It is almost two years since my last post on the Cononish goldmine (see here) and five since the Loch Lomond and Trossachs National Park Authority (LLTNPA) granted it planning permission. Since the mine was first mooted there has been a steady stream of “news” stories from the owners, Australian Company Scotgold Resources Ltd, about the mine’s prospects and of how well it was doing (see here for example). Those stories have frequently mentioned the potential for Scotgold to expand its mining operations across the Dalradian rocks of Scotland through its (other) subsidiary SGZ Grampian which holds 13 licenses from the Crown Estate to mine gold (see here). Most of this spin is reported uncritically by the media so the piece in the Herald (above), after Scotgold announced (see here) it maybe isn’t a “going concern” after all, was not before time. This post takes a critical look at what is going on.

Scotgold’s finances

Gold is inherently almost as valueless as cryptocurrencies – far more gold has been mined than will ever be needed for the manufacture of mobile phones – but has dazzled people for centuries and its lure has been used to justify almost anything, including the mine at Cononish.

God mining is a very risky business, requiring lots of capital investment up front and is partly a matter of luck, depending on the amount of gold that is carried in the ores. According to the Scotgold Resources website (see here), investigations at Cononish in 2015 had found 65 tonnes of proven ore reserves with a further 490 tonnes probable. The financial viability of the mine has always depended on how far the “probable” gold bearing ore delivers on its promise.

The financial viability of gold mining also depends on the price of gold on world markets. This fluctuates enormously, if not quite to the extent of cryptocurrencies, and is currently at record highs due to the current financial crisis. When the world banking system risks collapse, “gold” is seen as the only safe investment and its price rises. The paradox is that this “safe investment” will only be safe so long as other people believe that this inherently valueless substance has value. If left alone after Armageddon, what would be more useful, a sack of gold or a sack of grain?

Nine months ago Scotgold was claiming the “cut and fill stop[e] (sic) mining” was progressing well and resulted in “record profitable gold production” of 1,984 oz of gold in April and May (see here). This was still well below what would be needed to produce the average annual production that had been predicted for the mine – 23,370oz. As recently as 30th January Scotgold was claiming to the BBC (see here) that it was about to ramp up production, that the gold vein itself, and others nearby, are “hundreds of kilometres long” and that by “the end of this year, it aims to be extracting about 2,000 ounces (57kg) of gold monthly [ie meet its original target] worth more than £3m.”

As long as Scotgold can persuade investors the mine might be about to produce enough gold to become profitable, there will be people prepared to gamble more money and ten days later, Scotgold went to the markets to raise new working capital (see here). The financial markets were not impressed and the value of Scotgold’s shared declined by a third. That they were right was shown at the start of last week when Scotgold reported that in February and March “gold grades began to decline significantly” and that it is now in the process of introducing a different method of mining, “long hole stoping” (see here for an introduction to mining methods). Scotgold did not report how much gold the mine had actually produced in the last few months and unsurprisingly the share price then collapsed, not the first time this has happened.

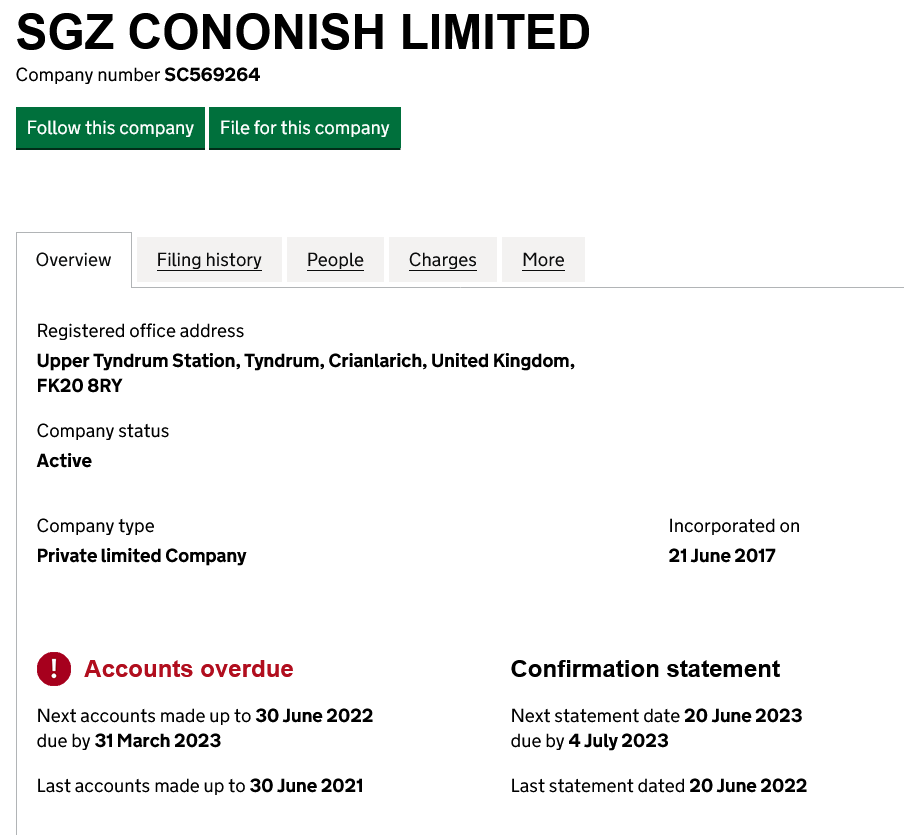

Scotgold allowed the bad news to dribble out slowly and left it to Thursday to reveal that in the half year to December 2022 it had made losses of £5.2m (A$9.5 million), quite a contrast to the £3m a month it had claimed it would start earning in January. The last accounts for the operating company and Scotgold’s subsidiary, SGZ Cononish Ltd (see here), for the year to 30th June 2022 are now overdue:

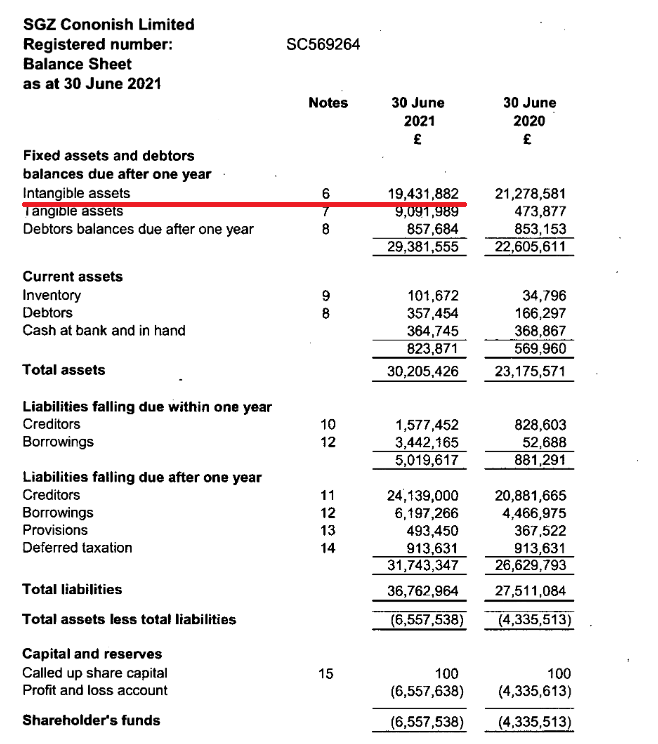

Without accounts, it is impossible to verify the accurateness of the various interim reports issued by the company. However, its last published accounts indicate that SGZ Cononish was in deep trouble in June 2021.The loss for the year was £2,222,075 but what really matters is the balance sheet:

Without accounts, it is impossible to verify the accurateness of the various interim reports issued by the company. However, its last published accounts indicate that SGZ Cononish was in deep trouble in June 2021.The loss for the year was £2,222,075 but what really matters is the balance sheet:

Without reported intangible fixed assets of £19,431,882, SZG Cononish’s liabilities would exceed £25m. So what are those intangible fixed assets? Note 6 to the accounts show that they mainly comprise “Mine Development Expenditure” and this is treated as an asset “unless a project is abandoned or considered as of no further use to the company”. The moot point here is how much anyone would be prepared to pay for those intangible fixed assets given there appears to less gold ore than predicted and the mine has never reached its production targets?

With gold production and revenue stalled, what counts is working capital and, with liabilities in the last accounts increasing from £27,511,084 to £36,762,964 only investors with an enormous appetite for risk are likely to likely to take a punt. Unfortunately it is the small investors, lured by the glow of Scotgold’s golden promises, who are likely to have had and to get their fingers burned.

Besides the production figures, the monitoring reports provided to the LLTNPA provide further indirect evidence that all may not be well:

Why would SGZ Cononish have extended the mine beyond the area granted planning permission if everything was going to plan?

The possible environmental consequences of Scotgold’s financial difficulties

Each time Scotgold runs out of working capital, the pressure on it to cut costs also increases, hence the recent announcement that it intended to change from traditional cut and fill stope mining to long stope mining, which is cheaper. Unfortunately, the LLTNPA only publishes mine monitoring reports on its planning portal six months in arrears (see here), so the most recent available pre-dates the current crisis and the extent to which Scotgold are still abiding by the LLTNPA’s planning conditions is not in the public realm. That is not in the public interest nor in the interests of those being asked to invest in the company as it helps conceal the true extent of Scotgold’s liabilities – I have therefore requested the reported under Freedom of Information.

Given the lure of gold and current prices on world markets, if SGZ Cononish enters administration another mining company might try their luck but there is a risk they could make any takeover dependant on environmental conditions being relaxed. But if not and Cononish is abandoned, the cleanup cost will be considerable.

When LLTNPA officers provided their annual report on the Cononish mine to the Planning Committee in November (see here) they considered “that the value of both the Restoration and Aftercare Bond and the GCGMP [Greater Cononish Glen Management Plan)] Bond could be deficient to meet the anticipated cost of implementing the GCGMP and meeting the Decommissioning and Restoration Obligations”. The restoration bond was only £537,918.20 and the need for this should have been apparent for some time but the review of the amount was only due in January (again, I have requested it under FOI). Scotgold now probably doesn’t have the money to increase the bond even if it was prepared to do so meaning the public could be left with the costs of a significant clean up bill.

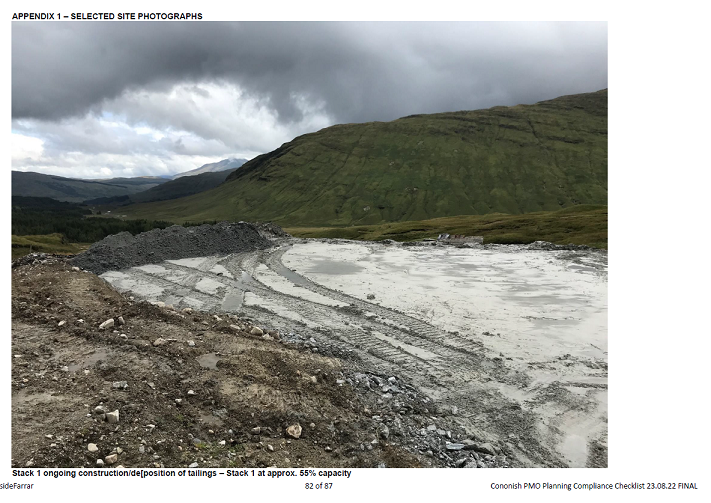

Gold mining is one of the world’s most destructive and unnecessary industries, as explained in this excellent article. The mine at Cononish was partly justified on the grounds that it would use cleaner methods. The LLTNPA allowed, however, the dirtiest part of the process, the extraction of the gold from the concentrated ore to be exported abroad while allowing Scotgold to pioneer a new method of storing mine tailings, in stacks disguised as glacial moraine:

The LLTNPA has recognised some of the risks associated with this. They have set up a Habitat and Land Management Group (whose membership and meetings are secret) to advise on habitat restoration and officers appear to be doing their best to monitor the stack construction closely (information on the stack restoration comprises a large part of the monitoring reports).

While so far there is no sign of the disaster that I predicted might happen, however well restored initially once created there is no escaping the longer-term forces of erosion. The consequences of compressed tailings being exposed to water – whenever this does eventually happen – would appear to be very much more severe than for normal moraine, unless the tailings set like concrete (see photo above). In that case in 200 years time Cononish Glen could be graced with some half finished concrete mounds, standing proud of the wild land round about, monuments to the human obsession with gold.

While so far there is no sign of the disaster that I predicted might happen, however well restored initially once created there is no escaping the longer-term forces of erosion. The consequences of compressed tailings being exposed to water – whenever this does eventually happen – would appear to be very much more severe than for normal moraine, unless the tailings set like concrete (see photo above). In that case in 200 years time Cononish Glen could be graced with some half finished concrete mounds, standing proud of the wild land round about, monuments to the human obsession with gold.

Who knows too what other horrors may emerge once the mine does stop working?

Gold mining in Scotland and public policy – what needs to happen

If we stopped extracting black gold, Scotland’s oil and gas, immediately that would cause obvious problems – there needs to be a transition – but if we stopped extracting the real stuff now we would immediately reduce carbon emissions and reduce the damage to the natural environment. Moreover, while the mine currently employs a fair number of people (c80 according to Scotgold), most are expert tunnellers whose skills could be deployed creating an alternative to the A83 under the Rest and Be Thankful and to the plans to widen the A82 along Loch Lomond.

Politically, with the Scottish Greens still partners in the Scottish Government, there is an opportunity for them to demand an end to any further gold mine development in Scotland now. As part of this, Lorna Slater, the Green MSP who has retained responsibility for National Parks in the new Scottish Government, could be seeking public assurances from the LLTNPA that they will not relax any of the planning conditions that apply to the Cononish Mine as a result of Scotgold’s difficulties.

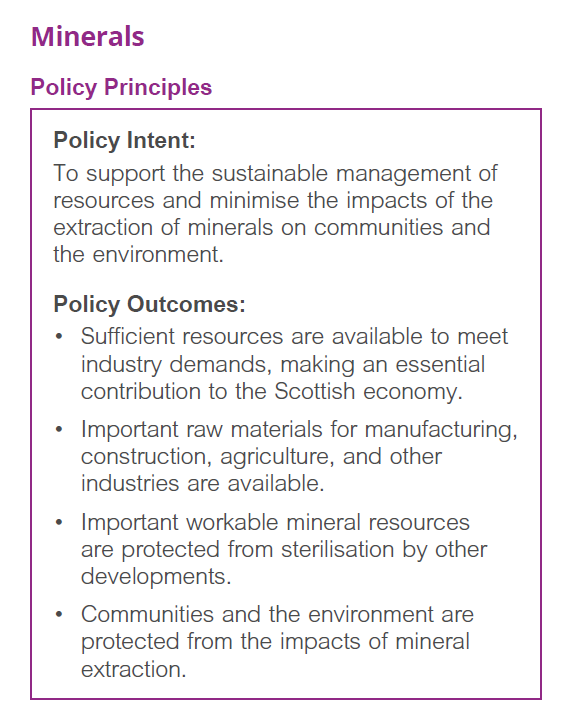

Gold mining is not mentioned in National Planning Policy Framework 4 – a serious omission – and the policy principles could be interpreted either to support it or oppose it:

The effect of the policy very much depends on whether gold is regarded as an “important” mineral. My argument and one that I think needs to be pressed for nationally, is that gold is not important for industry and because of the emissions and pollution it causes, should be left below ground.

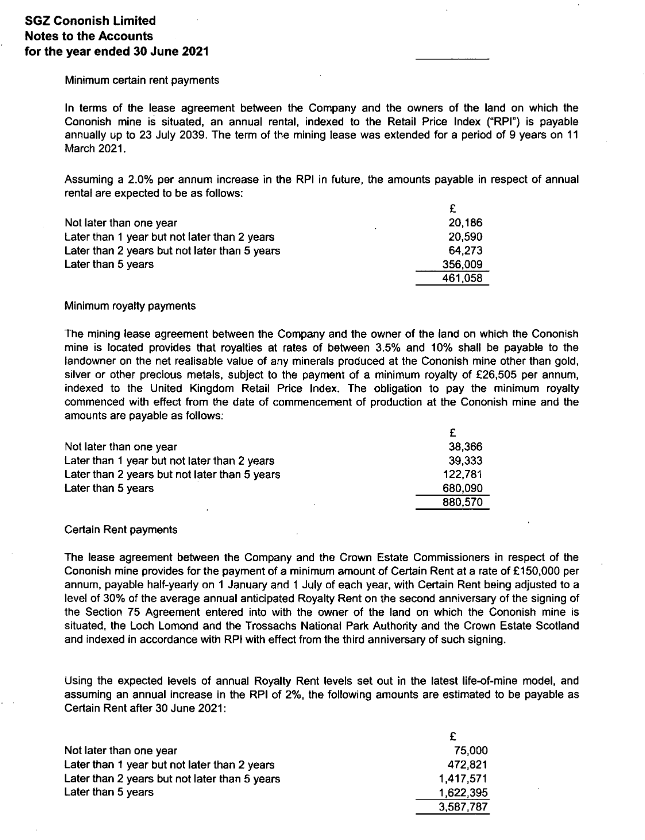

If we are to create a policy presumption against gold mining in Scotland, that means tackling private landowners, including the Royal Family and the Crown Estate, who have such influence over the Scottish Government. SGZ Cononish’s last accounts do not record how much money has been paid in rent and royalties up until now but they do report how much is due in future:

While Cononish Farm, where the mine is located, was put up for sale in 2001 (see here) the details of who owns it and benefits from the annual rent and royalty payments are not on the Registers of Scotland.

The Crown Estate, however, receives £150k rent each year before royalties with a quarter of this, under the agreement made between the UK Government and the Queen in 2017, goes to the Royal Family. King Charles therefore is profiting out of Cononish to the tune of a minimum of £37,500 a year raising further concerns about his credentials as an environmentalist (see here) and (see here)! While not directly controlling the Crown Estate, King Charles could call of them to cease issuing any further licenses because of the environmental destruction gold mining causes. That would be entirely consistent with the call he has made today to school children to put the planet first (see here).

As for the LLTNPA, it has the opportunity to reverse past policy mistakes and give real effect to all the noises it is now making about the need to address the climate and nature emergencies. Its original Board quite rightly opposed the proposals to develop a gold mine in the National Park but then under political pressure, first a narrow majority agreed to support the original planning application for the mine and then, when the revised application was submitted, agreed unanimously to support the mine. That decision always was wrong and the current crisis affecting the mine now leaves the LLTNPA very exposed. Any reasonable public authority would now take the opportunity to admit past mistakes and initiate a public discussion with the other public authorities who went along with the mine proposal, NatureScot and SEPA, about how the public interest can now be protected.

An excellent review of this ill-conceived project, the inadequate monitoring by LLTNPA, and were the real monetary benefits are going. Unfortunately, I predict nothing will be done until SGZ Cononish goes belly up, and then the Scottish Government and all its related organisations will be running around trying to find excuses for their inactivity and trying to find someone else to blame.

I took a small position in this effort when it first came to market (for “serious” investments I put between £10-20k, but for one like this – a direct equivalent of going into a bookie’s and placing a bet on a horse – I only put a couple of thou), being a bit of a goldbug AND keen on supporting job-making enterprises. The initial outlook was good, the company releasing statements practically daily along the lines of “We’re gonna make stacks of wad an’ we’re gonna make it NAH!”. But as time went on it became more worrying that, despite the imminent Eldorado, the slightest thing would hold everything up – “Oh, err… Fergus has got a touch of athlete’s foot and Hamish is about to become a daddy, so we can’t work today…”. After a few weeks of this it became apparent that I’d bought shares in the Eiffel Tower, so I bailed. On reflection, this whole thing smacks of deliberate fraud, and I hope someone is held to account for it.

I don’t know enough about the UK’s lax regime for regulating companies to know whether any of the statements issued by ScotGold could potentially be fraudulent in terms of current company law. What is not in doubt is the then convener of the LLTNPA planning committee did buy shares in Scotgold and the LLTNPA then tried to cover this up The ethics of the LLTNPA Board and the Owen McKee case (7) and, as far as I am aware, that was never investigated by the police

My cousin had a hand in it, Prof. Adrian Boyce, Glasgow Uni. I mentioned it before.

When the opencast coal mining industry collapsed, the local authorities and the Scottish Govgernment were left with 100’s of hectares of unrestored mines. When the restoration bonds were called in, the failure of planning authorities to properly maintain the value of these bonds meant that the funds were grossly insufficient. On top of that, the light touch of planning enforcement had allowed the mines to drift off plan, huge volumes of materials were not where they were supposed to be.

The scandal led to a major review of mining development management……I do hope that LLTNP have read all the reports.

That was started in response to a price hike in gold. Finance capital doesn’t care whether assets are productive or unproductive or liabilities or debts. It’s sell the sizzle not the steak. I mentioned this before. The NP planners have zero powers to investigate the business cases of applicants. That’s “internal affairs.” I raised it about the time of the bank crash 2008. Peter Cummings, head of HBOS Corporate Lending, the “Lender to the Stars,” lived here in Dumbarton. The NP did have a business case “tick box” in the big NP Plan. Blink and you’ve missed it. Who’s seen Flamingo Land’s “£40 million investment?” Come off it. Blackstone Private Equity is next door and in with SE. They’re the biggest fleecers on the planet.

Jim, you are right about finance capital not caring how it makes money (the ongoing investment in oil and gas is another pertinent example) and the LLTNPA not have powers to investigate BUT our National Parks do have a sustainable development duty. That is not defined so I would take it to cover both the environment and finance and argued that in respect to some of the bonkers planning applications at Cairn Gorm. The problem is the National Park Boards and other agencies are effectively controlled by businesses

Ofcom is now investigating the BBC for broadcasting fake news about a new gold vein discovery at Cononish, fed to its reporter by Scotgold CEO, Phil Day during a BBC Scotland facility visit. Scotgold have not made any market announcement about a new gold vein discovery but the BBC didn’t bother to check. This was shortly before Scotgold launched a £3m equity fundraising so it looks very much like market manipulation and abuse. The complaint about the BBC can be seen at https://tinyurl.com/mrxwxz4f while the Ofcom response (and other insights) can be seen at https://twitter.com/search?q=%23Scotgold&src=typed_query&f=live

Meanwhile, the £3m raised in February had seemingly dwindled to just £8,000 by the end of March according to Scotgold’s updates. Shareholders have been given no information about where the cash has gone.