gorm was in desperate need of investment but almost the first thing HIE did on appointing Natural Retreats was to agree it could take out £500k from the operation in fees. That money could have been far better spent.

HIE’s evaluation of NRUK/NAIL’s economic and financial standing

The BBC’s coverage rightly states that the main justification for the outsourcing was that it would result in investment in the mountain. This is confirmed in the tender documentation:

High evaluation scores will be awarded to investment plans that can demonstrate they are deliverable, fundable and support diversification within the environmental constraints of

Cairngorm.

While NRUK may have met the minimum turnover requirements for the tender, its accounts to March 2013 show it had made a loss of £592,117 and had net liabilities of £1,910,105. While this was less than NAIL’s net liabilities at the time (£2,866,549), NRUK’s accounts suggest it was in no position to raise money to invest at Cairngorm (even though its liabilities did not subsequently increase in the way those NAIL did (see here)).

In fact, aside from the question of whether it was legitimate for HIE to switch from one company to another during the tender process, the fact is that NEITHER NRUK nor NAIL were in a position to invest in Cairngorm, hence why HIE offered a £4m loan. This raises two questions in relation to the procurement process.

The first relates to HIE’s assessment of NAIL and NRUK’s financial standing. In response to Mike Shepherd questions about this HIE are like a stuck record:

“HIE’s advisors, EY [Ernst and Young], applied the minimum financial standing test in order to assess the financial standing of bidders during the procurement process. This exercise was undertaken using best practice principles. All bidders who moved through to the bid stage met the necessary criteria as part of this evaluation, including Natural Retreats. EY evaluated the economic and financial standing of NAIL in its capacity as the proposed parent company guarantor using best practice principles”

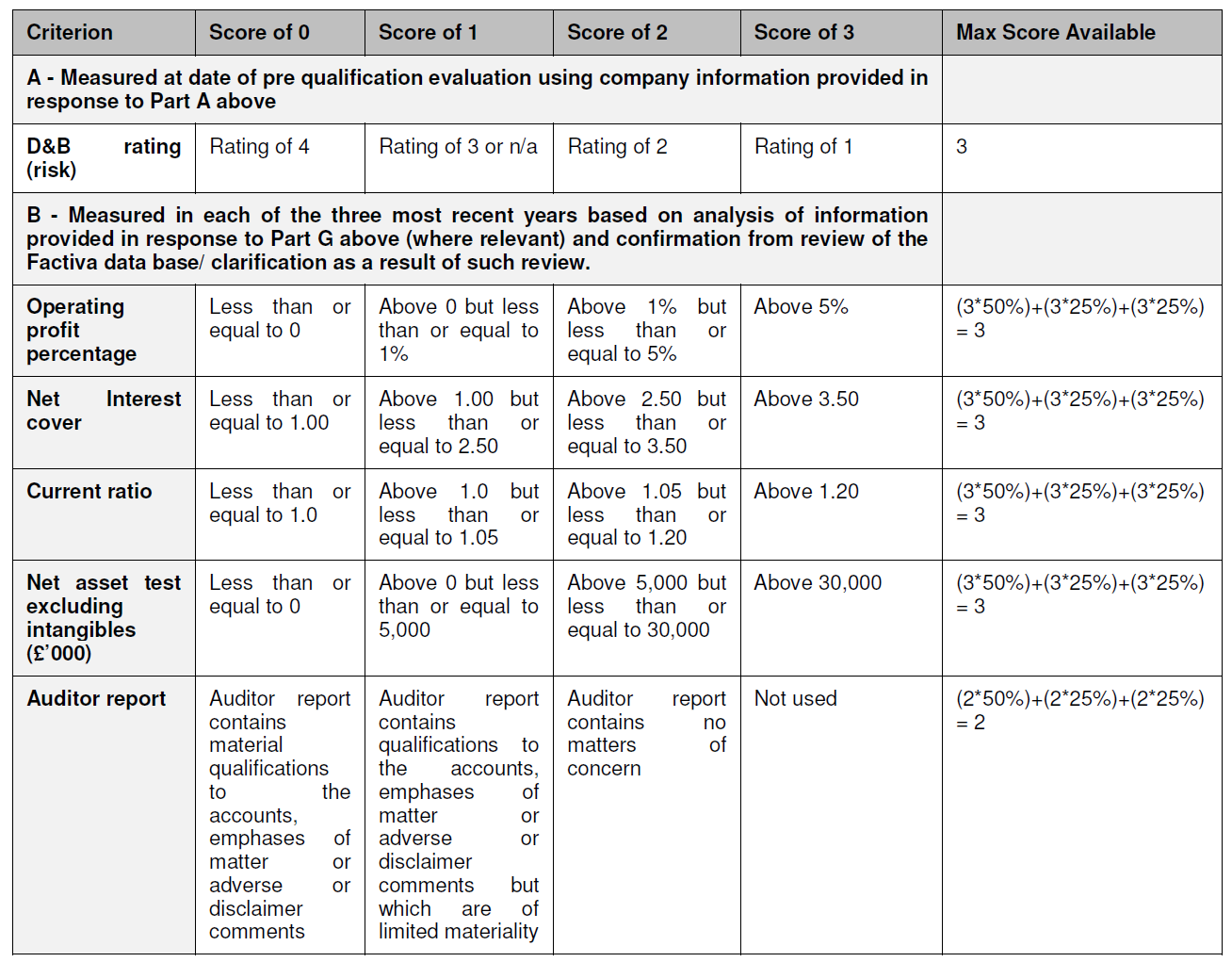

Perhaps its time that HIE released the scores awarded to NAIL and NRUK under the criteria set out in the tender documents? (D & B = Dun and Bradstreet)

From their accounts, its hard to see how NRUK or NAIL could have achieved anything but a low rating – yet HIE proceeded to negotiate with them. Why?

The second question is when and how HIE decided to offer “Natural Retreats” a £4m loan before the tender process was concluded. This was highly irregular. There was no mention that I can find in the tender documents of such a loan being available. Had there been, other organisations with more relevant experience but without access to capital might have been encouraged to bid. That failure should have invalidated the entire tender process. Instead, what seems to have happened is that HIE having been that Natural Retreats were the people to run Cairn Gorm realised they had no money and then offered them a loan. Its unclear whether this £4 loan was approved under delegated authority or went to Scottish Ministers for approval. If it did go to Scottish Ministers, they would be implicated in the failed procurement process.

HIE’s failure to oversee what was going on at Cairn Gorm

The BBC’s coverage also reveals that on top of the £40k a month management fees that other money was being taken out of Cairngorm Mountain and HIE did not know what this was for:

“There were other payments in the accounts that stood out.

CairnGorm Mountain Limited was paying administration charges to the wider NAIL Group.

These amounted to more than £2m in the period 2014 to 2017.

That’s more than the management fees that were signed off by HIE as part of the asset transfer.

What were these for?

We asked HIE and they said they didn’t know – but were still trying to find out.”

That says it all really. HIE only knew about half of what was going on. £4m extracted out of Cairn Gorm in four years and for what?

The BBC coverage also found that:

HIE also told us that over the period Natural Retreats was in charge, HIE spent an additional £3.5m of public money on infrastructure.

That is twice the £1,708,122.23 that HIE had admitted to spending at Cairn Gorm in responses to Freedom of Information requests (see here). So, what was the rest of the money spent on and why has HIE only admitted the full amount now?

What needs to happen

No-one should have any faith that HIE will look into these issues unless forced to do so by the Scottish Parliament. Its not just that their Chief Executive is fully implicated in the failed procurement process, so is the HIE Board which approved the loan while it now appears that Scottish Ministers may also be implicated The HIE establishment is never going to investigate itself.

What’s needed is not just a full investigation of HIE’s mismanagement of Cairn Gorm, including failures in procurement, but also public consideration of their fitness to own the place and oversee its management in future. While it appears that Audit Scotland are now becoming involved, partly because of the efforts of local MSPs, I do not think this will be enough. What is needed is a parliamentary inquiry and the debate now should be whether this would best be undertaken by the Scottish Parliament’s Public Audit and Post-legislative Scrutiny Committee, by the Rural Economy and Rural Connectivity Committee (to whom the Minister, Fergus Ewing, is accountable) or some other Committee set up specially for the purpose.

[My thanks to Mike Shepherd for sharing his correspondence with HIE – his successful local business deserved a lot better]

I looked into these companies as soon as it was made public that they got the operating licence from HIE. I wrote on a few websites that the group of companies was a “money-go round” & that they appeared to a bunch of asset strippers & I speculated that they would strip money out of CGM Ltd. & that CGM Ltd. would have to be “rescued” from bankruptcy within 5yrs & they (N.R. Ltd. etc.) would escape scot free & do a runner…..

If I can see that, & I do not class myself as a financial expert, then why can’t the so called experts see that at HIE et all??..

The following info from Companies House:-

Directors of the company (NAIL) are listed as Timothy Dennis, Ewan James Kearney, Matthew Dawson Spence, Anthony Wild. The exact same for CGML!

Ewan James Kearney, Matthew Dawson Spence, Anthony Wild, are members of K2 Equity Partners LLP

Also of note regarding “where did all the money go”, & contained within the lodged accounts of the various companies are the following statements:-

The first set of full (1yr) accounts for CGML under NAIL is the year ending 31/03/2015:-

Section 17 “Control”

“On the 11th June 2014 the entire share capital was purchased by NAIL” – “The ultimate controlling party is considered to be Mr. D. Gorton”.

NAIL, direct statements from the NAIL complex accounts year ending 31/03/2014:-

Section 10. “Investments”

“Subsidiary undertakings”, companies that are part of the group, & under NAIL control.

Pentire Fistral Beach Ltd., holiday lettings

Trewhiddle Village Ltd., holiday lettings

Natural Land 3 Ltd., holiday lettings

North York Moors Ltd., property development

DOL Park Ltd., holding company

John O’ Groats Highland Ltd., holding company

Snowdonia Land Ltd., land ownership (now called Na Lews Castle Ltd)

Yorkshire Dales Ltd., holiday lettings

Natural Outfitters Ltd., Retail & guiding services

Mini Gems Ltd., Design & development of camping pods

Natural Land 1 LLP, property development (subsidiary of DOL Park Ltd.)

JOG Highland LLP, property development (subsidiary of John O’ Groats Highland Ltd.,)

Pentire Management Ltd., property management (subsidiary of Pentire Fistral Beach Ltd)

NL3 Cottages Management Ltd, property management (subsidiary of Natural Land 3 Ltd)

Natural Land 3 Management Ltd, dormant (subsidiary of Natural Land 3 Ltd)

“Other participating interest held by the company”

Jog 2 Ltd, land ownership

Jog 3 LLP, land ownership

Gibbon Lawson McKee Ltd, surveying & architecture

End to End Ltd, leisure & events company

Section 13. “Creditors”

Group £43million

£37million of which is the company & is owed to D.Gorton!

£2.7million of a bank loan on a secured debenture, payable by June 2022

Section 16 “Related party relationships & transactions” .

GROUP

“Interest amounting to £2,801,864 was payable to D.Gorton, the ultimate controlling party of the group”.

“Long term creditors including loans amounting to £40,590,861 (yes £40million) owing to D.Gorton at various interest rates with an indeterminate repayment date”.

“Group received services to the value of £46k from K2 Equity Partners LLP”.

Section 20 “Ultimate Controlling Party”

“The ultimate controlling party is Mr. D. Gorton”.

Who is Mr. David Gorton? a Hedge fund manager!

I’m getting to the point of being lost for words at the total ineptitude of HIE. On Friday 22 March I listened to Susan Smith of HIE being interviewed for BBC Scotland 1.30 p.m. News. She had the audacity to claim that public money has NOT been lost on Cairn Gorm Mountain – an incredible and frankly insulting claim. I understand that Fergus Ewing was interviewed by Radio Scotland on Tuesday 26 March. In that interview he maintained that the contract award process was in order (!) but just ‘ducked and dived’ on the subsequent issues such as the syphoning off of £500k per year for ‘management costs’. I think it is highly likely that Fergus Ewing and his predecessors are implicated in this debacle – if they are not, then they have displayed extraordinary negligence in the management of public money.

HIE and the Scottish Government will just try to play for time and hope it all gets ‘archived’, and then make a magnanimous announcement of new funds for the redevelopment of Cairn Gorm Mountain to gloss over the past incompetence. We must try to keep the momentum going to get a fully independent enquiry into the massive loss of public money. so that lessons are learnt, before, any new money is committed to Cairn Gorm.

All very true and how has a failed hotel manager is still in charge of the mountain

It was NAIL or HIE or closure. Still is but NAIL have given up.

As usual a great post from Nick and the detailed analysis of the sums involved by Mr Ross (above) is truly gobsmacking. Who indeed is this character David Gorton and how come his financial involvement (£40 Million!!!) was ever allowed to accrue to such an amount without, as history has all too clearly demonstrated, proper accountability.

As for this rebranding from NR to Great Travel Company to “Together Travel” it would appear that far from some serious soul searching and questioning their own ethics (or lack thereof) the merry Directors just whimsically move from one “foul-up” onto another without a moment’s reflection on what they might be doing wrong. Together (no pun intended) the Directors that David Ross so carefully outlines, inc Messrs Spence and Kearney, appear to make the US President look a model of honesty and propriety, IMHO. The fact that they now lack the cahoonas to respond to questions posed by the BBC speaks volumes for their character.

Only a few years ago they were conspicuously less self-effacing. The following is extracted from a BBC article (see here)

“Matt Spence, founder of Natural Retreats, said he hoped to attract the international winter and summer X Games to the Cairngorms.

X Games sports include skateboarding, snowboarding, skiing and BMX.

Mr Spence said: “I am immensely thrilled with the appointment of Natural Retreats as operator of CairnGorm Mountain.

“We truly believe Natural Retreats will elevate CairnGorm Mountain as one of the leading leisure and adventure resorts in Europe.”

What a pile of steaming stew!!!!

It is good to know that the BBC are doing some Reporting of the situation and in particular about the fine line that the conflicted “not me, guv” Mr Ewing is now treading, seeking to hold HIE to account for their accountability in the “running” of the Funicular Fiasco (aka him passing the buck)

(here)

26 Mar 2019 – Labour MSP Rhoda Grant raised concerns with Mr Ewing at Holyrood about the running of Cairngorm Mountain

Well done Rhoda Grant. Pity there aren’t more MSPs like you.

Colin, its not just Rhoda Grant who has now taken the issue up among local MSPs, John Finnie, Green MSP has taken the matter up with Audit Scotland as I understand it and Edward Mountain, has just referred the matter to the Scottish Parliament’s Audit and Scrutiny Committee. So, plenty of local political concern now. Unfortunately local MSP, Kate Forbes, after expressing incredulity at what has been going on, more recently has implied in the Strathy that criticism of what has happened is destroying the reputation of the area, i.e that critics should shut up. My view is that this has nothing to do with the reputation of the area, rather with HIE and why they still own the Cairn Gorm estate, and Ms Forbes should be pressed to support a public inquiry.

HIE should be disbanded in its present form and Fergus Ewing sacked