The financial position of Cairngorm Mountain Ltd

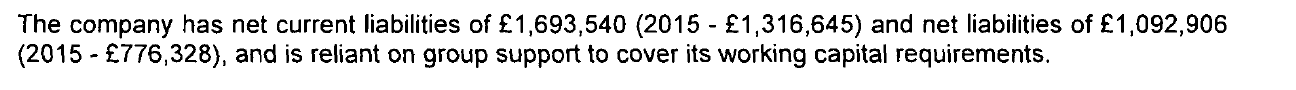

Following my post on the finances at Cairngorm (see here), a Natural Retreats spokeswoman claimed to the Strathy this week that “Overall despite an operating loss the company was cash flow positive requiring no group support or bank intervention”. This is completely misleading, as the Cairngorm Mountain Ltd accounts show:

So, both current and net liabilities increased significantly – by c30% – in 2016 and while the spokesperson claimed no “group support” was required the accounts say the opposite!

Given that the 2017 ski season was terrible, it should be safe to conclude that CML is now, almost a year later, in an even worse financial position with all the consequences that could have to local businesses, including suppliers. I say “should” because the loss in 2016 was created by the large increase in administrative charges paid to Natural Retreats UK – which HIE needs to explain – and could, and should, be reduced. I doubt that any bank would intervene to support this business, so why is HIE still supporting it?

CML and Natural Assets Investment Ltd

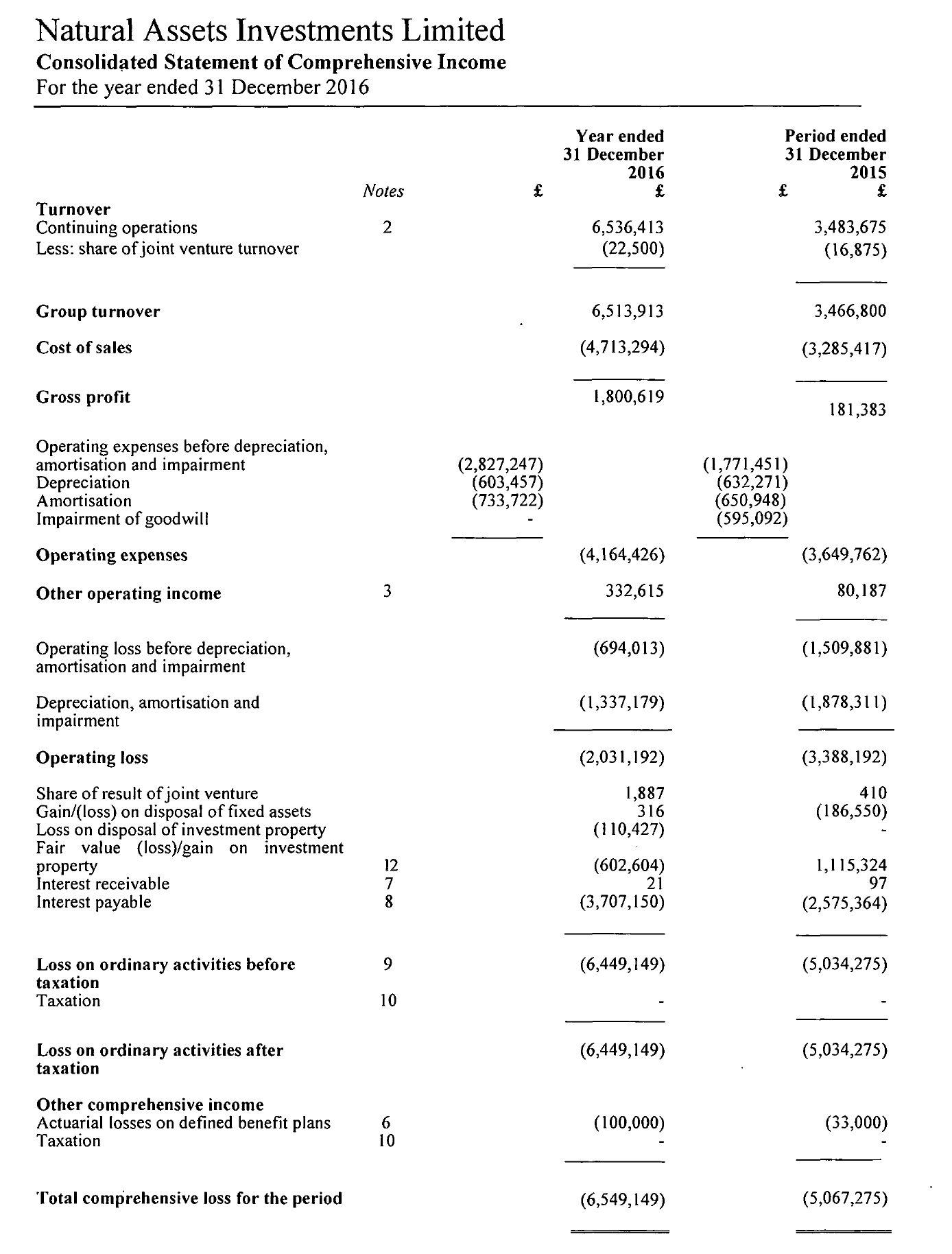

In this post however I wish to focus on CML’s relationship with its parent company Natural Assets Investment Ltd which published consolidated accounts for the group, which includes CML, in October (see here). Start with the bottom line:

NAIL’s loss increased by almost £1.5m compared to 2015 to £6,549,149. This is reflected further down in the accounts in an increase in its net liabilities from £22,831,678 to £29,380,827. Yes, NAIL is almost £30m in the red!

NAIL’s loss increased by almost £1.5m compared to 2015 to £6,549,149. This is reflected further down in the accounts in an increase in its net liabilities from £22,831,678 to £29,380,827. Yes, NAIL is almost £30m in the red!

The key point however is that total turnover, i.e income, for the group was £6,536,413 which is less than the loss that was made. The group is in an extremely parlous financial position and can only continue because of guarantees from its owner David Michael Gorton. No bank would lend to a company in this position.

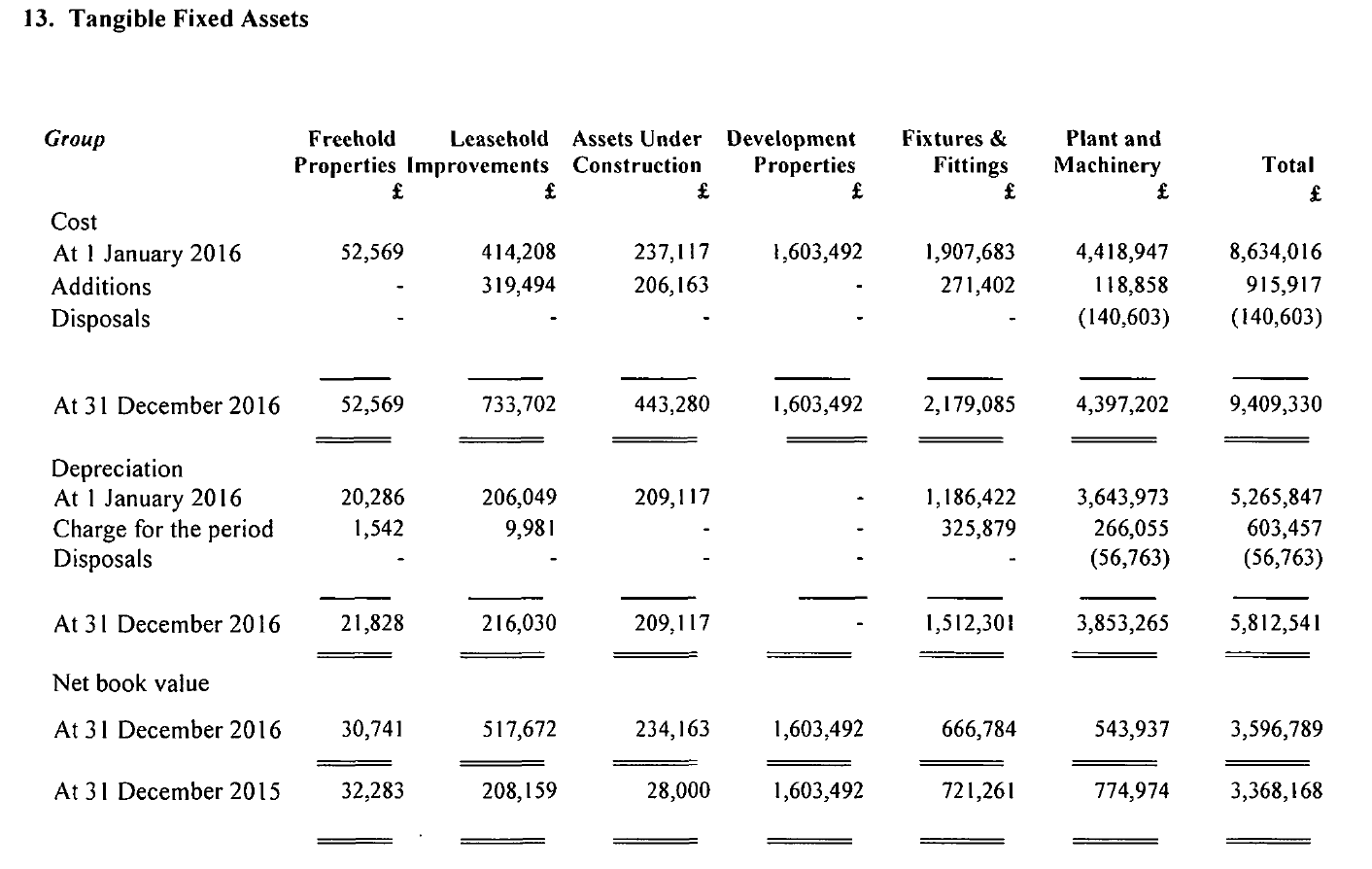

The reason for this deficit is not because the company is investing huge sums:

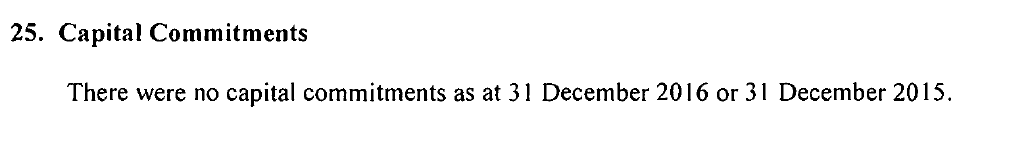

This table shows the group invested just £915,917 (second line) in the year across all their businesses of which we know £360,882 was at Cairngorm (from the CML accounts) . Moreover, NAIL was apparently not planning to invest anything either:

This account fits with the evidence of lack of significant investment since Natural Retreats took over at Cairngorm, with almost any work that has been done funded by HIE.

The main reason for the losses has nothing to do with trading (the Group made an operating profit of £1,800,619) or investment, its down to other expenses. Most notable among these is the amount of debt owed (£46,468,212) and interest paid (£3,633,498) to its owner, David Michael Gorton, who used anyway to be described as a hedge fund manager:

What this shows is that despite paying Mr Gorton more than in the previous financial year, the total amount owed to him has also gone up! We can therefore expect that in 2017 payments to Mr Gorton will be even higher. £3,633,498 is a pretty good return on fixed assets which are now valued at £3,596,789 and investment properties which have a net book value of £20,340,101 especially when some of the purchase price of the assets was paid for by a bank loan (c£4m) from HSBC.

The other important thing to note about NAIL’s consolidated accounts is that out of the total turnover of £6,536,413, £4,749,982 comes from Cairngorm (figure from CML accounts). What this means is that the NAIL group is almost entirely dependent on operations at Cairngorm for income. Its the only cash cow in the group.

While Natural Retreats UK and Natural Assets Investment Ltd are separate companies, they share many of the same Directors and what’s more NAIL has NO employees. Its dependent on Natural Retreats UK to do work and this is reflected in the notes to the accounts:

It appears therefore that Cairngorm is being used to keep the whole NAIL group going and that most likely explains the huge increase in administrative costs charged by Natural Retreats UK to Cairngorm Mountain Ltd in 2016.

What needs to happen

Its a public scandal that HIE sold Cairngorm Mountain Ltd for a knockdown price to a company which had no track record and whose net liabilities have increased by about £5m each year since it was incorporated in 2011 and now total a staggering £29,380,827. The risk now is that when Natural Assets Investment Ltd, whose main income comes from Cairngorm, goes into administration – as it surely must do at some point – that will put both jobs and assets at Cairngorm at risk (at present, through a charging order the bank HSBC appears to have first call on all assets in the group).

HIE and the Cabinet Secretary responsible, Fergus Ewing, now needs to explain publicly what action it will take to protect the public interest at Cairngorm, including how it will safeguard assets purchased with the public purse and how it intends to prevent monies continuing to drain out of the local area.

Unfortunately, as Minister responsible, Fergus Ewing, appears to have his head in the sand:

- No mention of the money being extracted from Cairngorm or the risks posed by Natural Retreats

- No appreciation that Natural Retreats will invest nothing at Cairngorm – its HIE staff who have had to go and check out the snow making machines

- Re-writing of history. Since the installation of the funicular HIE has been obsessed with increasing numbers of summer visitor and has just paid for removal of the Coire na ciste infrastructure

- No mention of the Save the Ciste Group or role it has played in making people understanding the importance of winter activities at Cairngorm

- The failure to mention the Aviemore and Glenmore Community Trust and his preference for listening to selected people who he implies represent local opinion.

Are we taking bets that when NAIL fails, another D Gorton company will purchase the assets at a discount – leaving the debts behind? Having a foreign hedge fund own your national heritage doesn’t seem, on the face of it, the most strategic or stable way to develop local business or sustain a national asset. From all you’ve reported this is crying out for public ownership.