Regular reader will know that in investigating what is going on in our National Parks, contributors often use information published on the Companies House website. Recent examples include my coverage of the Cameron House fire (see here) and Tim Ambrose’s analysis of the level of public subsidy provided by Highlands and Islands Enterprise to Cairngorm Mountain Scotland Ltd (see here). The provision of company information for free online has been a major step forward in transparency. It was not that long ago that the public or someone doing business with a company had to buy the information, as is still the case if you want to see information about Land Ownership which is held on the Registers of Scotland.

The problem, however, has been that of the c4 million companies registered in the UK, almost 90% are exempt from providing full accounts and only have to publish balance sheets. This makes it almost impossible for anyone to understand what is really going on in most companies. The UK Government in December launched a consultation (see here) on reforming the law, so that all companies would now have to file full accounts. This would mean all companies would have to publish the trading information contained in their profit and loss accounts as well as their balance sheet. The consultation closes today but if you are interested in promoting greater transparency in the way businesses do please consider submitting a response to transparencyandtrust@beis.gov.uk welcoming the proposals.

For anyone interested in understanding why this is so important I highly recommend viewing the ten video from Richard Murphy (see here) explaining the background. Meantime here is an example from the Cairngorms of why this reform is needed:

The Glen Banchor and Pitmain estates, which border the villages of Kingussie and Newtonmore on Speyside, appear to be owned by Majid Jafar, the Chief Executive of Crescent Petroleum. He is a very rich man and have been subject of a number of parkswatch posts (see here for example).

From the abbreviated accounts its impossible to tell what role Pitmain and Glenbanchor Ltd plays in the operation of the two estates, although the notes reveal the parent company is based in Lichtenstein, one of the tax havens in the EU. It may therefore be that other trading carried out on the estates goes through other channels (eg there is a Pitmain Hydro Ltd but this is at present a dormant company).

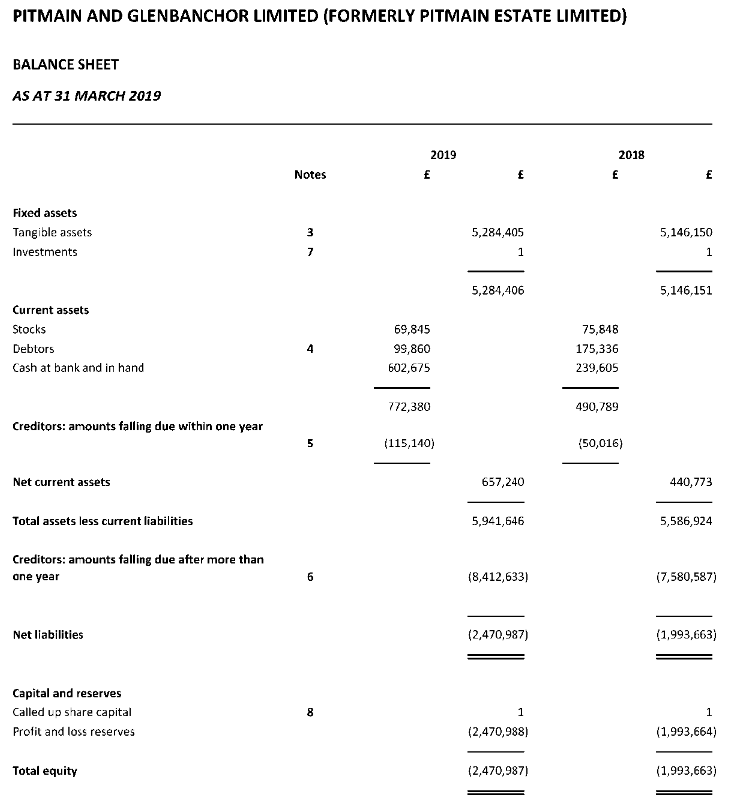

The balance sheets shows the amount owed by the company increased from £7,580,587 to £8,412,633, ie over £800,000 in the last year. This is yet another company where the liabilities appear significantly more than the assets, i.e it should be on its way to going bust. The public however are denied the right to see whether the Director of the company believes it is a “going concern” and if so why as there is no requirement to state this in abbreviated accounts.

It seems highly unlikely that the company is going to go bust given the wealth of Majid Jafar. He donated £400,000 to the Tory Party up to 2018 (see here) and was in the news again recently for having donated £4000 (see here) to the election campaign of the new UK Business Secretary, Kwasi Karteng. So just what is going on? The public, who are affected by the activities of this company, should have the right to know.

It should be self-evident that it is not in the public interest that very rich people are able to hide what they are doing with their money in companies that don’t have to submit full accounts. Reform of company law also has a key part to play in land reform in Scotland and we should welcome the proposals to require companies to publish full accounts as a first step to wider reform.

Of course he could trade in a partnership or as a sole trader as many do both in national parks and in wider Scotland and you would know even less.

Hey Ho.

But yes reform of company law and very least companies house is overdue.

I don’t think Majid Jafar could set up as a sole trade at Pitmain. To be a sole trader you need to run a business and Mr Jafar clearly leaves that to others. But there is another reason a very rich person would not do this, it would expose them to unlimited liability, whereas if they operate through a company their liability is limited. In the case of Pitmain, for example, if the Gynack overflow funded by the estate had failed, as it almost did, and killed someone the liability could have been huge. I agree with you that all forms of Limited Liability Partnerships, Trusts, etc should have to file the same information as public companies.

Spot on Nick, openness and transparency is required.

And, when you walk over the Glenbanchor and Pitmain Estates and see the degraded landscape, caused by massive overgrazing by red deer and excessive hill road construction, you wonder why such estates are in receipt of large sums of public money through agriculture, forestry and conservation grants. The public funding tap needs to be turned off until such time as ecological and landscape restoration takes place across the whole of this landownership. And if Majid Jafar wants to learn how to do this he only has to travel a few miles across the strath and meet with Anders Povlsen on Glenfeshie Estate. This Danish citizen is setting the standard for private estates in the Cairngorms National Park and it is about time the rest woke up to their climate change and biodiversity responsibilities.

I totally agree with you, Nick, but will the Government listen? There are also examples of development companies operating in Cairngorms National Park, set up as £100 initial capital companies, which have won public contracts on a single tender basis and which have been given loans at well below market rates by a local authority. In these examples only outline balance sheets are produced, at least one I could name has a negative value balance sheet, so how is public money in these companies protected? Additionally, due to Covid-19, there is almost blanket permission for these companies to have 3 months grace before lodging their minimal accounts.

Companies will claim that the extra cost of producing full accounts is prohibitively expensive for small companies. Sole traders and partnerships cannot use that excuse with HMRC, so why should limited companies be given preferential treatment?

Hi Gordon, I don’t think audit costs are that high, but maybe people should be expected to pay for that for the privilege of obtaining Limited Liability? Also at present small companies upload unaudited profit and loss accounts, which at least tell you more than balance sheets and could be used in cases where turnover is very very low.

Yes, I agree, the provision of audited accounts should be required (not just minimal balance sheets) for all limited companies.

I think you are getting muddled up here, i am sure there is a lot more excessive hill road construction on feshie than there is on pitman.