This post provides a summary of some recent evidence that has emerged about the Loch Lomond and Trossachs National Park Authority (LLTNPA)’s mis-management of the crisis at the mine and some related financial developments.

The “regular updates” given to LLTNPA Board Members about Cononish goldmine

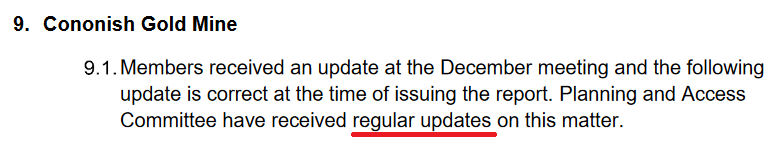

The Chief Executive’s report to the LLTNPA Board Meeting on 11th March (see here) made the following claim:

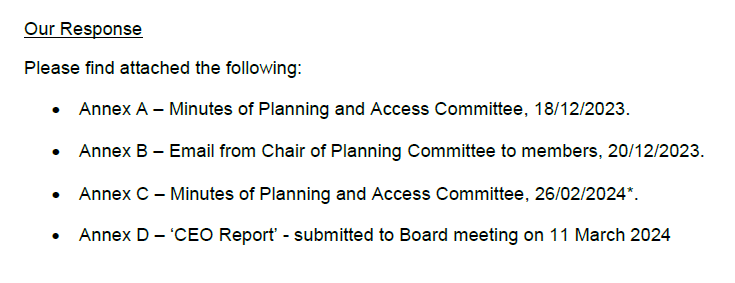

I questioned this in my last post on Cononish (see here) as the goldmine had only been on the agenda of the Committee once in the previous 15 months (in October) and an Information Response had established NO emails had been sent to Committee members before the end of last summer. A subsequent Freedom of Information Request asking for all communications to Board Members elicited a response on 3rd April:

Not so many regular updates after all!

Annex A had me baffled because Cononish was not on the agenda of the Planning and Access Committee of 18th December and there is nothing in the minutes of that meeting either! The Annex B – Email of 20th December, shows there was in fact a discussion about the pollution incidents reported to SEPA at the meeting. The absence of a reference in the minutes shows LLTNPA staff and board members wanted to keep this secret.

It appears the Annex B email was prompted by my December post (see here) – I am referred to as “this individual” – about the pollution incidents at the mine. The email shows that LLTNPA staff were so concerned about the pollution incidents at the mine that they had threatened “the operator” (unnamed) with enforcement action.

In relation to Annex C, Cononish was not on the agenda of the February Planning and Access Committee either, though the minute shows it was mentioned under AOB. The minute provides a short summary of what was said by the Director of Planning, Stuart Mearns, designed to tick governance boxes and not reveal any information (for example has SGZ Cononish fully uprated the restoration bond?):

“SM updated Members and took any questions from Members on Planning Application 2017/0254/MIN – Cononish Gold Mine, Tyndrum. SM confirmed that SGZ is not in administration. SM confirmed that the site remains in a care and maintenance regime. SM provided assurance that mitigation and remedial works are in place following discussions. SM confirmed that SEPA continue to monitor the site alongside the National Park Authority. SM confirmed the status of Bond holdings relating to the site.”

There are two key points to note here. The first is the secrecy, epitomised by the fact that staff had deemed none of the information in the Annex B email worth reporting openly to the Planning Committee which took place just two days earlier! The second is that I had been predicting such pollution problems ever since the mine started to get into financial difficulty (see here), asked the Convenor of the LLTNPA Heather Reid to take action on many occasions and have never once received a response from her or the conveners of the Planning and Access and Risk and Audit Committees.

By failing to scrutinise the “operational arrangements” LLTNPA senior management had put in place to protect the environment after the goldmine closed and by failing to hold staff to account, the Committee Conveners and Board Members on the Planning Committee abdicated their basic responsibilities.

The December Mine Monitoring report

A key means which LLTNPA staff have used to keep both the public and their Board Members in the dark has been to hold back mine monitoring reports for six months. I had asked for these reports before but when the LLTNPA refused to release the Monitoring report of 13th December (referred to in the email above) I made it clear I intended to pursue this through to the Information Commissioner if necessary. Miraculously, on 26th April in an obtuse piece of reasoning FOI 2024-003 Review Response the LLTNPA decided they could release this report after all, while refusing to accept the principle that all monitoring reports should be released timeously.

The December report has still NOT been published on the planning portal although that for October 2023 has recently appeared. Unfortunately it is too large to publish here.

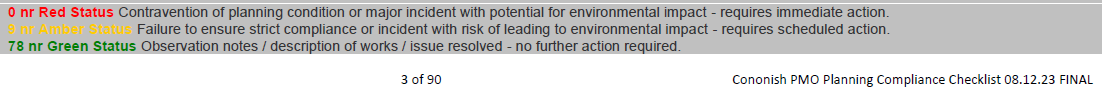

Not a single action in the Monitoring Report is marked red despite the Annex B email sent just seven days later revealing that LLTNPA staff had been considering enforcement action and despite the report itself stating urgent action was required:

Farcical!

Farcical!

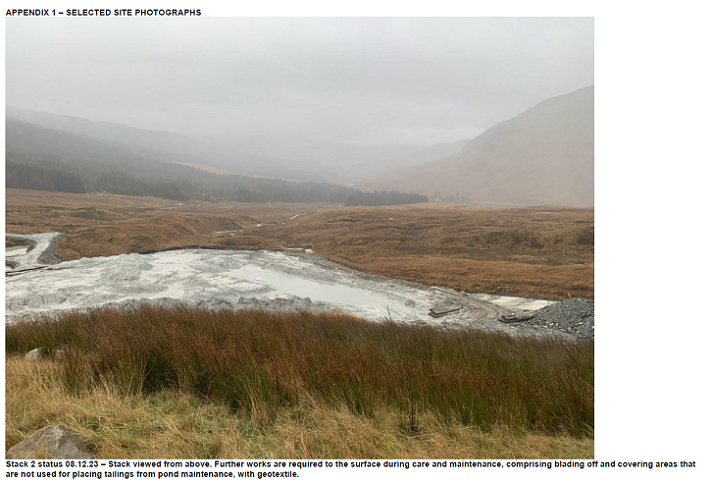

The report shows the LLTNPA’s response to the signficiant number of pollution incidents was to require the operators to “seal” Tailings Stack 2 with geotextile by mid-February (the CEO’s report to the March meeting shows this target was missed) and to empty sediment from the settlement ponds to stop it overflowing into the river system.

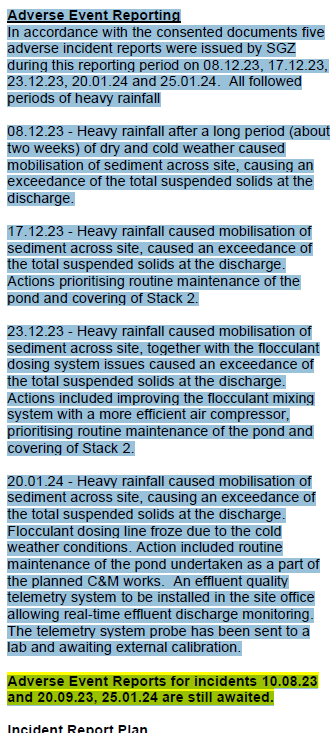

These actions could and should have been taken BEFORE the winter. The Monitoring report reveals that despite the urgent actions required in December the pollution incidents continued:

The only reason that there has not been a major environmental disaster at Cononish is that tailings stack 2 was at a relatively early stage of development when the mine stopped working. Instead of the Board investigating this narrow escape, past experience suggests senior management will soon be patting themselves for a job well done.

What does the LLTNPA know about SGZ Cononish’s finances and the continued risks?

Both Stuart Mearns and Gordon Watson, the CEO, have emphasised in reports that SGZ Cononish, the company that operated the goldmine, is not in administration unlike its parent company Scotgold Resources. On 29th February a notice was published by the administrators in Australia saying a resolution had passed (see here) to wind up Scotgold Resources voluntarily. So where does that leave SGZ Cononish?

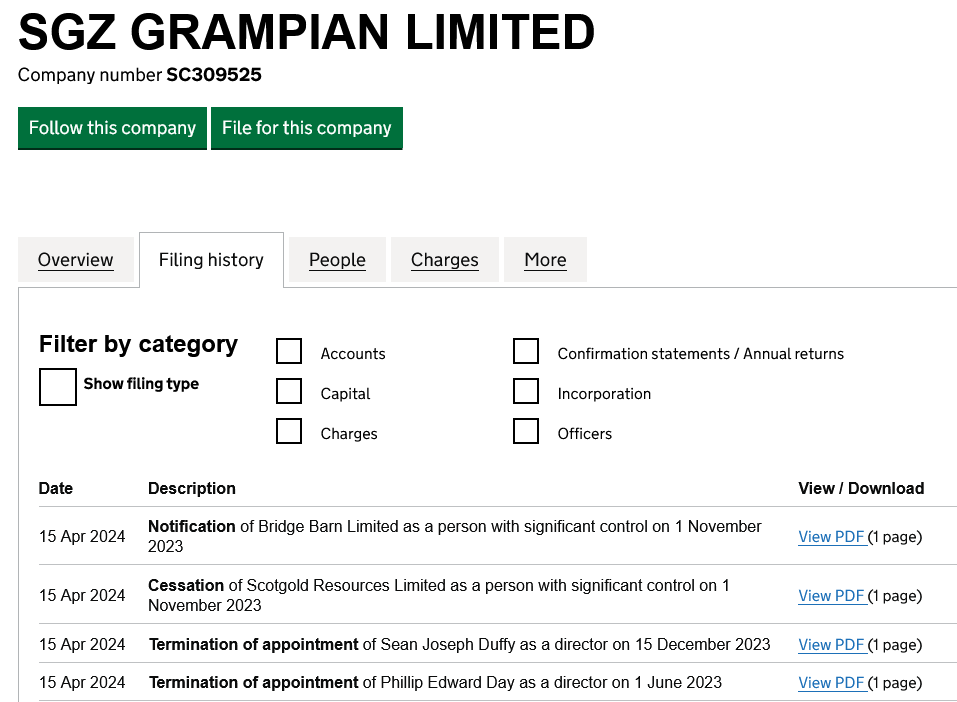

Recent updates for SGZ Cononish’s sister company, SGZ Grampian, which have posted at companies house indicate a notable change:

On 1st November, just before Scotgold Resources went into administration, control – i.e ownership of SGZ Grampian – transferred from Scotgold to Bridge Barn Ltd. This is a private company, controlled by Nat Le Roux, who was also a Director of and shareholder in SGZ Cononish.

Bridge Barn Ltd had provided a secured loan facility of £8.5m to SGZ Cononish, which had been fully utilised, at a nominal interest rate of 8.5%. That loan facility was secured by a fixed charge whereas two further loans provided in 2023 by MRI Trading Ag were secured by floating charges. Fixed charges always take preference to floating charges in cases of insolvency leaving Mr Le Roux as the creditor in the most powerful position.

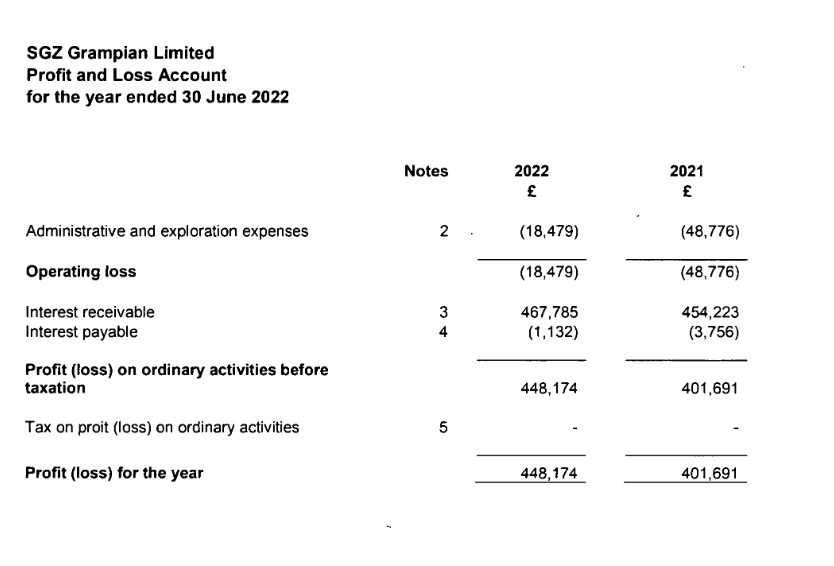

SGZ Cononishhad also been lent money in the form of promissory notes by its sister company, SGZ Grampian (over £15m in capital and it owed a further £1.6m in accrued interest). The last accounts for SGZ Grampian show it was undertaking very little exploratory activity – a maximum of £18,479 – but had received £467,785 in interest most of which appears to have come from SGZ Cononish:

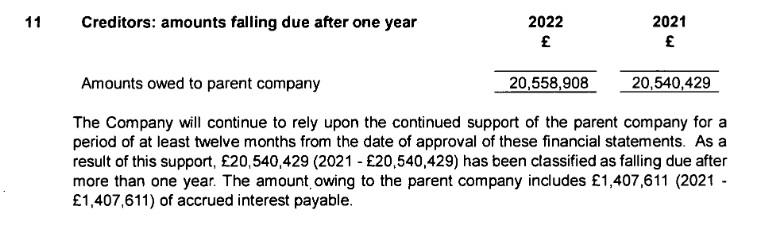

SGZ Grampian’s accounts also suggest that the money it had lent to SGZ Cononish had originally come from its parent, Scotgold, to whom it owed £20,558,908:

In other words Scotgold Resources main means of financing the Cononish Goldmine latterly was indirectly through its other subsidiary SGZ Grampian.

By assuming control of SGZ Grampian before Scotgold went into administration, it is now Nat Le Roux rather than Scotgold who has a call on those promissory notes as well as the secured loan. Given all this, it appears the liquidators of Scotgold in Australia may have determined SGZ Cononish was completely worthless as an asset to them and effectively left it to its creditors. As the owner of SGZ Grampian and Bridge Barn Ltd, Nat Le Roux, appears to have secured his position as the minority shareholder in the mine (companies house records him as having had significant control since 2017) and it appears that he is now effectively responsible for what is happening there.

How all this plays out in terms of company law remains to be seen. (While Scotgold is referred to as the parent company in SGZ Cononish’s accounts it is not recorded on Companies House as having significant control). It will also be interesting to see from SGZ Grampian’s accounts, when they eventually appear, how Bridge Barn gained control of.the company.

It is unclear what plans Mr Le Roux might have for the mine or its remaining assets, only that if my analysis is right it appears likely he is financing the “care and maintenance regime” at present by some means or another. If so, it is not clear whether LLTNPA staff know this but are keeping it secret or whether its never crossed their mind to ask how any “care and maintenance” at the mine has been paid for over the last seven months.

Under Condition 2 of the planning consent granted for the mine, once its has not been used for a year – that is less than five months away – it becomes an “abandoned mine” and the owner then has to produce a restoration plan within six months. After the LLTNPA approves such a plan – which could take months or years – the owner then has a further two years to restore the mine using the monies from the restoration bond. The sealing of tailings stack 2 with geotextiles suggests that LLTNPA may now be planning for this eventuality and they expect the mine to be in a mothballed state for a significant period of time.

That will create further environmental and financial risks which should be openly discussed and considered by the LLTNPA Board. Were it come to a case of the National Park v Mr Le Roux, who might conceivably be hoping to re-open the mine at some point in the future, given past performance and the LLTNPA’s head in the sand approach I know where I would place my bets.

The December monitoring report also showed that a representative from the Crown Estate, which leases out the mining rights and receive royalties from the mine, and the landowner were present at the site visit along with Stuart Mearns, as Director of Planning. That is an indication that other things are going on which should be being publicly considered by the board.

It would be good to hear from any local Scotgold creditors about what the administrator has told them regarding the likelihood of getting any of their money. In cases like this, administrators must ensure that they get the most cash they can from the disposal of Scotgold assets – or at least offer some proof that the assets are worth less than the amount the company owed to Mr Le Roux/Bridge Barn before handing them over to him. It’s their duty of care to creditors to maximise the cash pot from which their claims will be settled and that isn’t possible unless the mine has been offered for sale to potential buyers. Of course, the administrators having approved the transfer of title to Bridge Barn, the assumption must be that the assets are worth considerably less than Le Roux/Bridge Barn lent to the company on a secured basis…but creditors are entitled to transparency on this valuation.

I am interested in this as I am a geologist and worked at Tyndrum but not at the mine. If you look around Tyndrum there are lots of areas of where mining has been carried out in the past. There are open mine shafts but I don’t see anyone complaining about them. I don’t see any mention of the lost jobs in Tyndrum? So what if the National Park has been slightly polluted. It would be less polluted if the hordes of visitors to the National Park did not visit in the first place.

Frankly, for a geologist, this seems like a head in the sand approach to this issue – excuse the metaphor. We live in very different times from when these old mine workings were active, and have very different environmental and safety standards. Maybe LLTNPA and/or the Crown Estate should be updating any risk assessment they might have on the potential dangers from these old mineshafts.

Secondly, the presence of old mine workings is no excuse for letting off Scotgold and its owners from their environmental responsibilities, or for the negligence and secretive approach from LLTNPA in managing the planning conditions. As a public body, funded out of taxpayers’ money, LLTNPA needs to be much more diligent and open in its approach to such problems. The viability and benefits of National Parks is currently a moot topic. LLTNPA has over the years provided a bad example of how a National Park should be managed.

Lastly, it feels like this geologist is anti-tourism. His approach if pursued would have a vastly larger effect on jobs in this rural area. Yes, some visitors could be much more responsible – focus on that rather than discouraging visitors.