With the ongoing crisis at Cairn Gorm, the bungled planning applications and the question of the funicular, its important that people don’t forget how Highlands and Island’s enterprise created this pickle. After the decision to build the funicular in the first place, arguably HIE’s greatest mistake was the sale of Cairngorm Mountain Ltd to Natural Assets Investment Ltd (NAIL) and through that the “appointment” of Natural Retreats to maintain and operate the facilities at Cairn Gorm. Neither company – they were closely related with shared Directors – had any experience of running facilities such as Cairn Gorm, unlike other organisations which bid for the contract, and there are serious questions that remain unanswered about the procurement process (see here). It was re-assuring therefore that in August, after MSPs had raised concerns, Audit Scotland announced it would prepare a further report for the Scottish Parliament for Spring 2020 on the grounds that:

It is important that HIE can demonstrate that its decision to transfer CML to NAIL was robust, that it managed its relationship with CML well and that its decision-making around events leading to the

company’s administration was robust and well-founded.

The 2018 accounts for both the UK Great Travel Company (the current name for what was Natural Retreats) and NAIL have been published over the last six weeks. They provide further evidence about what HIE got wrong.

What NAIL’s 2018 accounts tell us

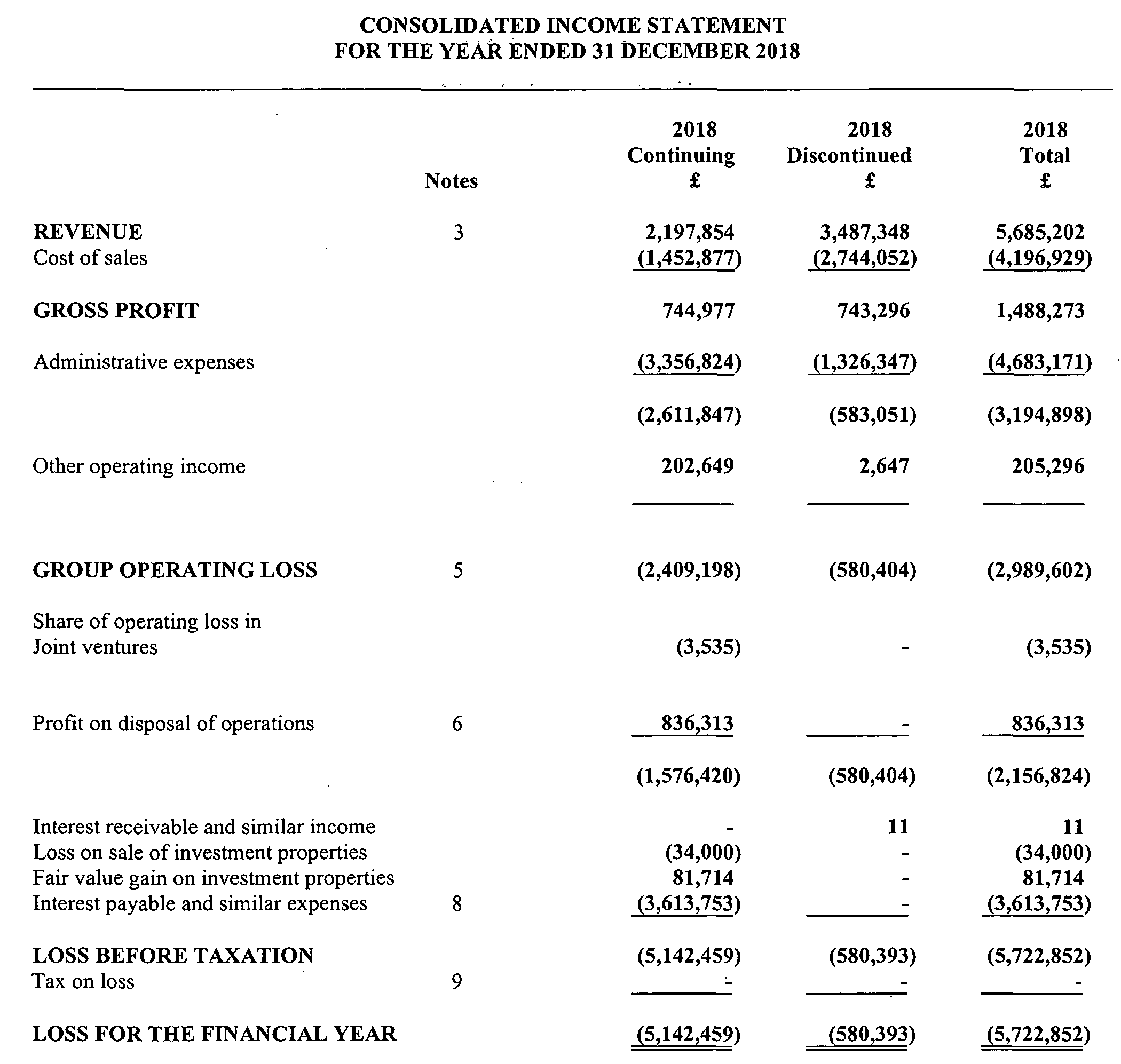

Past parkswatch posts have highlighted how the income the NAIL group has earned has never been sufficient to pay off debt obligations and the net liabilities of the company have increased by £5-6m most years since it was set up (see here for example). The 2018 accounts confirm this picture, with income dropping slightly from 2017 (£5,879, 367) and an even bigger loss. Two years ago I was warning about net liabilities having reached almost £30m. Well in the last year they owned CML they reached £41,339,517! Normally the public sector would not contract with companies in such a financial position, its against public procurement rules. HIE, however, argued the company was in its growth phase and would start to earn income eventually. The NAIL groups consolidated 2018 accounts show that that has still not happened.

Moreover, they also show that is now unlikely ever to happen. For the first time the accounts have been separated into “continuing” and “discontinued” operations (see here for explanation). CML went into administration late in 2018 and therefore its contribution to the group’s income and expenditure for that year come under the discontinued operations column. The discontinued operations earned significantly more for NAIL (£3,487,348) than the continuing operations (£2,197, 854). While Note 6 to the accounts states that several operations were disposed of in course of year and therefore the discontinued line does not only represent what CML contributed to the group, subsidiary accounts suggest that CML and Yorkshire Dales Ltd were the main income generators for NAIL. Since YDL is still part of NAIL, it looks like CML provided over half the income to the group as a whole. That income is no longer there and the remaining income (£2,197, 854) is greatly exceeded by the interest payable on loans (3,613,753). NAIL looks ever more broke.

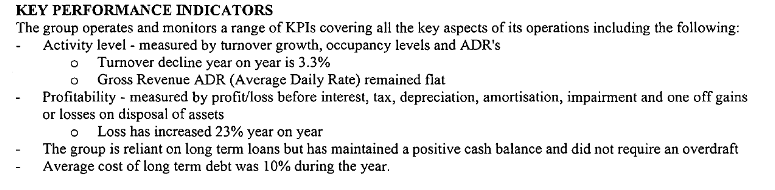

NAIL’s sorry performance is confirmed by the Directors report on Key Performance Indicators

If you were an investor reading this, red lights would start flashing – so why didn’t HIE pick up the warning signals six years ago?

There are several references to CML in the accounts. The first is NAIL’s account of why it went into administration:

This fails to mention that David Gorton, the owner of NAIL, had in the 2017 accounts for CML, provided written assurances that he could guarantee CML as a going concern for another year. That assurance was given in September 2018 just two months before CML went into administration. So why did HIE ever trust these people?

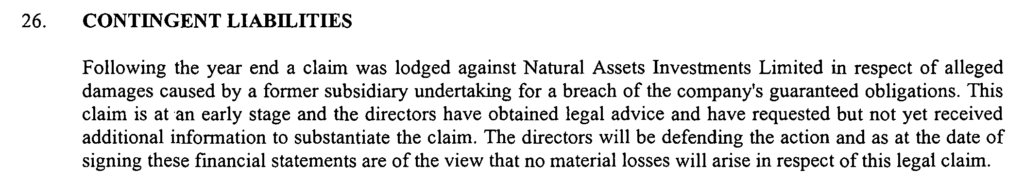

That HIE has subsequently taken legal action – after Parkwatch had highlighted the broken guarantees – is unlikely to make up for the original mistakes. Indeed, the following note to the accounts, which can only be a reference to HIE taking legal action, suggests NAIL are confident of defending the claim:

Its not possible from the accounts to ascertain the overall profit/loss that NAIL made/incurred through its ownership of NAIL. The accounts do record a loss against amounts due from subsidiaries, which is likely to include CML:

What’s more the Administrator’s statement of affairs on winding up the company stated that NAIL had loaned CML £2,294,561. Even though they will get a chunk of that back from the residual assets, ostensibly CML appears to have contributed to NAIL’s losses in the last year at least.

What UK Great Travel Company’s accounts for 2018 tell us

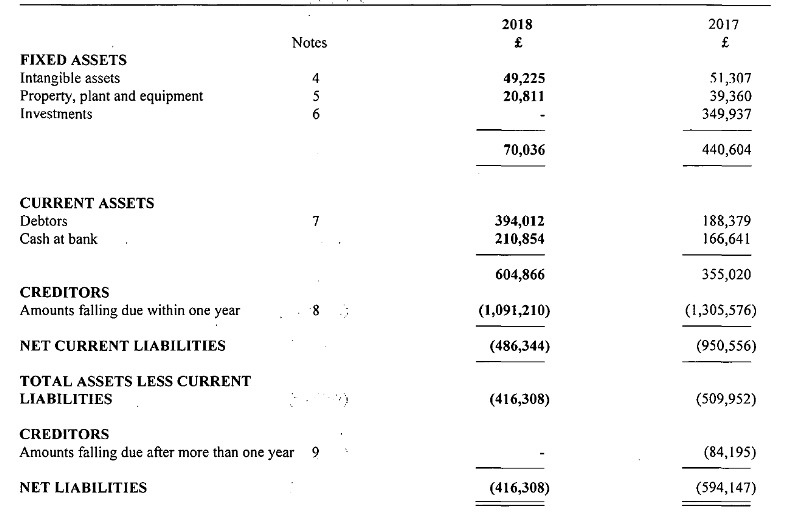

Set against this ostensibly dismal picture , however, readers may be surprised – as I was – by the UK Great Travel Company’s unaudited financial statements:

These don’t show income and expenditure but they do show that in the year up to Dec 2018 that the net liabilities of the company reduced, i.e their financial position improved. It appears therefore that the UKGTC wasn’t seriously affected by CML going into administration. While, given the level of management fees paid by CML (see here) its income is likely to be much reduced in future, for 2018 once again it appears that what may have been lent to CML by NAIL was then being taken out of the company by the UKGTC (with both companies sharing the same core group of directors)..

That raises the question of what, if any, level of critical oversight did HIE give to internal group transactions which involved CML?

What needs to happen?

I have consulted a qualified accountant and its very difficult to tell what is really going on from the accounts of NAIL and UKGTC (they provide another illustration of just how inadequate company law is when in comes to ensuring financial transparency). Audit Scotland’s investigation of the procurement process and HIE’s subsequent management of their contract with CML provides an opportunity, which is not available to the public, to take a much closer look. HIE should, through their contract with CML, have had access to the CML’s management accounts. These should show transactions between the companies in the NAIL group and between NAIL and the UKGTC which are not recorded in the accounts. From these it should be possible for Audit Scotland to get a clearer view of what was really going on and how effectively HIE was managing the contract from a financial perspective.

What the accounts do confirm, however, is that in terms of the financial standing of the company, HIE should never have sold CML to NAIL in the first place.

Well done, Nick, for keeping these issues to the forefront. (I am reminded of the Skye Bridge Toll campaign which took 9 years to win and the need they had to keep their campaign alive). HIE taking legal action against NAIL is a joke, because if the legal process ever gets to the point of NAIL losing, they will just fold the company and no money will be available – just further legal costs for HIE.

I have for a long time been asking for HIE to produce an in-depth and honest report on what they did wrong and importantly what the learning points are. however HIE just don’t want to do this as it would demonstrate a total lack of competence amongst the Board and the senior managers. Maybe the outcome of the Audit Scotland investigations will arrive at this – it should!. This in-depth and honest report on lessons learnt is not just for HIE’s future benefit, but will be valid for many if not all of Scotland’s public bodies, including Scottish Enterprise, Scotland’s NHS Trusts, local authorities, and especially the core of the Scottish Government, all of whom exhibit similar managerial failings.

The scale of HIE’s incompetence has been breathtaking and the Scottish Government have been content to allow them continue with their shambolic strategic and operation decision making.

Following the appointment of NR as the leaseholder, it might have been expected that some costs would be reduced. As soon as they were handed the keys, they got rid of the CEO and removed the Finance and Marketing Functions from Cairngorm. However, these redundancies did not translate into savings because they were more [much more] than offset by considerable rises in Administration Expenses. NR told me [and others] that they had agreed with HIE that they would not remove more than 10% of any Nett profit earned, on the mountain. Increases in Administration Expenses ensured that there was never any Nett profit to be removed [it having already been removed as Admin Expenses].

HIE’s incompetence allowed them to give the lease to a company that removed employment from CairnGorm and transferred it out of Scotland. How they failed to see that coming as well as failed to see what would happen to the Profit and Loss Account is testament to their serial incompetence