In the majority of National Parks across the world land is publicly owned but not in Scotland nor the wider UK. That might not matter so much if Scotland’s National Parks had real powers to control how land is used and traded but their current powers are limited.

Just as importantly, neither the Loch Lomond and Trossachs National Park Authority (LLTNPA) nor the Cairngorms National Park Authority (CNPA) have shown much interest in promoting any land reform agenda within their boundaries, let alone monitoring what is going on or using the powers they do have. Both appear to accept the current system of landownership as it is, which helps explain why they have made so little difference: the conservation, forestry and sporting estates landowners all do what they were going to do anyway.

The failings of our National Parks are epitomised by what happen when significant areas of land comes onto the market. This post will take a look at Auchreoch, one of three significant landholding currently up for financial grabs.

The Auchreoch Estate – Strathfillan and Cononish Glen

The Auchreoch Estate is being marketed by Galbraith at offers over £2.5m (see here). It is 615 hectares in size so well below the 3000ha threshold which the Scottish Government proposed last year should be subject to a public interest test before sale.

The public interest in this land, however, is very great: it includes a significant area of degraded peatbog, the second most southerly remnant of Caledonian Pine Forest in Scotland, Coille Coire Chuilc, and land planted with conifers which, once felled, should be used to enable the native woodland to expand.

Auchreoch is therefore a key piece in the jigsaw of landscape scale conservation and provides a good illustration of the stupidity of setting size thresholds for public interest tests. The smallest Site of Scientific Interest in Scotland, Bo’mains Meadow, is just under 1 ha in size. Is the Scottish Government really saying there should be no checks on who can own such pieces of land?

The challenge at Auchreoch, as I explained two years ago (see here), is that despite 50 years of intermittent efforts by NatureScot and its predecessors, the Coille Coire Chuilc SSSI is still in poor condition as a result of grazing pressure.

In 2020 in yet another attempt to save the pinewood the LLTNPA decided to try and help by using “conservation” money from the Cononish goldmine to pay for yet more fencing around the SSSI, having also decided fenced an area adjacent to it.

The new fences, as I showed last week (see here), may have been misguided but they have fallen through not because they mark poor conservation practice but because Auchreoch has been put on the market. Mr Lewis’ agents are now marketing Auchreoch for its “superb natural capital potential” at offers over £2.5m. If someone pays that price it will represent a financial return to Mr Lewis on his original purchase price of 27.5% a year. While the Registers of Scotland shows that Major Cruickshank, the previous owner, had retained the right to buy back the property at its original price he died in 2019.

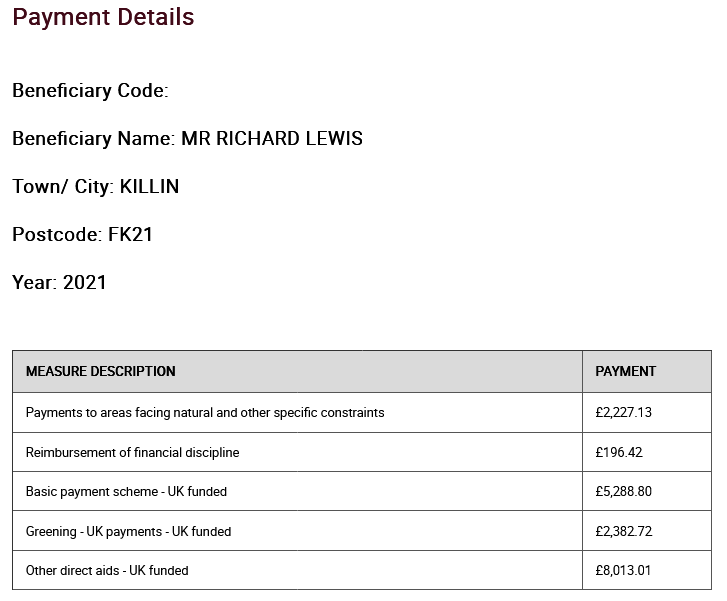

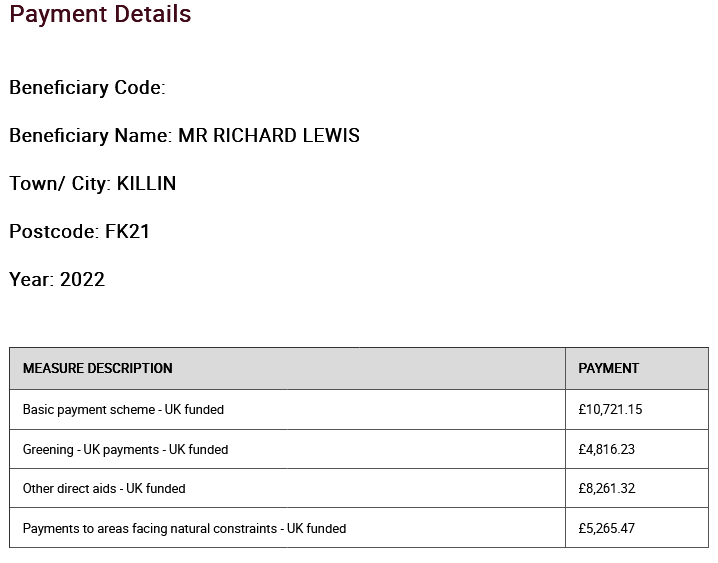

There is no evidence to suggest that Mr Lewis has left the land in any better state than he bought it. Instead, it would appear he has been subsidised through the Rural Payments system to continue grazing the sheep which have helped prevent the pinewood regenerate:

The LLTNPA was helping to use this rural payments system to contribute £20k towards the cost of a new fence around Coille Coire Chuilc with the remaining £10k coming from Scotgold’s mine. So the state pays a landowner to keep sheep which have been destroying a SSSI and then would pay again to protect it from those sheep. This is complete madness and the LLTNPA board should have been leading the calls for reform: instead they have kowtowed to the farmers and landowners and reinforced the current system by playing along with it.

Having subsidised previous landowners to destroy the nature conservation interest at Auchreoch, it is likely that any new owner will be eligible for yet more Scottish Government grants for peatbog restoration and native woodland planting to restore the estate’s “Natural Capital”. That owner will then be free to trade carbon credits through the peatland and carbon codes, potentially making even more money. Hence why Mr Lewis can ask for £2.5m for land he bought for £240k 10 years ago.

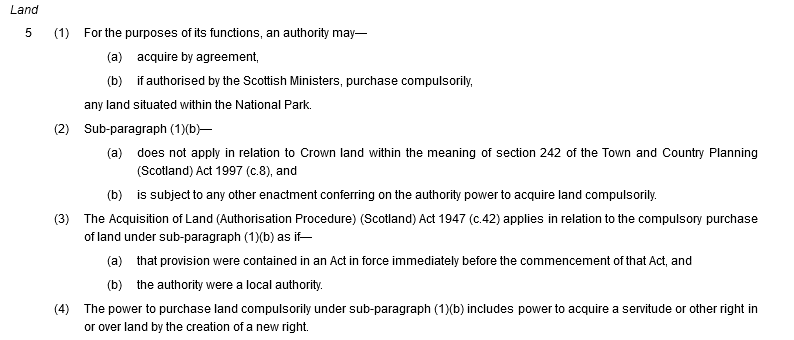

All this system does is fuel land prices putting them well beyond what either local communities or public agencies can “afford”. Under Paragraph 5 to Schedule 2 of the National Parks (Scotland) Act 2000 (see here) the LLTNPA has the power to:

Two years ago I argued the land at Auchreoch needed to be compulsorily purchased. Imagine if ten years ago the LLTNPA had made the case to Scottish Ministers that Auchreoch should have been bought for £240K? At present staff don’t even report what land is on the market to the LLTNPA Board.

While the £2.5m asking price might now be prohibitive, if the LLTNPA were to openly state it would NOT pay for peatland restoration (it is now responsible for those grants in its area) and would oppose any forestry grant applications, that would likely affect what potential new owners would be prepared to pay Mr Lewis considerably. The principle should be those who have damaged the land pay to repair it.

Unfortunately, the Scottish Governments proposals to reform National Parks (see here) includes no discussion on their role in relation to land, let alone any ambition to intervene in the land market or to control how land in National Parks is used (except for some new minor powers in respect of byelaws aimed at the general public).

It will be interesting to see if the LLTNPA in their response to the current consultation on biodiversity raise what is happening on estates like Auchreoch to make the case for reform – it would be a first. What should be clear, however, is that without fundamental land reform in our National Parks the mismanagement of land for private not public interests is likely to continue and both the climate and nature emergencies will as a consequence continue to get worse, not better.

https://reidfoundation.scot/2023/09/land-reform-open-letter-to-the-cabinet-secretary/

I’ve signed this letter, in the absence of much else I can do to support the case for land reform in Scotland.

I am impressed with so much of your output, which I have shared on the few chat groups of which I’m a member. I think that, in this age of continuing impoverishment, the largess being doled out from the public purse should be more and more questioned and challenged.

I’ve written a few blogs myself, to try to raise awareness:-

https://yoursforscotlandcom.wordpress.com/2022/06/06/stands-scotland-where-it-did/

https://yoursforscotlandcom.wordpress.com/2022/11/06/as-cop-27-opens/

https://yoursforscotlandcom.wordpress.com/2022/12/01/the-health-of-nations/

Well, said Fiona

Aye, Nick, this is one of the main reasons why I wrote the 2016 piece on the need for a totally different approach.

Can you give us the link to that Ron?

The Scottish Government needs to look towards Land Value Taxation. More accurately known as Annual Ground Rent and introduced as an alternative, not additional, revenue source, this would make all landowners liable for an annual charge based on rental value. With a ballpark selling/rental ratio of 20:1, a £2.5m estate (land alone, excluding improvements) would pay £125,000 per annum, making land much less attractive as an investment or as a vanity purchase. Prices would fall and stabilise of course, but any increase in value from subsequent changes to public policy or public investment in infrastructure etc would be reflected in regular valuations and be absorbed back into the public purse rather than landowners’ private pockets. In its submission to the 2022 “Land Reform in a Net Zero Nation” consultation the Scottish Land Commission urged “systemic changes to enable government to tax land values more effectively”. The sooner the better.

And so force the last few hereditary estates (which have somehow suceeded in passing down their home for generations within the same family, in some cases for centuries,) must be forced onto the open market?

A disinterested ‘market’ where the historic landholdings can then be purchased with gov support under community buy-out rules, to then become managed, probably by consultancy firms ? Is this not the same professional group who would favour this approach to land management anyway? The actual professional group that today advise .gov about new legislation.

If not purchased by local community groups , land that might need to be sold to meet % land tax liability , might then be bought up “wholesale” by global commercial concerns looking to “evade” global carbon emissions by selling off carbon credits. The distant management of these entities offer little or no experience of managing a highland estate at all, They will look only to some nebulous “bottom line” .

Currently public subsidy in Scotland for land comprises all sorts of grants. These can make corporate land investments attractive. But opaque corporate landholdings too often appear to deliver nothing to the exchequer thanks to clever tax-efficient offshore returns?

Please give a reason why the long term family farms/estates all across Scotalnd will be improved by now being compelled to struggle to meet land tax obligations? Asset based, annual working capital-stripping “grab” taxes do hold out this fear. Who benefits?

See this by a landowning farmer:

https://reformscotland.com/2022/10/it-is-possible-to-farm-without-subsidies-duncan-pickard/

Hmmm – yes try selling that idea to every homeowner in Scotland. In the case of most actual landowners you will of course be trying to take breeks off heilanders.

Land transactions are taxed at the point the land changes hands.

It would be an alternative, not additional, source of public revenue.

In 2021 the Scottish Government’s own Social Justice and Fairness Commission urged LVT as part of a reform to end our reliance on Council Tax, Business Rates and Land & Buildings Transaction Tax.

Sorry but the idea is predicated on the idea that landowners have the income to pay the tax – by no means always the case.

Land – in and of itself generates nothing – it is what one does with and on the land that generates economic return which can pay taxes.

The commission you quote lacks coherence in its own thinking in my view

I can’t read your message apart from the first sentence. Words all jumbled. See the link I sent to Tom.

Now reading this on a PC which shows your post properly! A landowner making full use of land, within what is permitted under planning and environmental contraints, would be generating the income. If he is witholding the land from use, maybe in the hope of speculative gain, then he wouldn’t be generating the income. The obligation to pay LVT would encourage him to dispose of it to someone who would put it to optimum permitted use and generate the economic return.

I don’t know which of the two commissions I mentioned you think is incoherent, but the documents are both online and worth a read in their entirety if you wish to make a judgment.

Yes, applied to all land. As you say, urban land values are much higher. Land came free with no production cost and its value is the result of the level of public demand for particular locations but, as I said, increased by public investment in local infrastructure etc. Those values are publicly created and belong back in the public purse. LVT would do that.

Response to “Unfortunately, the Scottish Governments proposals to reform National Parks (see here) includes no discussion on their role in relation to land, let alone any ambition to intervene in the land market or to control how land in National Parks is used (except for some new minor powers in respect of byelaws aimed at the general public).” Personally, I am in favour of more land in Scotland being publicly owned. But it would appear that LLTNPA are probably not the best to look after it as they continually report that Nature is in Crisis within The Park. According to the External Auditors the LLTNPA don’t know the value of the land they do have within their ken. The Audit and Risk Committee Meeting takes place on 5th December ’23 at Lomond Parish Church, Balloch at 2.00pm. This meeting will not be webcast live for public viewing. Meeting will be accessible in person. The main thrust of this meeting is Financial but with items 11- 14 being CONFIDENTIAL. 14. Risk Registers 14.1 Project Risk Register 14.2 Corporate Risk Register. Item 8. Annual Audit Report. The relevance of my Reply lies in the following excerpts from the External Audit. Page 19 of this Report shows that : “Audit conclusion We identified that LLTNPA had not appropriately reflected the right of use asset for its leases with peppercorn rents. See page 22”. Page 32 of the Report : Financial sustainability finding as reported by previous auditor :- Estates planning and impact on accounting treatment The valuation of land and buildings is a complex area, requiring significant estimation and judgement. The accounting recognition of the asset is often dependent on the current and planned use of a building. We found that LLTNPA does not currently have a clear asset plan or strategy in place and therefore decisions on the use of land and buildings often takes place on an individual level. This is evident in the valuation of the Gateway Centre. We recommend that in supporting the National Park Partnership Plan and LLTNPA’s long term vision and priorities, Management look to establish a clear Estates Strategy to outline how LLTNPA will maximise the effective use of its estate to deliver its priorities. Management response and implementation timeframe. Work undertaken and judgements made in 2022/23 : Progress against the recommendation The Board approved the Estates Strategy in June 2023. Conclusions reached: Conclusions Complete. …… REALLY??

Just curious I presume you are going to apply this equally across the land ie in the urban situation?

I would have thought land values would be much higher in those areas, as well its value would have been much more as it had more demand.

The value of any given land is surely driven by among other things the local improvements and a such would it not be fair to take that into account.

To paraphrase socialised improvements (railways, bridges, schools utilities) private gains House prices.

Yes, applied to all land. As you say, urban land values are much higher. Land came free with no production cost and its value is the result of the level of public demand for particular locations but, as I said, increased by public investment in local infrastructure etc. Those values are publicly created and belong back in the public purse. LVT would do that.

The outcome when a couple of ceuries ago authorites thought to levy taxes on light coming through windows is on record. . Centuries before that, in medieval times, tax was raised on the area of land , the “footprint ” of any residential building at ground level. Neither tax produced any long term advantage. Ways were found to get around the supposed levy .

As an earlier respondant ( Brigadoon) to your previous post has suggested already: Land per-se does not produce an income..it is what can be found to generate income from use of the land itself that might lead to some level of profitable return.

Placing a fiscal “pre-pay millstone” onto every owner of land, regardless of net worth, would lead to a collapse in land values. Some land would fall derelict. Families would become homeless and bankrupted. When related to agriculture alone such a tax would only ensure that farmers retained little ability – to plant, invest or obtain stock in season – so as to exploit that landholding. For farmers of marginal land across Scotland, and also for owners of properties already morgaged heavily, such taxation would lead to a collapse in equity value. This would be disasterous.

A few points:

(1) Window tax was stupid – people blocked them up. You can’t hide land (nor move it offshore!).

(2) I have answered Brigadoon’s point about income from land.

(3) You say “regardless of net worth”. LVT is what it says on the tin, based on value, not acreage. Some land is virtually worthless and valuation would reflect that.

(4) Inflated land prices are a fool’s paradise. The bubble always bursts as in 2008 leaving people with negative equity. As Duncan Pickard says, farmland prices are bloated and do not reflect productive capacity, leaving new entrants struggling to get started.

(5) Derelict land would pay LVT according to current permitted use. Usable land held derelict or under-used would be a financial burden and the incentive would be to put it to its optimum permitted use or get rid of it to someone who would.

(6) Don’t forget that this would be an alternative, not additional, source of revenue.