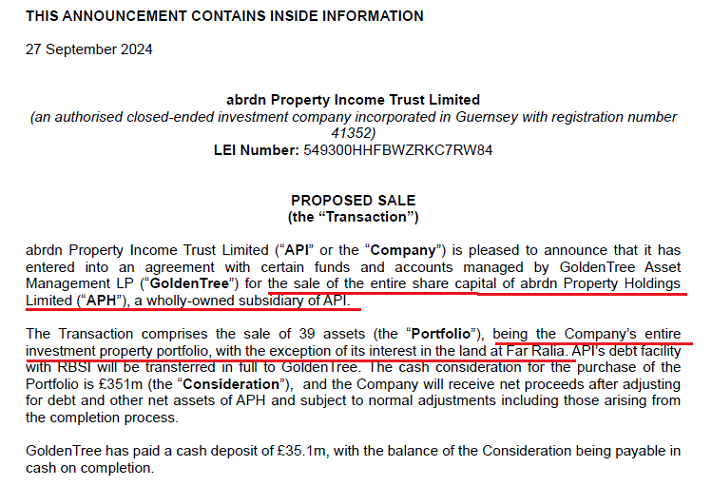

After putting Far Ralia on the market for £12m in July (see here)at the end of September Abrdn’s Property Income Trust (APIT) announced it had reached a deal to sell all the remaining propterties it owned to GoldenTree Asset Management (see here). This post consider the implications.

Far Ralia and the sale of Abrdn Property Holdings

In March APIT shareholders rejected Abrdn’s proposal to sell the whole of APIT to Custodian Real Estate Investment Trust on the grounds they could receive more if its properties were sold off individually. Six months later, having sold just two properties from its portfolio, the APIT board has sold the remainder, all that is except Far Ralia, to one company anyway claiming this was “the best solution”. The difference to the original plan is that instead of selling APIT itself, they are selling APH (Abrdn Property Holdings) the subsidiary set up to own the properties.

While Far Ralia was put on the market two months before the deal to sell APH was announced, there was nothing to stop GoldenTree acquiring it as part the purchase. Clearly, GoldenTree did not want it because APIT has had to make special arrangements for Far Ralia in the period leading up to the sale of APH on 29th November and afterwards. This is explained in APIT’s Interim Results for 2024 published on 30th September (see here):

While Far Ralia was put on the market two months before the deal to sell APH was announced, there was nothing to stop GoldenTree acquiring it as part the purchase. Clearly, GoldenTree did not want it because APIT has had to make special arrangements for Far Ralia in the period leading up to the sale of APH on 29th November and afterwards. This is explained in APIT’s Interim Results for 2024 published on 30th September (see here):

“The land at Far Ralia is the only property asset that is not part of the portfolio sale. The plan is to transfer this asset up from the subsidiary company [i.e APH] (which is being sold) to abrdn Property Income Trust before the completion of the disposal of the portfolio. This process depends on getting

certain governmental approvals [including Scottish Forestry]. The managers and advisers are doing all they can to obtain this, but it may not be achievable. If it can’t be done before completion, and to

avoid any delay in the sale of the rest of the portolio, GoldenTree has agreed to hold Far Ralia on behalf of the Company and will transfer it back once the appropriate permissions have been obtained. In the meantime, the managers are marketing the land for sale to a third party.

It is likely that a liquidator will be appointed shortly after the completion of the sale of the portfolio and the proceeds have been received by the Company………………Shortly after that the liquidator will distribute the majority of the proceeds of the portfolio sale to shareholders by way of a capital distribution. The liquidator will then seek to sell Far Ralia, settle all Company liabilities, wind-up the Company and distribute the remaining cash balances to shareholders.

The timing of the final wind-up of the company is highly dependent on when Far Ralia is sold.”

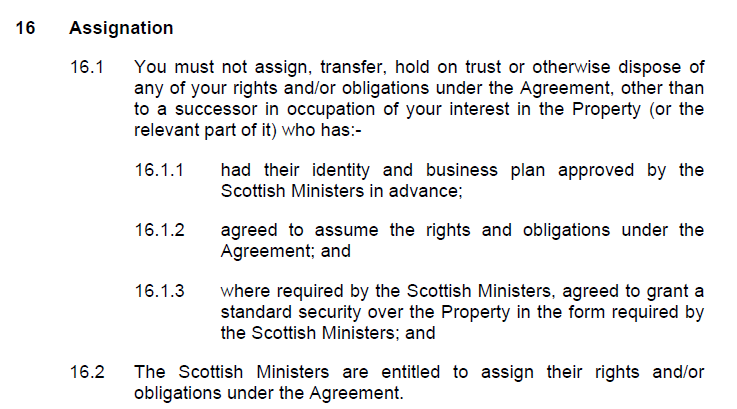

While it may take time, in principle it should not be too difficult for APIT to get permission from Scottish Forestry to transfer Far Ralia from APH to itself because both the management and business plan are likely to remain the same. APIT’s liquidator, however, will then have to seek further permission before they can sell Far Ralia to someone else “whose business plan” must, according to the contract with Scottish Forestry, be “approved by the Scottish Ministers in advance”:

Discussion

The whole process as described above could clearly delay the sale of Far Ralia and the proposed liquidation of APIT. It could also affect the sale price and who eventually purchases the estate.

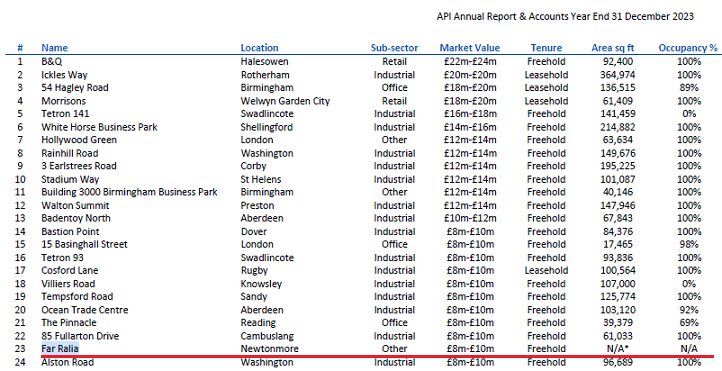

Despite Knight Frank marketing Far Ralia for £12m, APIT’s interim results show its value is significantly less than this:

Moreover, while the Interim Results noted that Scottish Forestry had not yet paid APH any of the grant it had awarded for tree planting, it did not mention there had been a serious breach of grant conditions. Following the site inspection in June Scottish Forestry required 16% of the planted trees, which came from the wrong seed zone, to be replaced and the removal of sycamore imported from the tree nursery (see here). That is a considerable amount of work which APIT will have to do or they will risk enforcement action and losing the Forestry Grant. That could have a further significant impact on the value of the property.

As a consequence of all this it is possible that the liquidator will decide to cut their losses – time is money – and decide to sell off the land for whatever they can get for it. Given the damage to the ground (the top photo provides a further example) it is difficult to see any conservation body or the local community wanting to take it on unless the price was very low.

APIT partly acknowledged this in their interim results statement: ” The value obtained from the sale of Far Ralia when the Company can sell it is a further uncertainty.” That is a change from their annual report for last year, when the carbon bubble was still inflating, which stated “Indications suggest the capital value uplift on a sale will make this investment one of the Company’s better investments.” Clearly at the time they hoped to get £12m for a piece of land they had bought for £7.5m just two and a half years earlier.

While GoldenTree may not have wanted to buy Far Ralia because of the £12m asking price, it is also quite possible that it has no interest in the potential to offset some of the carbon emissions of the properties it is buying or in land speculation. Having seen how APIT bought the land not for conservation but for speculative purposes, aided and abetted by the promises of grant funding from Scottish Forestry, Scottish Ministers should now resolve to use their powers to try and prevent the same happening again.

More specifically at Far Ralia Mairi Gougeon, who is the lead Scottish Minister, could use Scottish Forestry’s contract with APH, which APIT want re-assigned to them, to make it clear to APIT what sort of purchaser and business plan they would be prepared to approve. While APIT might try and cut and run, the reputational damage to Abrdn and the Scottish Forestry grants system would be significant. Far better for both parties to the contract to find a prospective purchaser who might be prepared to pay for conservation on the property on an ongoing basis, most importantly by reducing deer to 2 per km or less, rather than using it for speculative purposes.

Perhaps the Cairngorms National Park Authority could start acting like at National Park and give them a public nudge in that direction?

The whole grants for trees system is failing spectacularly and fuelling land grabs by speculators. The Scottish Government’s track record on conservation and land use reform (not to mention marine habitats) is poor to dismal and needs urgent reform

£12 million?

They’ll get a gig at the Fringe with jokes like that.

Institutional money hitting a speculative craze who would have thought.

So who or whom was responsible for the bad management..was it Aberdeen or a professional tree company..planting the wrong areas and adding sycamore..

Professional liability??..

Akre trees appears to have grown most of the trees in their tree nursery and then planted them – so would appear to bear primary responsibility for this. The contract Abrdn, as it then was, had with AKRE is however not public and it is not clear whether it covered situations such as this and who has ended up paying for the work. One of the major problems at present is that organisations attracted to make money out of the woodland carbon code market (Abrdn, BrewDog, Oxygen Conservation) have almost no conservation expertise or forestry experience. They are thus totally dependent on forestry consultancies. Some of those consultancies are better than others but relying on just one organisation for everything is very dangerous for organisations that don’t know what questions to ask.