Not a week goes seems to go by without some group of business interests claiming they are paying too much tax. Ten days ago the operators of small scale hydro schemes, many of which are quite large, were back at it (see here for example). Not content with the enormous subsidies that they have received through the Feed In Tariff, which the public pay for through higher electricity bills, they have been mounting a sustained attack on having to pay non-domestic (business) rates. This post argues that this is totally unjustified, using examples from the Glen Falloch Hydro schemes, and is being driven by the interests of the City of London and landowners rather than the needs of the population as a whole, local communities and the natural environment.

The lobbying on business rates

In 2015 hydro power owners and operators, represented by the British Hydropower Assocation, complained when the Scottish Government abolished non-domestic (business) rates relief for small hydro schemes. Effectively, the hydro industry wanted to be doubly subidised, first through the Feed in Tariff and then through business rates relief.

When business rates were belatedly updated in 2017 as a result of a rating revaluation, rates for hydro scheme increased significantly (while those for many other businesses fell). The British Hydropower Association first managed to persuade the Scottish Government to restrict the increases to 11% for operators of schemes under 1MW in size. Then, the following year, they managed to get “temporary” 60% business rates relief on all schemes with a Rateable Value under £5m while the Scottish Government committed to a review of business rates for hydro schemes.

That review, under Professor Tretton has now reported and its that report (see here) which has been attacked by the hydro power industry which claims its a whitewash, they are being treated unfairly and that the industry is close to collapse threatening jobs.

The Report is well worth reading for anyone who wants to understand how the state has been hijacked by vested interests. The Tretton Review was unable to make any clear recommendations because the hydro industry were represented on the review group just as landowning interests were represented on the Werritty Review into grouse moor management (see here). In this case it appears the representatives of the British Hydropower Assocation and Green Highland Renewables refused to agree any recommendation that might have led to a reduction or the abolition of rates relief for their industry. One has to feel sorry for the two Professors and Rates Assessors who tried their best and who have been subject to unwarranted public criticism.

They actually agreed to delay the Report for a year to take account of a legal challenge by hydro business interests to the methodology used to determine hydro business rates back in 2010 (the Old Faskally case). In April 2019 the Land Valuation Appeal Court Court basically rejected business arguments that certain elements of hydro plant and machinery should be exempt from business rates. That, however, didn’t stop the British Hydropower Association from continuing to push the case. Hence the lack of agreement and recommendations in the report.

Amazingly, the Review reveals that if anything, hydro power schemes have been paying too little business rates to date:

“64. “The assessors were of the view that treating 55% of the assets of a scheme as non-rateable was generous to the ratepayers, and that it could have been argued that a significantly higher proportion of the assets were rateable. The assessor’s position was that even if, contrary to his view, plant and machinery was not rateable under Class 1, much of it could have been rateable under the other classes, in particular under Class 4.

65. The group acknowledged that this decision to give the benefit of doubt to the tenant had effectively delivered a lower rateable value than would otherwise have been the case.”

Already treated generously from a business rates perspective, it appears hydro power businesses want even more.

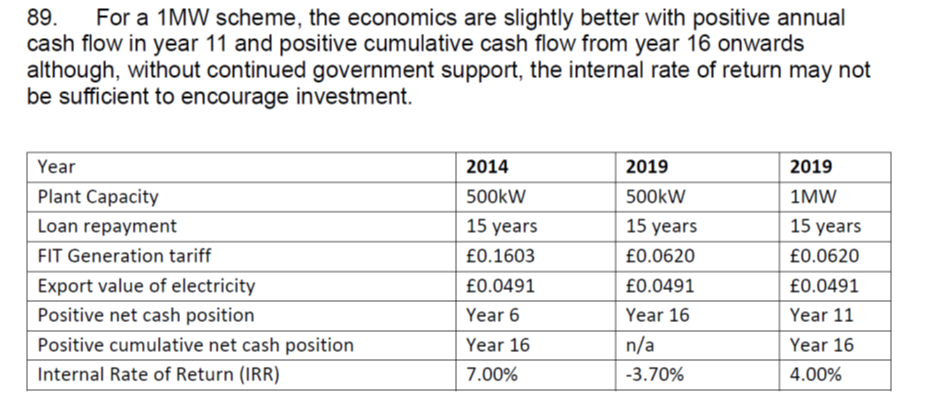

What came through to me above all from reading the Tretton Report, apart from the clear account of the complexities of the system, is that business interests will use any chink or contradiction in the current system to try and avoid paying taxes. For example, one of their main arguments was that its unfair that they should have to pay relatively more business rates than other forms of renewable energy rather than considering whether any of these operators pay enough. In this respect, crucially, they appear to have managed to keep off the table any factual information about how much money hydro schemes are actually making at present. Instead of a factual analysis the Report is based on some hypothetical examples which appear little resemblance to reality (see below).

The main achievement of the Review is its recognition that “the rating system needs to be more transparent and relevant information flows between stakeholders must improve”. Unfortunately it makes no recommendations as to how this will be achieved. This is urgently needed because the value and profitability of hydro schemes depends to a great extent on what they are paid under the Feed In Tariff – and before that the Renewable Energy Obligation. With the abolition of the FIT, the rentable value of NEW hydro schemes will drop considerably and, unless business rates reflect that new schemes might be made unviable. Business Rates therefore do need to be based on actual income and expenditure.

The fairest way to do this would be for all businesses such as hydro schemes to prepare full audited accounts. These would have to contain sufficient information for Business Rates Assessors to determine rates under what’s know as the Receipts and Expenditure method. Unfortunately, at present smaller hydro schemes are exempt from preparing full accounts and the Scottish Government has no control over company law. This, however, would not prevent the Scottish Government from laying down what information companies are required to provide to enable business rates to be determined.

Analysis of the ability of the Glen Falloch hydro schemes to pay business rates

Unlike smaller hydro schemes larger schemes, such as the four in Glen Falloch in the Loch Lomond and Trossachs National Park, do produce accounts which contain sufficient information to show whether or not they can afford to pay full business rates.

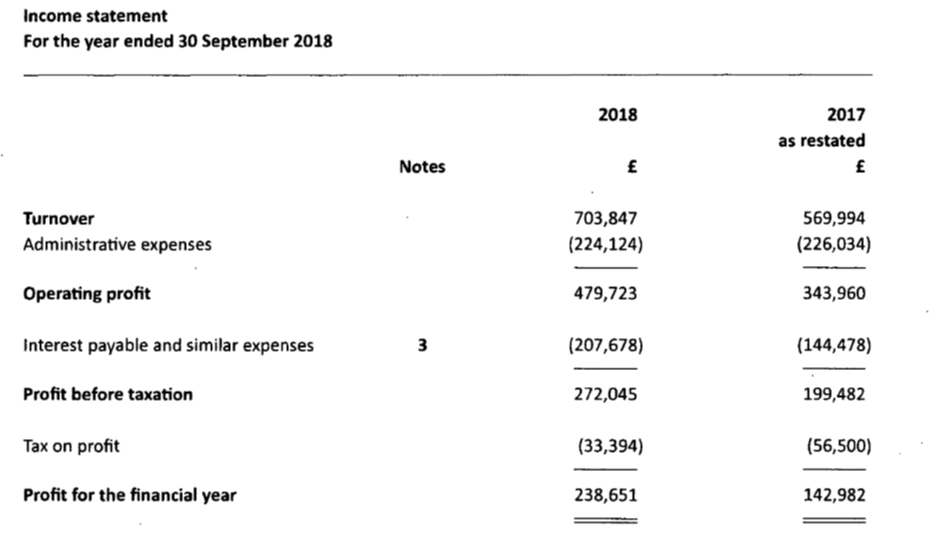

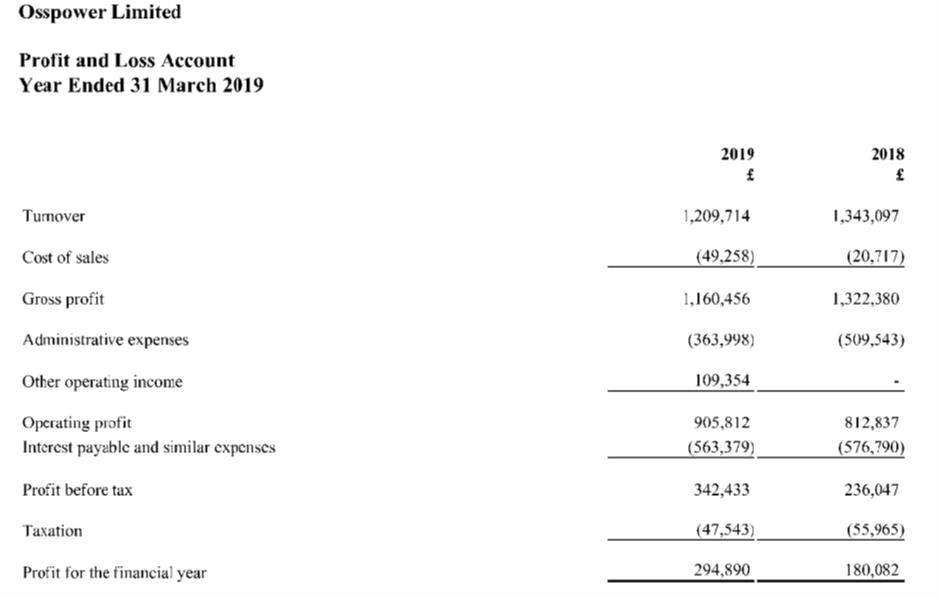

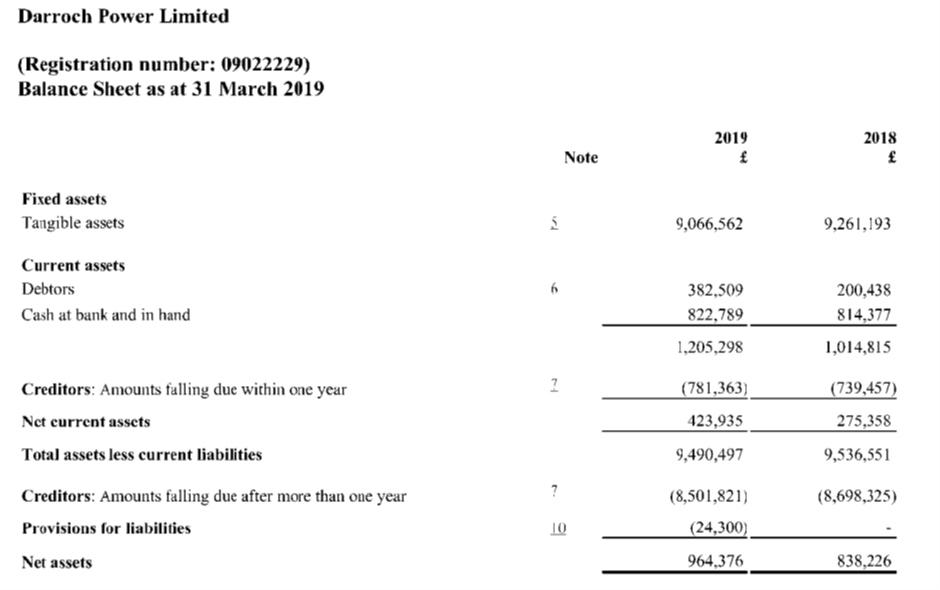

The latest accounts for the four companies which operate the hydro schemes on the Glen Falloch Estate (Ben Glas Power, Oss Power, Darroch Power and Upper Falloch) show that they made profit AFTER tax of £238,651, £294,890, £126,150 and £112,021 respectively on turnover ranging from £1,306,716 to £472,676. (The low turnover and profit for the Upper Falloch scheme was due to work undertaken to increase the size of its intake chamber to enable it to produce more power and increase the income it generates in future).

While the accounts don’t show the same things – so Osspower shows “cost of sales” which may be staffing costs while Ben Glas shows nothing for this – its the bottom line, profit for the financial year that matters. What the bottom line shows is that AFTER paying interest on loans, rent to the landowner (however this is done), business rates and all other expenses, these schemes are highly profitable. On turnover of £1,209,704 Osspower makes almost 25% net profit..

This, however, is not all and in effect there are two sets of profit here. First the profit on the loans to pay for the schemes to be constructed (which is usually around 10% on an investment where the return is guaranteed by the public, i.e very safe). This appears on someone else’s books and possibly ultimately in a tax haven. And second the profit which goes to the company which owns the scheme (that shown in these accounts).

The Glen Falloch scheme companies are partially owned by the Lowes Family who own the Glen Falloch Estate, so some of this company profit goes to the landowner (on top of the rent they receive). The rest goes to the other companies that part-own the schemes. As an example, one of these in Glen Falloch is a company called Ventus VCT 2 which is basically an investment company – meaning that part of the profit from these schemes appears to be going to the City.

You would not know any of this from the claims of the hydro industry. Unfortunately the Tretton Review appears to be contributing to the myths:

This is rubbish. Not only do the accounts of the Falloch hydro schemes show that they are extremely profitable for investors and owners, they also show net assets – after depreciation – increasing year by year:

What this evidence shows is its time that Scottish Government policy on business rates for hydro schemes was decided by independent objective financial analysis rather than the claims of an industry driven by vested interests. (And its worth noting here that the British Hydropower Association vigorously attacks any increase in costs which might detract from profits (see here for its attack on the Scottish Environment Protection Agency)

The importance of business rates

Apart from community hydro schemes (such as at Arrochar and Stank Glen in the Loch Lomond and Trossachs National Park and Kingussie and Braemar in the Cairngorms National Park) business rates are often the main contribution hydro schemes make to the local economy. The reason for this is that apart from monitoring water flow and electricity generation rates, there is very little work to do apart from clearing dead vegetation occasionally from the intake screens. The Tretton Report confirms that operating costs are very low. As a consequences these schemes employ very few people and incur little expenditure locally.

While the British Hydropower Association claimed in response to the Tretton Report that hundreds of jobs are at stake, I’d be surprised if there are as many as 100 full time equivalent local jobs supported by the 500 schemes which operate across Scotland. Perhaps its time too for hydro schemes to report on how many people they actually employ?

Most of the income generated by hydro schemes appears to flow out of the countryside to service debt repayments and the investment companies which increasingly own them. What this means is more and more money is being siphoned off to the city. Most of the rest goes to the landowner, who may be absentee as appears to be the Lowes Family in Glen Falloch. Whether they invest the money they receive from these hydros locally or use this to pay for their lifestyles elsewhere is up to them. Again, the extent that they do so would be something worth studying but there appears to very little evidence to back up claims that run of river hydro schemes are the saviours of the Highlands economy.

The abolition of Business Rates relief would, however, decrease the proportion of money which goes directly to local communities where hydro schemes are in community ownership and would redirect this money to local councils. The obvious solution to this is for local Councils to return to Community Development Trusts any increases in the business rates they pay. Most of these schemes are very small and the loss of income to Councils would be tiny compared to what they would receive from all the larger commercial hydro schemes.

What needs to happen

The evidence suggests – and there is nothing to suggest Glen Falloch is exceptional – that the Scottish Government should abolish business rate relief for hydro schemes immediately. They should also instigate as soon as possible a new system in which hydro operators have to provide transparent information on their income and expenditure so that non-domestic rates assessors can set business rates based on the value of those businesses. Only by doing this will the Scottish Government put a stop to the financial windfalls generated by hydro schemes being siphoned out of the countryside

Unfortunately, this appears unlikely to happen. Just a day after the publication of the Tretton Review Kate Forbes, the responsible Scottish Government minister, met representatives from the British Hydropower Assocation (see here) who called the review a whitewash. A day! What clearer evidence could there be that business interests run the government?

Kate Forbes, instead of responding to these vested interests, should be acting in the interests of the local communities she represents as the MSP for an area extending from Speyside to Skye. Kate Forbes well knows, having been involved in increasing car parking capacity at the Fairy Pools in Skye, that local communities in her area are struggling with increased numbers of tourists without any concomitant investment in tourist infrastructure. She is now the Government Minister who can solve this with one click of her fingers. All she needs to do is abolish business rates for hydro schemesand suggest to local Councils that they should spend the money on much needed local infrastructure. This would bring in new income all over the Highlands in the same areas as where new tourist infrastructure is needed.

Now imagine that these hydro schemes, instead of being financed by the city at interest rates of 10% or so, had been financed and developed – in appropriate places only of course! – through a state owned Scottish Energy company at rates of 3%? Not only might we have avoided the environmental disasters created by schemes like Glen Falloch (see here), hydro schemes could have produced far more benefits for local communities and the natural environment.

The argument about business rates and hydro schemes is only a symptom of a much deeper problem about who controls and benefits from economic development in the countryside, whether in a National Park or not and whether portrayed as “green” or not.

These business Lawers are scum driven by greed ,the government are afraid of them which doesn’t help. shareholders are happy and also driven by greed

Great research again There`s little enough “resource” from the land and the income from electricity generation should at least partly be developing a sustainable economy in the Highlands. I think of the reported £3 billion that A9 dualling is costing and think a fraction of that could have bought up the contiguous Highland estates.

Pitmain,by Kingussie had expectation of a quarter million pounds per annum for an investment of a million and a half.

There is it seems a lack of boldness on the part of Government.Is it too easy to blame London for the state we are in?

Should we be campaigning not so much for independence and morethe employment of the powers that we,in Scotland,have at present?