Following my post (see here) on the flawed and unfair procurement process which resulted in Cairngorm Mountain Ltd being sold off to Natural Assets Investment Ltd, I have started to work out the costs to the public purse to date of that disastrous decision. The HIE Board should be doing this that would mean them investigating their current Chief Executive, Charlotte Wright, who back in 2014 was the Project Manager responsible for the disaster (see above). Given its failure to look critically at its longstanding history of mismanagement at Cairngorm, the chances of HIE initiating any investigation is low. The alternative is an investigation by Audit Scotland or preferably the Scottish Parliament. This post sets out the evidence I have collected so far about the financial issues related to Cairngorm being outsourced to “Natural Retreats” from May 2014 till November 2018.

The sale of Cairngorm

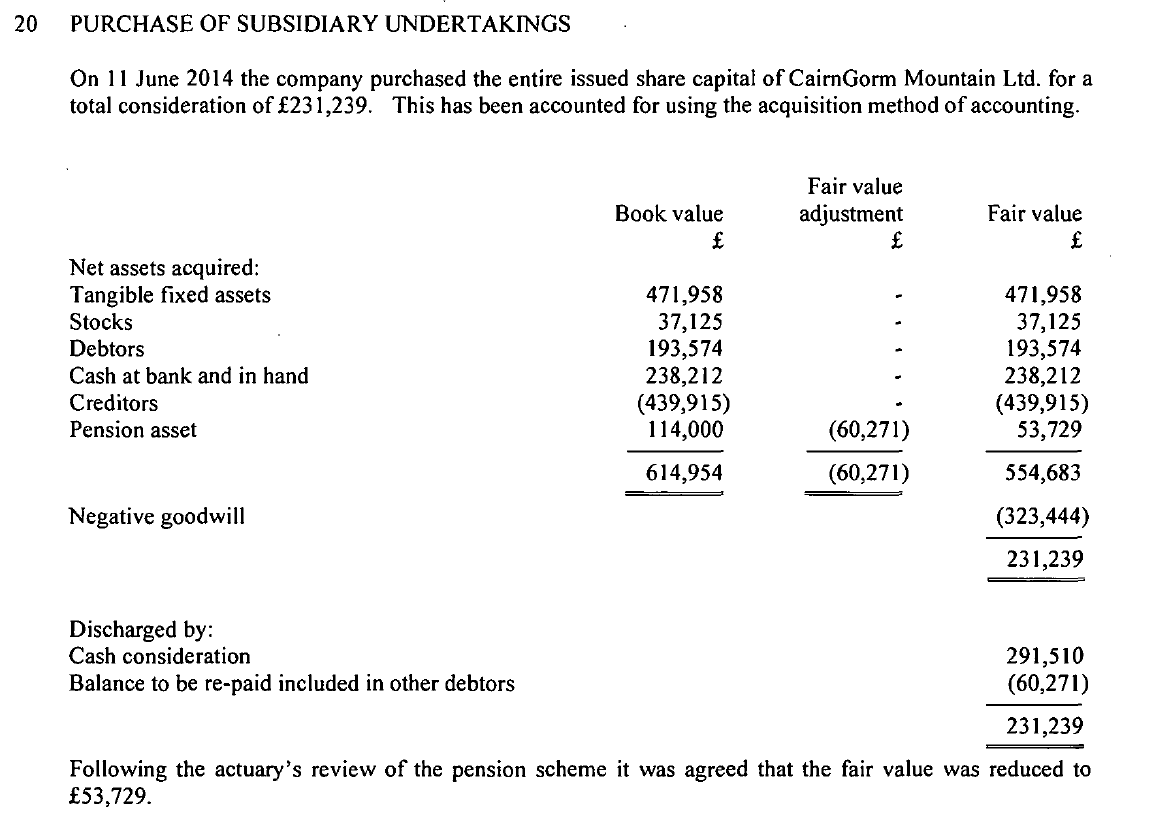

HIE sold Cairngorm Mountain Ltd to Natural Assets Investment Ltd for £231, 239. Evidence for how this valuation came about was included in NAIL’s accounts to 31st March 2015:

The NAIL figures raise several questions:

- The sale price of £231,239 was derived by deducting £323,444 ‘negative goodwill’ from the value of the fixed assets. Goodwill is an accounting term that expresses the intangible value of a company’s worth, such as its brand and customer base. Negative goodwill expresses the opposite and, as Investopedia puts it “implies a bargain purchase and the acquirer immediately records an extraordinary gain on its income statement. For the purchased company, negative goodwill often indicates a distressed sale, whereby unfavorable sale conditions lead to a depressed sale price.” Why then did HIE sell CML to NAIL for a bargain price (and loss to the public purse) when there was no pressing need to do so and they had unfairly excluded a sound local company, Cairngorm Snowsports, from the tender process?

- CML’s audited accounts to 31st March 2014, just two months before HIE sold off the company, record Tangible Fixed Assets as being valued at £615,562. Two months later they had reduced to £471,958. It appears that some of CML’s assets were sold off at a late stage in the negotiations with Natural Retreats. Why and what were they?

- Then there is the role of Ernst and Young, who were CML’s auditors but had also been engaged by HIE to conduct the tender process, creating a potential conflict of interest. Were Ernst and Young involved in determining the revised valuation and if so on what basis did they agree to a very different evaluation to that included in the accounts?

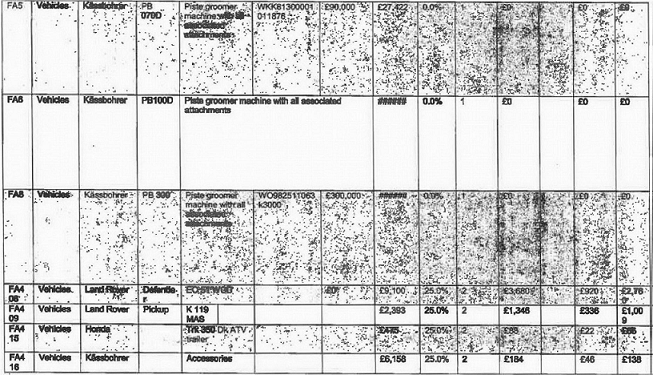

Before Xmas I asked for a list of all assets, including intellectual assets such as reports, transferred by HIE at the point of sale and, a week ago, received a response. The information provided consists entirely of vehicles, including piste machines:

The FOI response states ” this is the only information HIE holds relevant to your request”. It does not cover the ski and snowboard equipment, recorded under tangible fixed assets in the accounts, or stocks both of which are recorded in CML’s account before and after transfer. One assumes that stocks, from restaurant equipment to staff clothing, will have been included in the sale and it appears staggering HIE of no record of this. Surely, Ernst and Young must have vetted such lists in order to respond to “due diligence” checks by NAIL on the value of the company?

What assets have returned to public ownership?

According to CML’s accounts the tangible fixed assets owned by the company, after depreciation and disposals, increased from £471,958 in May 2014 to £1,283,230 in December 2017. Whether any of those assets were sold before CML went into administration and whether any have been subsequently sold to meet money owing to creditors are moot questions. Natural Retreats’ most obvious new investment at Cairngorm was in new snow fencing and HIE is likely to have paid something to get this back so that the Administrator could pay off creditors.

HIE has not yet made public what it paid to buy back CML or the fixed assets and stocks included in the purchase. How many of the assets originally sold by HIE, both major and minor, together with any replacements have returned to public ownership and in what state? What if any additional investment will HIE now need to make to plug the gaps?

How much was owed to creditors when CML went into administration?

The final cost to local and other companies is not public. I have obtained, however, through FOI a list of CML’s rent payments to HIE (see here). This shows that £139,985.01 (or c £100k if you adjust for the rent due the day CML went into administration) was owing to HIE on 29th November.

| Date | Period start | Period end | Description | Dues | Invoice | Invoice date |

| 13-Aug-18 | 01-Apr-18 | 31-Mar-19 | Insurance | 24694.82 | 235652 | 14-Aug-18 |

| 28-Aug-18 | 28-Aug-18 | 27-Nov-18 | 01 Quarterly Rent in Advance | 24581.47 | 234797 | 24-Jul-18 |

| 17-Oct-18 | 01-Apr-18 | 31-Mar-19 | Insurance-Terrorism | 397.82 | 239110 | 17-Oct-18 |

| 17-Oct-18 | 01-Apr-18 | 31-Mar-19 | Insurance-rolling stock | 40320.00 | 239110 | 17-Oct-18 |

| 22-Oct-18 | 11-Jun-17 | 10-Jun-18 | 01 Additional rent, 2017 rent review | 5627.20 | 239387 | 22-Oct-18 |

| 22-Oct-18 | 11-Jun-18 | 27-Nov-18 | 01 Additional rent, 2018 rent review | 4874.84 | 239388 | 22-Oct-18 |

| 28-Nov-18 | 28-Nov-18 | 27-Feb-19 | 01 Quarterly Rent in Advance | 39488.86 | 239390 | 22-Oct-18 |

| 139985.01 | including 20% vat | |||||

| If rent apportioned to 28/11/18 | -39056.11 | |||||

| If insurance apportioned to 29/11/18 | -22043.14 | |||||

| 118374.62 | including 20% vat |

Natural Retreats kept up with rent payments almost to the very end. Perhaps they knew that so long as HIE were receiving rent they would not ask too many questions about matters such as maintenence (see here)?

HIE only issued the insurance invoices (the costs of which under the lease it paid for and then claimed back from the tenant) between August and October and this accounts for most of the money owed. The non-payment of these invoices, however, should be recoverable by HIE from the former Directors of CML and ultimate owner, David Michael Gorton. In September, one of the Directors on their behalf, signed ff the company as a going concern (see here). They should not have done so if there was any question of CML being unable to pay invoices or go into adminstration. The question is will HIE try and recover the money and will they raise concerns with Companies House about what has happened?

Investment and the cost of maintenance failures

CML’s accounts show that Natural Retreats had invested £1,917,193 in the company in the form of additions between May 2014 and December 2017. This may sound a reasonable amount until you consider that the original cost of fixed assets disposed of in this same period amounted to £1,248,492

| CML Assets | |||

| Financial year | Additions | Disposals# | Fixed Assets year end* |

| Mar-14 | £615,562 | ||

| Mar-15 | £616,544 | £845,919 | £925,952 |

| Dec-15 | £351,849 | £11,500 | £899,788 |

| Dec-16 | £360,882 | 26,205 | £1,007,089 |

| Dec-17 | £587,918 | 364,868 | £1,283,230 |

| £1,917,193 | £1,248,492 | ||

| # Disposal recorded as cost price | |||

| * Fixed assets are recorded after depreciation | |||

In other words Natural Retreats was scarcely investing enough to replace the assets it had bought at a knockdown price.

While we know that CML installed some new snow fencing, we also know that they failed to maintain infrastructure as required under their lease with HIE (see here). The cost of putting this legacy of maintenance failures is at present unknown. It is likely, however, that HIE will have already paid for the cost of fixing the serious failings identified by the Health and Safety Executive (see P and J article above). The public need to know how much this cost.

We also don’t know yet whether the current safety issues affecting funicular also resulted from lack maintenance.

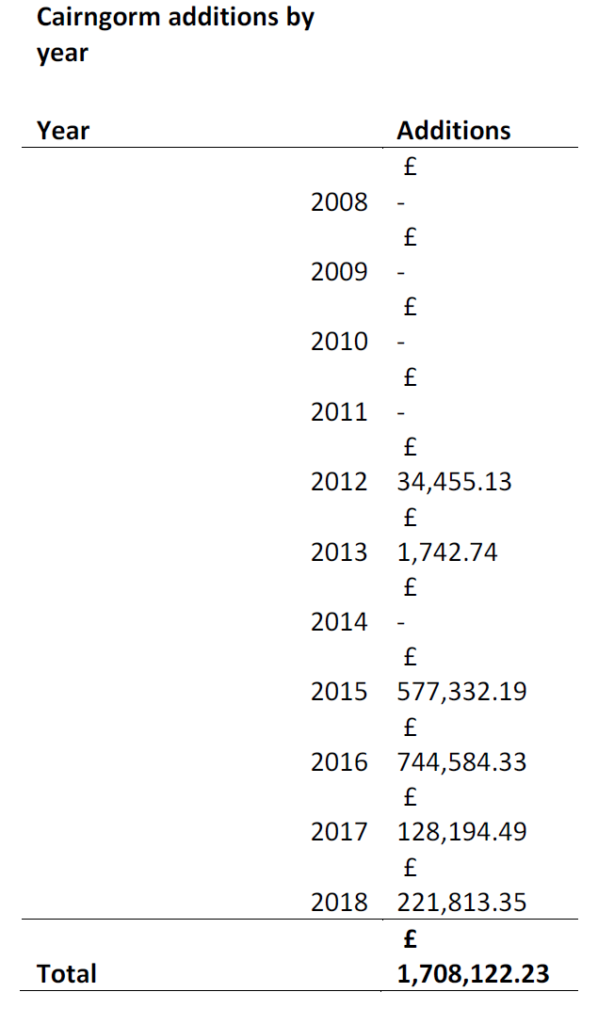

That there was a serious lack of investment by Natural Retreats at Cairngorm is demonstrated both by HIE’s agreement to lend CML £4 million to pay for a new dry ski slope and extension to the Ptarmigan. Its also illustrated by the amount of money HIE have spent at Cairngorm over the last four years:

What this shows is both the lack of investment by HIE at Cairngorm before Natural Retreats took over and that HIE then invested almost as much as Natural Retreats (£1,708,122 compared to £1,917,193). That investment was more than double the amount of rent £760,989 that HIE was due in the period. (The rent was due to go up significantly from March 2019 – after the partial rent holiday designed to help Natural Retreats invest money up front – and, as I have commented previously, from the information in the accounts it appears CML could never have paid this).

Most of HIE’s actual investment was to improve infrastructure which it owned, such as the installation of new electric cabling to lifts and the Shieling Rope Tow. Although none of this investment should have been lost by CML going into administration, some of it appears to have been wasted because in its new vision (see here)HIE is now proposing to close these lifts. In addition there remain many of questions about the standard of the works which HIE paid for but Natural Retreats delivered (see here).

Under the terms of the lease HIE also required Natural Retreats to put money into an Asset Replacement Fund (see here) which at 31st March should have received £100k in contributions. I have asked HIE for what information they hold about how much money was in that fund and how much, if any, had been spent before CML went into administration.

The siphoning of money out of Cairngorm

The lack of investment at Cairngorm by Natural Retreats has to be set in the context of the large increase in administrative charges since they took over (see here). That is all money that could have been invested in Cairngorm but instead was taken out of the company in operating charges. Despite having brought this and other financial matters to the attention of Charlotte Wright, the Chief Executive’s attention, she has consistently failed to address the issues (as I will detail in another post). That has added to the bill which HIE has now been left to pick up.

The need for an inquiry into HIE’s mis-management of Cairngorm

The outsourcing of Cairngorm to Natural Retreats between 2014-18 has represented a catastrophic failure by HIE, both in terms of how it managed the sale and procurement process and in how it then managed the contract with “Natural Retreats”. This post has tried to show some of the main consequences for the public purse. There is more work to do and I believe this would best be done by a Parliamentary Inquiry.

The need for this is partly so that we can understand more fully what has gone wrong and how similar mistakes can be avoided in future, which has implications for outsourcing across the whole of Scotland (including for Flamingo Land at Balloch). Its also vital, from a cost perspective, that the Aviemore and Glenmore Community Trust which would like to take on Cairngorm understands the full costs of doing so and does so within an agreed framework of what investment in future is the responsibility of HIE.

Once the report into the causes of the funicular shutdown become public, the case for a public inquiry is likely to become even stronger.

I totally agree that a full and independent enquiry into HIE’s actions and inactions over Cairngorm Mountain covering the appointment of Natural Retreats through to the present is urgently needed. I appreciate that many local people and businesses just want actions to be taken and public money spent to get Cairngorm Mountain back ‘on its feet again’, however as I have stressed before, unless we all fully learn from the catastrophic mistakes made by HIE, it is more than likely, especially if HIE or another Government body is involved, that a similar set of errors will be made yet again.

Meantime, if the HIE Board had any conscience over what has happened, all Board Members with more than two years service should offer their resignation – on my counting that will leave only 3 Board Members and no Chairman. Keeping the Board Members who have presided over the mess which is Natural Retreats will just prevent the right decisions from being made.

Lastly, although HIE must take responsibility for the safety failures which have resulted in the HSE’s improvement notices, there should be some way of getting at the former directors of Cairngorm Mountain Ltd, for negligence in not ensuring that safety repairs flagged up for several years in the consultant’s annual safety reports were completed. Again it will need HIE to take the appropriate action……is this for once possible?

Of course Natural Retreats and HIE have been chums for a while with the John O’Groats re-development and Lews Castle in Stornaway. Are they still chums one wonders?

An excellent question. Its beyond scope of parkswatch but people concerned about what is happening at JoG and Lews – and there are many local people concerned – should consider submitting FOI requests relating to those developments

HIE response to a FOI

“HIE has considered your request and is pleased to provide the following information;

• A link to the Audit Scotland Report – Review of Cairngorm Funicular Railway (October 2009) http://www.audit-scotland.gov.uk/report/review-of-cairngorm-funicular-railway

• Our financial system holds records of spend on Cairngorm Mountain Ltd only from 1998. The total spend relating to Cairngorm Mountain Ltd from May 1998 to Dec 2018 is £2,619,187 (This includes loan and overdraft funding totalling £1,845,180 repaid in full).

Cyril, thanks and I will look at further. There is a difference I think between spending direct given to CML (which this response appears to cover) and other expenditure on Cairngorm Mountain which would help the operator but was not directly to them. That makes the total expenditure greater than would appear from this response. Nick