Companies House, the part of Government responsible for registering and dissolving companies and filing information, including accounts, required by the Companies Act 2006 is under-resourced and ineffective. As a result often basic information which would help the public, shareholders or public agencies to understand what is really going on in a company is not available, often with disastrous consequences – think Carillion. Just sometimes, however, the financial interests of those involved casts a bit of light on what is really go on and that happened for Cairngorm Mountain at the end of last week. This post takes a further look (see here) at what is happening in the companies which own and operate Cairngorm and the implications.

All the assets owned by what was Natural Retreats now appears mortgaged to the US

The light cast at Companies House last week was a Charging Order (see here) which was placed on all the assets of the Great Travel Company. This is owned by Matthew Spence who is also one of the Directors of Natural Assets Investment Ltd, the company which appears to own Cairngorm, and the GTC appears to be (see below) the owner of the UK Great Travel Company, whose former name was Natural Retreats UK, the company which appears to operate Cairngorm on behalf of NAIL.

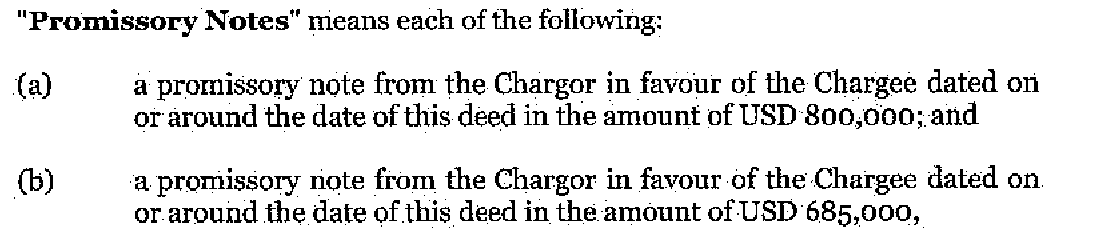

What the Charging Order shows is that the split between the US and UK parts of Natural Retreats (see here) was not a simple separation but involved a buyout of US shareholders by Matthew Spence. However, for whatever reason, he did not pay for the shares/buy the company outright but instead agreed to do so in the future by means of a promissory note:

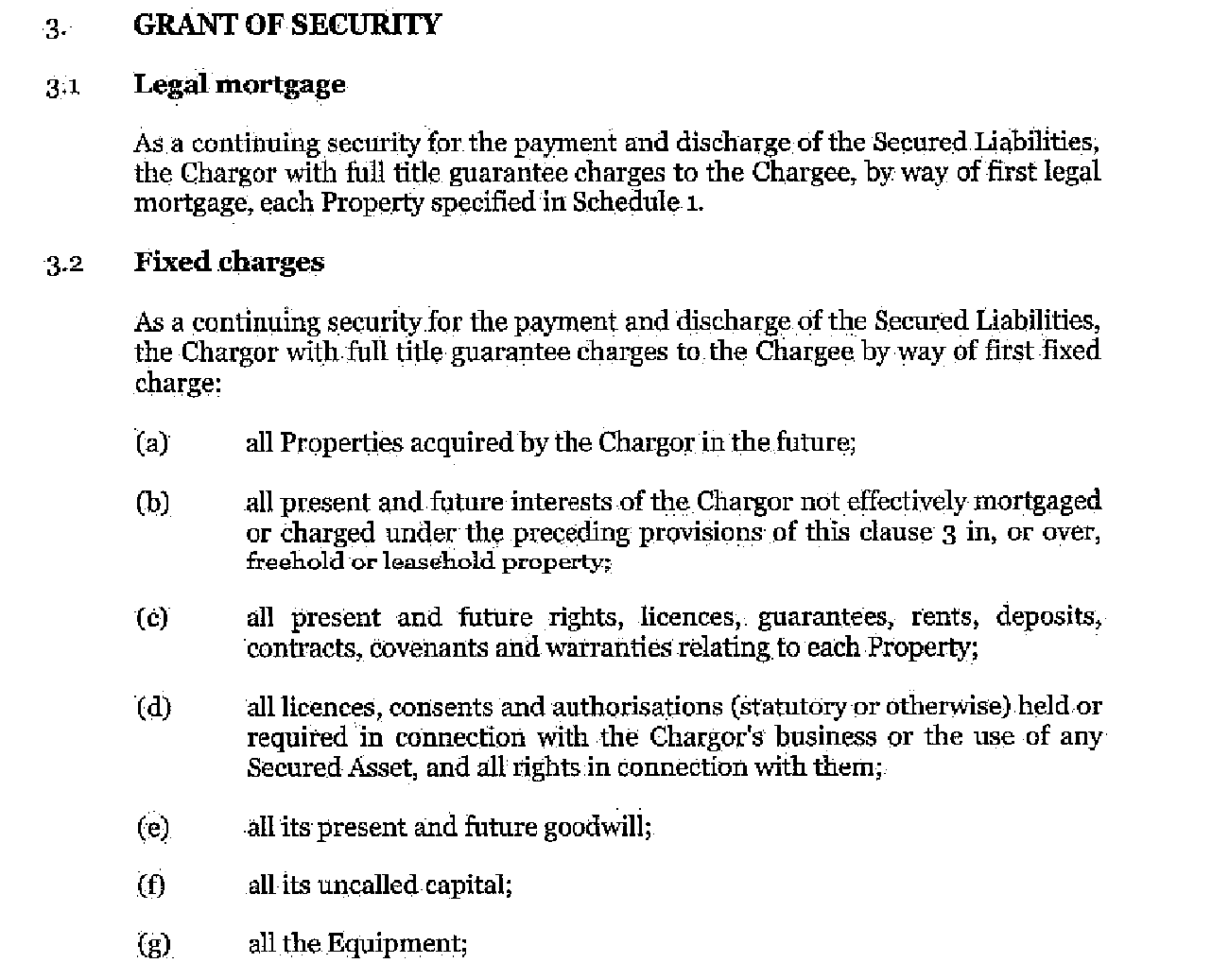

The promissory note covered the cost of purchasing both Natural Retreats UK and Natural Retreats Ireland (which suggests that Natural Retreats Ireland may also be owned by the Great Travel Company) but the important point is the $1,485,000 dollars Matthew Spence owes is secured on the assets of the Great Travel Company. In effect the whole company and its subsidiaries are now mortgaged:

The people in the US are no fools, they have engaged Bird and Bird, top end commercial lawyers to lodge the charging order and its a comprehensive document. It even contains a clause which it appears would allow them to chase Matthew Spence for the debt should either the company or its subsidiaries go bust:

The charging order also covers all relevant agreement agreements entered into by the Great Travel Company or its subsidiaries:

What this means, as far as I can see, is that HIE has no effective away of securing its proposed £4m loan to redevelop the Ptarmigan and install a dry ski slope at Cairngorm. It cannot now secure a loan on the assets of the Great Travel Company/UK Great Travel Company as these are now mortgaged. It cannot secure the loan on the assets of Cairngorm Mountain Ltd, as these are negligible as HIE should know, having sold the company for £231,239 and NAIL has since then invested negligible amounts in Cairngorm. And it cannot secure the loan on the assets of NAIL not just because their net liabilities were in December 2016 £29,380,827 but also because most of their existing assets already appear secured by other creditors (as these extracts from the 2016 accounts show):

The lack of assets in the Natural Retreats group of companies explains why why they cannot finance the development themselves as HIE promised they would do – their appointment was all about bringing new investment to Cairngorm. HIE now needs to explain publicly how it proposes to secure the proposed loan and, if it cannot do so, should reverse its decision to lend £4m to develop the Ptarmigan and build a new dry ski slope.

More changes in control registered at Companies House

While I believe the charging order is pretty clear and covers all the assets owned by the Great Travel Company, to complicate matters – and this is where Companies House is useless for finding out what is really going on – a few days before the charging order the following notification appeared for the UKGreat Travel Company:

You have been sent this email because you are following THE UK GREAT TRAVEL COMPANY LIMITED (07232597)

The following information is available from the company’s filing history.

| Date | Form | Description |

|---|---|---|

| 5 Mar 2018 | PSC09 | Withdrawal of a person with significant control statement on 5 March 2018 |

Go to the Companies House website and what the statement says is that a withdrawal of a person with significant control took place on 22/4/17, i.e over a year ago:

How this fits with the charging order or with the Great Travel Company being registered as a person with significant control of the UKGTC on 26/1/18 is not clear. The problem is Companies House allows companies to withdraw statements of significant control without clearly explaining who has withdrawn control or who, if anyone has replaced them. The system is a farce and for the first few months of this year has enabled a sort of “significant control” ping pong to take in the NAIL group of companies, with new controls being registered and others withdrawn. So on Friday, for example, I recieved notifications that persons with significant control over two NAIL subsidiaries, Natural Land 1 and Natural Land 4 had been withdrawn while at the same time NAIL was registered as having control (as its accounts show) of Natural Land 3 Cottages Management Ltd and Pentire Fistral Beach Ltd.

Its impossible to know what this means but HIE, instead of sticking its head in the sand, should take a look at the smoke, realise there is a great big fire going on under the Natural Retreats/Natural Assets group of companies and start to take decisions in the public interest at Cairngorm. Unfortunately, having sold the assets held by Cairngorm Mountain Ltd for a song (machinery etc) if HIE took the sensible decision and terminated any further involvement with Natural Retreats, that would create a small financial hole. Better though to spend some of the £4m proposed loan filling that and then entering discussions with the Aviemore and Glenmore Community Trust on how best to spend the rest, than lending any money to “Natural Retreats” which, at the moment at least, looks as though it would end up in the US. Time that Fergus Ewing, the responsible Government Minister, stepped in.

It’s disgraceful that HIE and Fergus Ewing MSP have remained silent about the precarious finances and the behaviour of Cairngorm Mountain’s holding company(s). It appears that they are just lying low and hoping something ‘turns up’ to save their embarrassment. This is a time for HIE and Fergus Ewing to take decisive action and protect public money and the future of skiing on Cairngorm, but I doubt whether they have the guts or the competence to take the action needed.

A public statement by HIE and Fergus Ewing is required now on what action they propose to take, or both can and will be held negligent when Cairngorm Mountain folds.

It’s clear that the Natural Retreats business model is to rent out their own or others’ expensive holiday homes, preferably located in nice places. The owner has stated that the UK national parks had not previously been targeted in this way, and that was his intent. Natural Retreats got investment from the Rockefeller family to repeat this model in the US. That’s all very interesting – but how does the Cairngorms Mountain resort fit into this model? Of course it doesn’t. So either Natural Retreats thought they could build/lease lots of expensive rental properties there, or they formed a view that it was a cheap asset that they could exploit to boost their brand. They’ve not built lots of expensive chalets; and are mortgaging the asset to the US company (wonder how that helps their US tax situation). Either way how can H&IE think they are a great company to run the Cairngorms Mountain resort?