Reforesting Scotland’s excellent Land Revival Study Tour to the Cairngorms in June 2018 – for the site visit to the Anagach community pine wood, see here – was based at the attractive looking Cairngorm Hotel in Aviemore (here). While enjoying a stimulating conversation over dinner the first evening, I doubt whether any of us present realised that some of the staff who made our evening possible were at the time probably not even being paid the statutory minimum wage. On 30th December the UK Government released a list (see here) of 139 named companies which had been served notice between September 2016 and July 2018 of failing to pay the statutory minimum wage “in a flagrant breach of employment law”. Included on the list was:

“WKW Partnership Limited, trading as Cairngorm Hotel, Highland KA21 failed to pay £4,057.00 to 7 workers”.

It is easy enough to be beguiled by outward appearances, a lovely looking hotel, without asking about the reality beneath, how the owners treated their workforce.

The WKW Partnership Ltd also operates the Garth Hotel at Grantown on Spey (see here). It’s not possible to tell from the UK Government list whether both hotels were involved in failing to pay the minimum wage or over what period between September 2016 to July 2018. It is possible that by the time of the Study Tour dinner, WKW had back paid their staff and paid off their fines. Anyone visiting either hotel could ask.

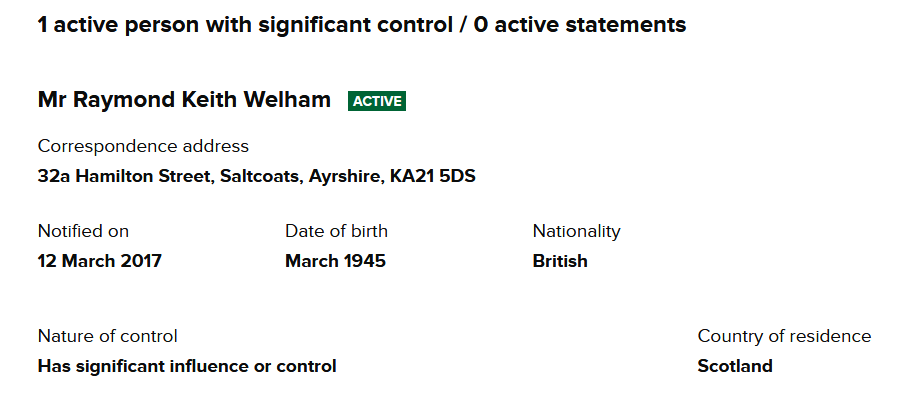

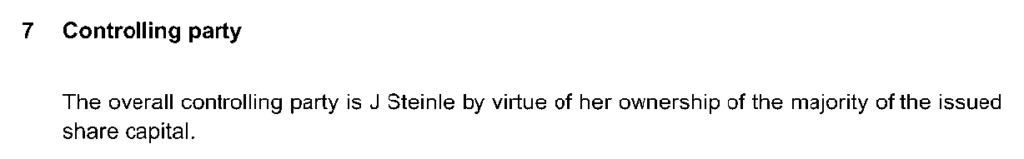

WKW has, according to Companies House (see here), two directors responsible for the operation of the company, Raymond Welham and Jane Steinle, both of whom appear to live in Scotland. While Companies House reports that Mr Welham controls the company, the accounts states that Ms Steinle does so:

Both statements cannot be true but unfortunately Companies House employs far too few people to challenge such errors.

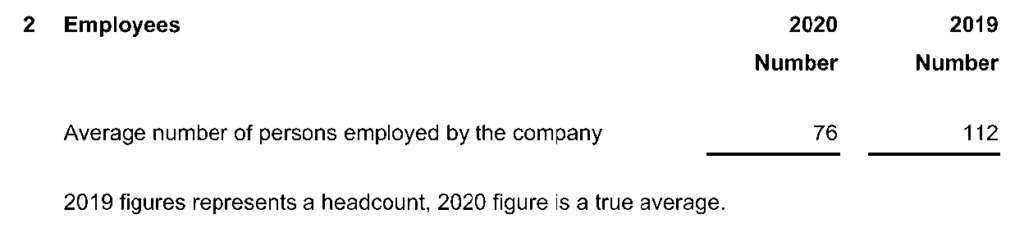

The accounts for WKW lodged at Companies House were prepared by the Directors on the basis that it is a small company (see here). They were able to do this because the company had turnover of less than £10.2m and assets of less then £5.1m, even though they employed more than 50 people, the third threshold which is used to determine whether a company is small.

As long as a company doesn’t exceed two out of three of these thresholds, its Directors don’t have to have their business audited and can withhold profit and loss accounts. Unfortunately the amount of information small companies are required to publish is very little and certainly not enough to determine whether they are meeting their legal obligations, such as payment of the statutory minimum wage.

The fact that just seven workers at WKW out of a workforce of 70 plus were not paid the statutory minimum raises further questions. Were the seven, for example, migrant workers with poor English who were singled out for exploitation? Were the seven just discriminated against in terms of pay or did they suffer more generally from worse working conditions?

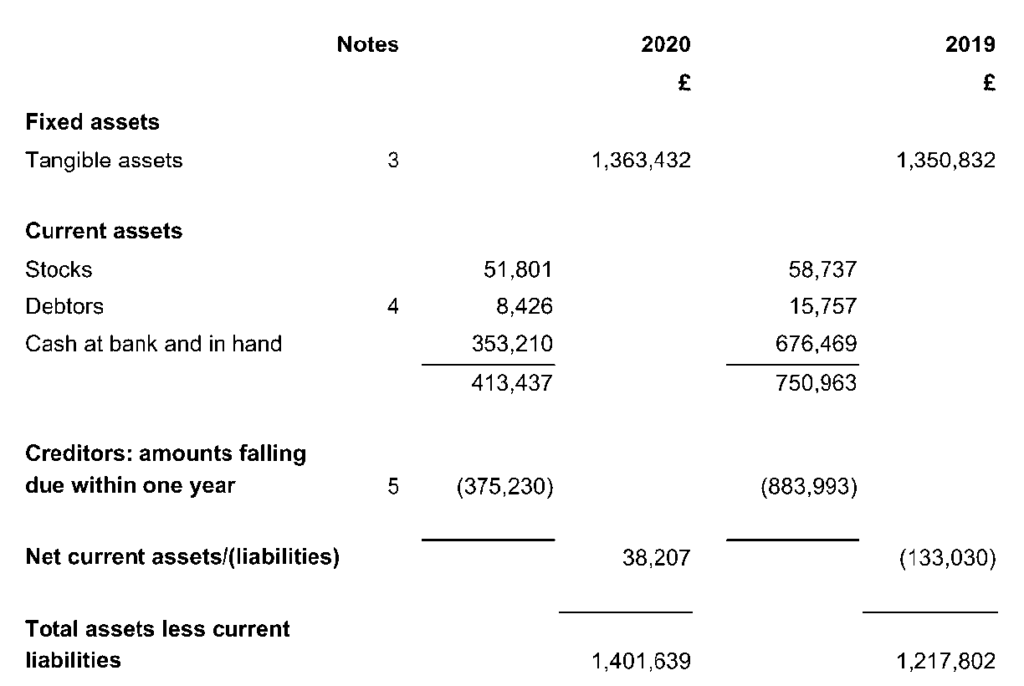

WKW also withheld from Companies House, as they are entitled to do under the existing law, their profit and loss account and just submitted their balance sheet. This makes it very difficult for anyone (including those responsible for enforcing the law on the minimum wage) to understand what was going on. WKW’s balance sheet and “filleted accounts” do, however, provide some evidence that the company was not on its knees and could have afforded to pay the minimum wage:

Whlle there was a slight drop in net assets of the company in 2017-18, from £1,200,814 to £1,174,991, the following two years they increased significantly:

No doubt it was information like this which persuaded the UK Government to name and shame WKW along with 138 other companies, a number of whom were registered in Scotland.

What does the Cairngorm Hotel tell us about the tourism industry in our National Parks?

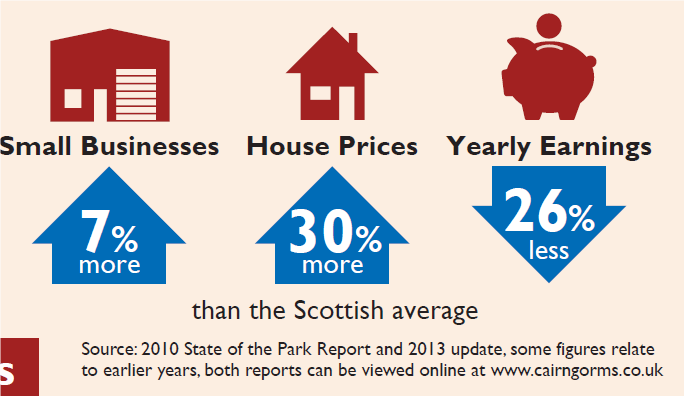

There are almost 6,000 employed in the tourism sector in the Cairngorms National Park (see here) and the seven workers employed by WKW will not be the only ones who have not been paid the statutory minimum wage. WKW just happened to be get caught. Research from the Cairngorms National Park Authority shows that the economy in the National Park has a “heavy reliance on low waged tourism sector”:

The graphic shows wages in the Cairngorms National Park are 26% below the Scottish average (despite the area being home to some of the richest people in the UK) and explains why the shortage of social housing is such a big issue. Unable to afford to pay for housing, employees often end up in accommodation provided by their employer, putting them even more at their employer’s mercy. An example from earlier this year were the staff whom the Coylumbridge Hotel attempted to evict at the start of the Covid crisis (see here).

Criminally poor pay and working conditions is not all the fault of tourism businesses. Behind many lie the landowners and banks, who extract money from their businesses, making it very difficult to remain financially viable, let alone to invest. They have played a crucial role in driving pay in the tourism sector to the bottom while feathering their own nests. WKW’s accounts don’t show how much it had paid in interest on the £883,993 it was due to repay creditors in 2019-20, but it is likely to have been considerable. It is rents and loans that have been bankrupting tourism businesses during the Covid-19 crisis, not wages (which have mostly been covered by furlough).

The challenges our current banking system causes tourism and other businesses is also perhaps illustrated in WKW’s case by Gladstone House, a property they own adjacent to the Garth Hotel in Grantown. Gladstone House, a C-listed property, was put on the buildings at risk register in 1997 but the explanation for its subsequent dereliction appears likely to be linked to the costs facing small businesses when they wish to invest. WKW’s accounts show that after obtaining planning permission for the site they tried to sell it although the Registers of Scotland shows that no sale has, as yet, been concluded. All this suggests that while WKW appear to have had sufficient revenue to pay the minimum wage, this probably was sufficient to finance significant investment.

What needs to be done to address low wages in the tourism industry?

The Cairngorms Economic Action Plan 2019-22 (see here) committed the Cairngorms National Park Authority to “investigate and promote adoption of a living wage scheme for the Cairngorms”. While a worthy commitment, it is unlikely to prevent people being paid poverty wages. Even if the public sector in the Cairngorms committed not to do business with any company that failed to pay the Scottish Living Wage, how would they or the public know which businesses were complying with that requirement and which not?

That is why accounts are so important. Ultimately company law needs to change so that all companies have to report and provide evidence about the terms and conditions under which they employ their staff (and other important matters like their carbon emissions and impact on the natural environment). The UN Committee on Economic, Cultural and Social Rights said as much when it produced its report on the UK, including Scotland, in 2016 (see here):

While currently, under the Scotland Act, the Scottish Parliament has no powers to legislate on company matters, there is no reason it shouldn’t develop proposals for reform and then either request the UK Parliament to legislate or include its proposals in the case for independence/further devolved powers. It could also, now we are out of the EU, incorporate much tougher provisions into Scottish procurement law, including the need for any companies that do business with government in Scotland to publish full accounts. Such initiatives would help strengthen the hand of the workforce who at present are extremely vulnerable and have almost no power.

The Scottish National Investment Bank, launched in November (see here), could also play a role by making it easier for tourism businesses to borrow at reasonable rates. At present, however, the SNIB doesn’t seem to be going in that direction and appears more like a state run commercial bank.

WKW’s two hotels are located in the constituencies of Kate Forbes, Cabinet Secretary for Finance, and Fergus Ewing, Cabinet Secretary for the Rural Economy,. They, along with Fiona Hyslop the Economy Minister, are the members of the Scottish Government who are best placed to address poverty pay in the rural tourism sector. Now that they have evidence from their own constituencies of how companies flout the law on the minimum wage, they should resolve to use every power at their disposal to put an end to poverty pay in the tourism industry.

I would never condone illegal pay practices, for that is what they are. Exploitation at best, criminal at worst

As for blaming Banks and Landowners what a pile of guff.

If the Banks and Landowners are the operators then fair enough, but you simply are making that up in this case.

And while we are at it where is the most expensive properties in Scotland?

Where is greatest density of Wealth in Scotland?

IT IS CERTAINLY NOT IN THE NATIONAL PARKS IS IT?

Polemic commentry is weak.

I am sorry you cannot understand the relationship between rents/loans and low pay but it works like this. Unless a (tourism) business is owned outright by the operator, it will either pay rent or interest on loans for any premises its uses. Those rents and loans have not stopped during Covid-19. Many businesses therefore have had continued outgoings and those that have had to shut up, like many in tourism, have no income to pay those outgoings. Furlough will cover some pay of employees and initial grants, including 100% business rate relief, really helped for a time but over time the rent and loan pressures build. These are what explain the business bankruptcies. While some landlords have deferred rent, others haven’t and there is nothing about the banks doing so (they usually charge even for talking to them about new loan terms). So what options do the businesses have? Well, if they can maintain some income – eg a hotel can stay half open for essential workers – they need to reduce all their other costs as much as possible to pay the rent/loans and that includes pay. This logic was operating well before Covid which is why I put some of blame on banks and landowners. This is what is widely known as the rentier economy and explains why the very rich in the UK have become even richer during Covid.

No mention of the council tax The council tax is still being collected by the Scottish Government Nicola Sturgeon her self said she would abolish the council tax Their being holding back on services Shops Pubs Restaurants all shut down but all paying council tax

What an incredible article misconstruing data. You have no idea why Cairngorm Hotel underpaid staff. It could easily be due to providing staff housing. Which is usually gratefully received by staff and necessary in the Cairngorms National Park because of all the second holiday homes and Airbbs, which go unregulated within the park.

Perhaps you could write a valid article in this instead of making up news.

Furthermore housing regulations favour employees as accommodation otherwise would be much more costly and impossible to afford in the National Park.

This savage attack on the Cairngorm Hotel’s owners – perhaps actually one of the best employers in the hotel industry in the National Park – for the sake of four thousand measly quid was sad to read, and lowered the standard of Parkswatch massively. It potentially damages the reputation of the hotel unjustifiably. It is certainly correct and inarguable that the Hotel was named by an arm of UK Government, but there is very little doubt that in this case, the UK Government was an ass (again). It would have taken very little effort on your part to have ascertained the circumstances under which this so called breach arose – simply as a technicality of how legitimate contributions for accommodation and meals were deducted in the case of just seven employees who elected to have those charges deducted directly from wages paid, rather than charged back – and it is hugely disappointing to find that no effort appears to have been made. Sadly, it calls into question the basis of everything posted on any subject. I’m sure the staff who made your evening possible were very happy with the wages and treatment they received, and equally happy to actually have a job at all, especially in a decently run establishment. In these extraordinarily difficult times, it is to be hoped that the potential damage unfairly done by this post does not tip the hotel over the edge.

Hi Dave, I would be very happy to give Cairngorm Hotel a right of reply but it seems to me that if the Cairngorm Hotel DIDN’T BREAK THE LAW they had plenty of time to sort this out with the UK Govt – in other words the information provided by the UK Govt in their news release is factually correct. It would be interesting to know therefore on what basis you think the UK Govt has been an ass? What I did try to make clear is that this case is likely to be just the tip of an iceberg and that appears substantiated by your comment that Cairngorm Hotel is one of the “best employers in the hotel industry in the National Park”. I don’t believe naming and shaming by the UK Govt will by itself work unless they also employ (or pay the Scottish Government to employ) a lot more people to check employers are obeying the law and take enforcement action where necessary. I strongly disagree that for people paid the minimum wage £570 (£4000 divided by seven) is “measly” as you put it. Nick

Lots of indignation within responses here. Surely the matter of legal remuneration of retained employees was addressed in Uk legislation over a century by the “Truck Acts”. The statute sets out definition of employee,/employer relationships .Definitions outlaw how any employer might seek to reward an employee unfairly through use of “tokens” and “discounts” at “company stores”.

If any Hotel owner wished to avoid the risk of being exposed in the way the govrernment report appears to have done , they have only to create paperwork which shows clearly the gross wage paid, any tax deducted, before further deductions would be taken off, based on a published tariff chart of employee benefits available. . The chart would set out values applicable to each “in house” benefit available to any employee, and would imply acceptance of choice by that employee. In the absence of such clarity, some conclusions the Hotel owner might least wish to see, may well be drawn from published figures submitted to authority. ( I am not familiar with these premises, or the sources for papers under scrutiny, but any display of indignation over exposure of this reported UK Government official conclusion does in the light of legislation, seem a bit parochial.