Recap

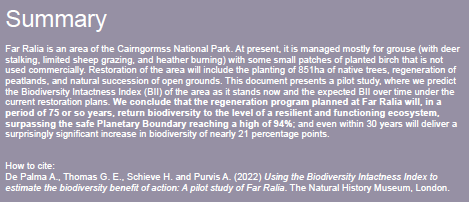

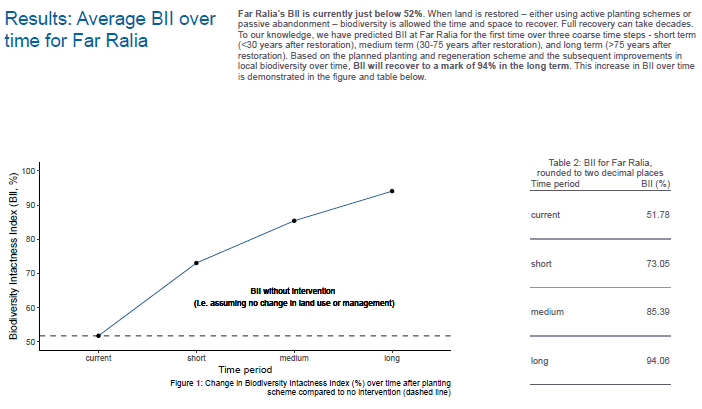

The Biodiversity Intactness Index (BII) was used by Abrdn to claim that its ‘restoration project’ at Far Ralia -actually a tree-planting carbon offsetting project financed by public money – would achieve a BII of 94 out of 100 ‘in the long term’ because of a report published by the NHM.

My first post used responses to FOI requests to show NHM staff had never visited Far Ralia but instead undertook a desktop exercise in which the applied something called the PREDICTS database. They then applied this theoretical framework to the proposed tree planting at Far Ralia without considering alternative ways of managing the land for nature, most notably reducing deer numbers and enabling it to regenerate naturally. When the NHM were asked to provide all the specific figures, statistics, formulae used in their calculations for Far Ralia, it refused to provide this information. That mean their figures cannot be peer reviewed and have NO scientific validity – a telling indictment of the state of science at a once venerable institution.

Who paid for the NHM’s report on the BII at Far Ralia?

In response to an FOI request asking if they had won the work as a result of a tender the NHM initially claimed they had done the work as a free of charge case study:

This did not sound either convincing, given the pressure public institutions are under in both the UK and Scotland to raise income for their work, or in the public interest so the NHM were asked to review their response. This elicited the following:

Just why “extensive enquiries” were required to establish that the report which the NHM had claimed had been done ‘free of charge’ was actually carried out as part of “a commercial barter arrangement” is unclear. The response begs two further questions:

- How did NHM’s commercial barter arrangement with Abrdn fit with this further information response whcih showed they had produce another report on the BII for Federated Hermes and for which they had received a “nominal fee”?

- And what did NHM get in return from Abrdn? Could they, for example, have been promised a share of the profit should Abrdn sell Far Ralia on the basis that its biodiversity intactness has supposedly increased?

Chasing the money – the TFND and the Green Finance Institute

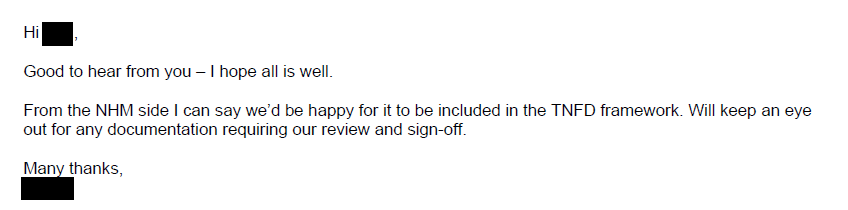

The NHM also provided some redacted email correspondence with EY and Abrdn. It appears from these emails that the NHM agreed that the Far Ralia report could be included as a pilot case study for the Task Force on Nature-related Financial Disclosures (TNFD):

The TFND (see here) is entirely funded by government and private foundations but run by private business: “The Taskforce consists of 40 senior executives from financial institutions, corporates and market service providers across the globe.” All the big four management consultancies, Deloitte, KPMG, Deloitte and PWC are represented. While its mission is ostensibly about concern for nature that concern appears entirely driven by a wish to protect and promote financial interests:

“Mission

Society, business and finance depend on nature’s assets and the services they provide. The acceleration of nature loss globally is eroding the ability of nature to provide these vital services. Taking action to conserve and restore nature is now a critical global priority. Doing so will reduce risks to business and finance. Mobilising business innovation and private finance to halt and reverse nature loss and contribute to nature-positive outcomes will be a major source of new commercial opportunity and competitive advantage. “

The TNFD secretariat is administratively supported by the Green Finance Institute (GFI) and operates as GFI PMO Ltd:

The co-chair of the TNFD taskforce and one of the Directors of the GFI PMO Ltd is David William Ian Craig (see here) who also happens to be a trustee of the NHM:

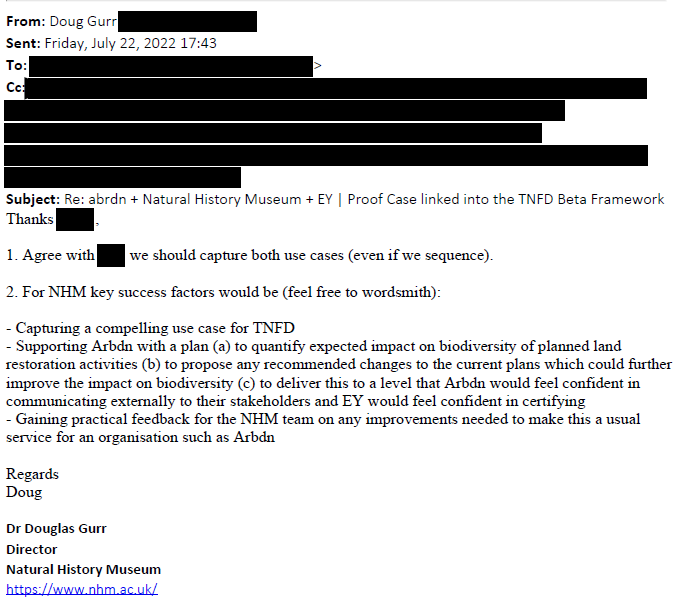

Another redacted FOI response shows that Doug Gurr, the director of the NHM, was very keen to use the Far Ralia study as a commercial opportunity stating “key success factors” for NHM would be “capturing a compelling use case for TNFD” and to “make this a usual service for organisations such as Arbrdn” (sic):

Fa

Having claimed that Abrdn’s tree planting would increase Far Ralia’s Biodiversity Intactness to 94% there was little room for the real scientists at the NHM to recommend changes to their plans. But the way Abrdn has quoted the NHM’s BII report all over the sales brochure for Far Ralia shows they were confident they could use this work to justify trying to sell land for £12m which three years previously they had bought for £7.5m.

Unfortunately, prior to leaping into this “commercial barter arrangement” it appears the NHM had neglected to establish HOW Abrdn would be paying for the tree planting and how green finance would be involved. In response to a question as to whether they were aware that the tree planting would be funded by the taxpayer to the tune of £2.5m the NHM responded as follows:

This also suggests that neither Abrdn nor AKRE told the Natural History Museum that Abrdn would be eligible for millions of pounds of public funds from the Scottish Government when the woodland creation plan was approved.

The GFI is also known for its close relationship with NatureScot and the Scottish and UK Governments. It is the organisation that made the highly questionable claim of a “£20bn finance gap” for nature restoration quoted by the Green MSP Lorna Slater when she was the responsible Minister (see here). The £20bn figure was later completely taken apart in an excellent blog post by Laurie MacFarlane on Future Economy Scotland article (see here).

Chasing the money – Federated Hermes

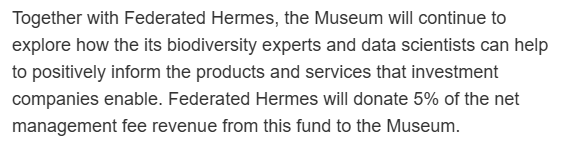

The NHM’s provision of another case study to the global investment firm Federated Hermes for a nominal fee appears linked to the Biodiversity Equity Fund which they set up in 2022:

The NHM also claimed (see here) that the Biodiversity Equity Fund would use the BII, which it described as a “scientifically rigorous metric”, while reporting it would recieve a “donation” of 5% of the “net management fee revenue from this fund”:

The Ferret recently revealed (see here) that a company called Finance Earth – created in 2020 but dormant till this year – had partnered with Federated Hermes to set up an investment vehicle called the “UK Nature Impact Fund”. The article explained that Finance Earth, a company with no record and no activity until this year, had been contracted by the Scottish Government to write two reports for NatureScot on how to attract private investment.

The Ferret recently revealed (see here) that a company called Finance Earth – created in 2020 but dormant till this year – had partnered with Federated Hermes to set up an investment vehicle called the “UK Nature Impact Fund”. The article explained that Finance Earth, a company with no record and no activity until this year, had been contracted by the Scottish Government to write two reports for NatureScot on how to attract private investment.

Conclusion

It says something about the state of the UK that a world famous museum and charity should be providing reports based on questionable predictions of future biodiversity gains to companies such as Abrdn. But then the NHM’s director Doug Gurr was previously the head of Amazon UK; its trustee David Craig is heavily involved in finance; while its chair is Sir Patrick Vallance, the Chief Scientific Advisor for the climate conference COP26 held in Glasgow in 2021 which was taken over by corporate interests.

According to Doug Gurr, so-called green finance funds “are helping to preserve and restore biodiversity” but in case of Far Ralia and many other native tree planting schemes in Scotland this is clearly untrue. Neither private funds (carbon credits) nor £2.5 million of public funds were needed to help restore nature at Far Falia as natural regeneration would have done the job if deer numbers had been reduced and without all the damage. The £2.5 million could have been far better used elsewhere but instead was effectively used to subsidise an investment fund held in a tax haven.

Far from financial interests restoring nature, it would be much closer to the truth to say that once venerable bodies concerned with conservation are now being taken over by financial interests. The NHM’s deal with Federated Hermes, in which they are supposed to recieve 5% of the management fee from its Biodiversity Equity Fund while also potentially calculating changes in biodiversity using the BII, appears a clear conflict of interest. This undermines their scientific credibility. Rather than science influencing finance, finance now appears to be driving the “science” and in the case of the NHM it appears in real danger of becoming a proxy for the Green Finance Institute.

The NHM has a code of ethics (see here) which should have prevented it ever getting into the position it has:

This Code raises multiple questions. How was the NHM’s work at Far Ralia in the public interest? How does doing work for Federated Hermes for a nominal fee and the commercial barter arrangment at Far Ralia demonstrate “prudence in the administration of public resources”? How does refusing to release the methodology behind the BII work at Far Ralia demonstrate “appropriate professional standards and practices”? How does failing to visit a site or checking how the tree planting was being funded demonstrate “research integrity”? As for transparency and acting “without influence or interference”????

“Green finance” interests often claim that private finance provides an additional source of funding which can reduce the need or the amount of public funds used for nature ‘restoration’ projects. The truth, as I have shown for Far Ralia, Muckrach and the Lost Forest is that the companies which have been buying up land claiming they wish to invest in nature have been hoovering up public funds. If the NHM wants to restore its reputation it needs to disown these speculative green finance schemes and return to what it was once good at.

In that respect it is worth mentioning a wonderful book by Richard Fortey, the famous palaentologist who used to work for the NHM: The Wood for the Trees – the Long View of Nature from a Small Wood. It would be hard to find a better description of what Biodiversity Intactness is all about although I don’t recall Mr Fortey using that term once and the woodland he bought was very different to that in the Cairngorms. Doug Gurr and the other Trustees of the NHM, however, could do no better than read that book and then take a visit to look at Far Ralia to understand where they have gone wrong.

Nick, do you think it would be possible to get this story to George Monbiot at the Guardian to get much wider exposure for this greenwashing hogwash. This private finance money making huge profits for “green” projects is getting more and more popular amongst the city.

Thanks once again Nick for another brilliant expose.

Hi Craig, will try and get it covered elsewhere. Nick