The accounts for Natural Assets Investment Ltd (NAIL) (see here), the zombie company which bought Cairngorm Mountain Ltd (CML) from Highlands and Islands Enterprise (HIE), were published at the end of September. NAIL placed CML into administration after the funicular became unsafe to operate in 2018 and was one of the parties HIE subsequently sued. In August HIE announced they had recovered £11m from the parties involved but did not provide further details (see here) NAIL’s accounts help to reveal a little more:

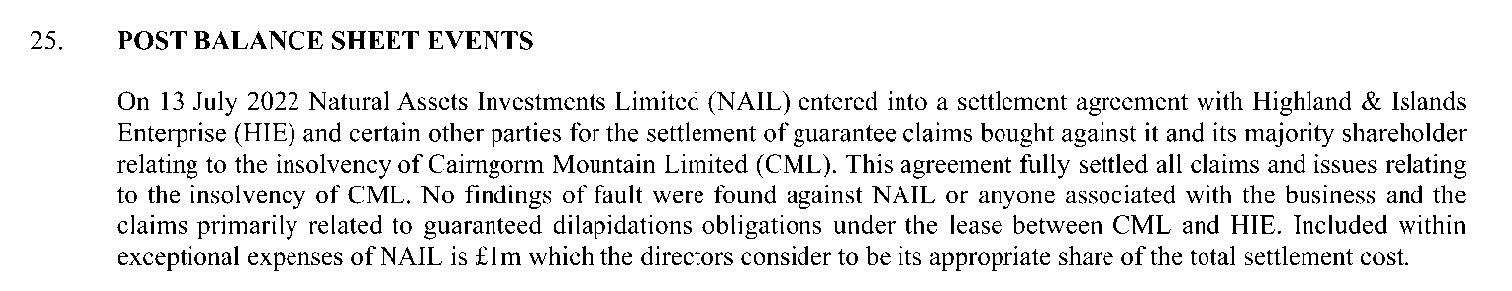

First, a clarification. It appears the 2022 date, over a year before HIE made its announcement, may be a typo which should have read 13th July 2023. That is also suggested by the heading, “post-balance sheet events”, and it would help explain the provisional allocation of “£1m which the directors consider to be its appropriate share of the total settlement cost”. It would also fit with the information provided by the Scottish Courts Service (see here) that three live actions concerning the funicular were extant this time last year.

The note is important, however, as it reveals that there were two different elements to the case HIE took against NAIL and its main shareholder. The first related to financial guarantees that had been provided when HIE sold CML to NAIL for £200k, the second to dilapidations. The note implies that most of the £1m NAIL agreed to pay HIE was for dilapidations and was agreed with “No findings of fault”.

What the note does not say is how much the main shareholder and multi-millionaire, David Michael Gorton, had paid under the personal guarantees he had provided HIE, i.e his share of the settlement agreement. We still don’t know therefore how much of the £11m HIE recovered in the court cases was from NAIL/Gorton and how much from the designers and builders of the funicular, let alone how much if anything was paid in court costs (the “No findings of fault” suggests each side will have paid their own costs).

The financial guarantees provided by NAIL and Gorton

NAIL is apparently a financial basket case, a zombie company whose income after operating costs was insufficient to meet the interest on its debt payments right from the start. Since it was incorporated in February 2011, its net liabilities have increased by about £5-6m year on year. 2022 was no exception and its net liabilities increased to over £61m:

With “current assets” of £568,119 at year end NAIL did not have the money to pay HIE £1m and with the Income statement showing revenue of only £1,596,968 that is unlikely to have changed this year. One way NAIL could pay the £1m it has agreed with HIE is to sell off some of its remaining assets.

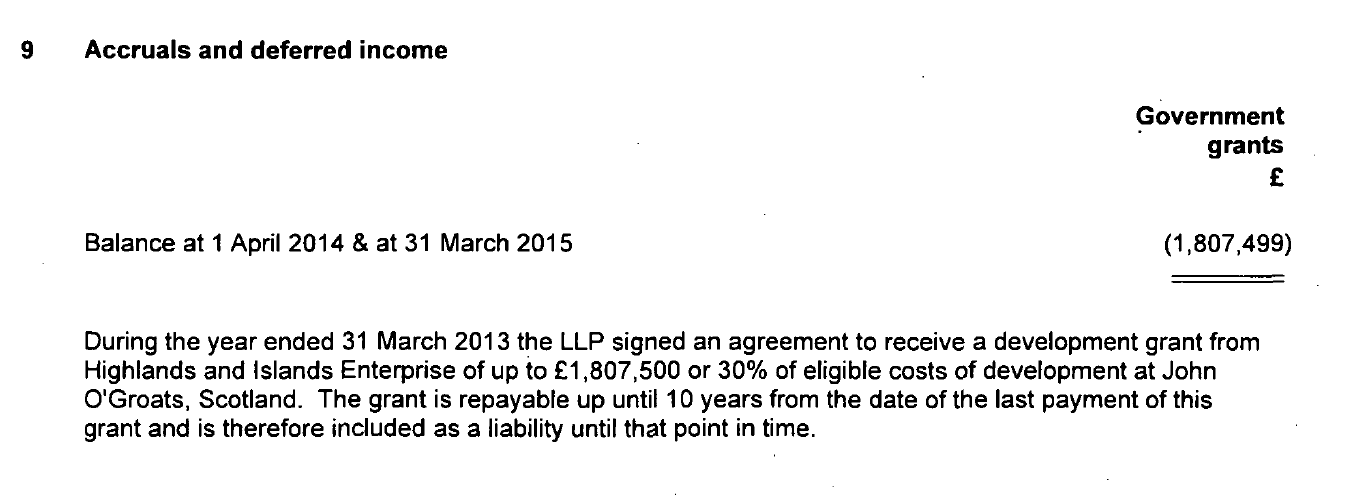

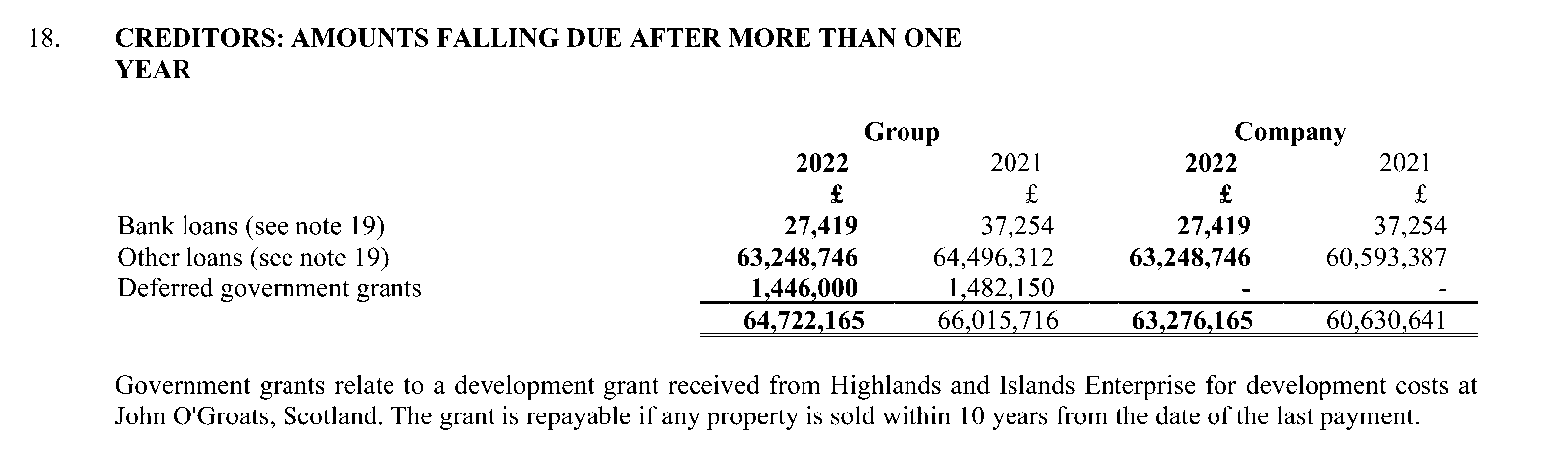

One of the “investment properties” shown on the balance sheet is at John O’ Groats where in 2011 HIE agreed to pay one of NAIL’s subsidiaries, JOG Highland LLP, a third of the cost of a new tourist development there.

That grant, which was paid over three years, was repayable if the property was sold within ten. That condition still applied and was shown in NAIL’s 2022 accounts, albeit with a slightly reduced amount of £1,446,000.

That grant, which was paid over three years, was repayable if the property was sold within ten. That condition still applied and was shown in NAIL’s 2022 accounts, albeit with a slightly reduced amount of £1,446,000.

That condition comes to an end in this financial year, 2023-24. It means NAIL could sell the development at John O Groats and use the proceeds from HIE’s £1,807,499 interest free grant to pay them back £1m. Does that sound like a good deal for the public?

Until then NAIL could have decided to sell off one of its other assets or get another loan from its main shareholder, David Michael Gorton. Why, might you ask, would he do this for a zombie company? The most likely explanation, I would suggest, is that NAIL and its subsidiaries companies have been used by Mr Gorton, quite legally, to reduce tax liabilities and avoid paying tax.

Mr Gorton is so rich (he is another who appears to have made £millions during Covid) that owning a company with net liabilities of over £60m actually becomes an advantage. However much HIE has managed to extract from Mr Gorton as a personal guarantee it should be seen in that context: his fingers have been ever so slightly warmed, not burnt.

The failure of our public authorities to recognise NAIL for what it was and is

How NAIL operates may be quite lawful but our public authorities in Scotland should not be having anything to do with their like. So far the Scottish establishment has shown little interest in asking how such an unproven company and its operating side-arm, Natural Retreats, was handed so much business by public authorities in a short time period: not just Cairn Gorm and John O Groats, but Lews Castle (another procurement scandal) and Scottish Canals (who handed over their lettings business to Natural Retreats and then had to pick up the pieces).

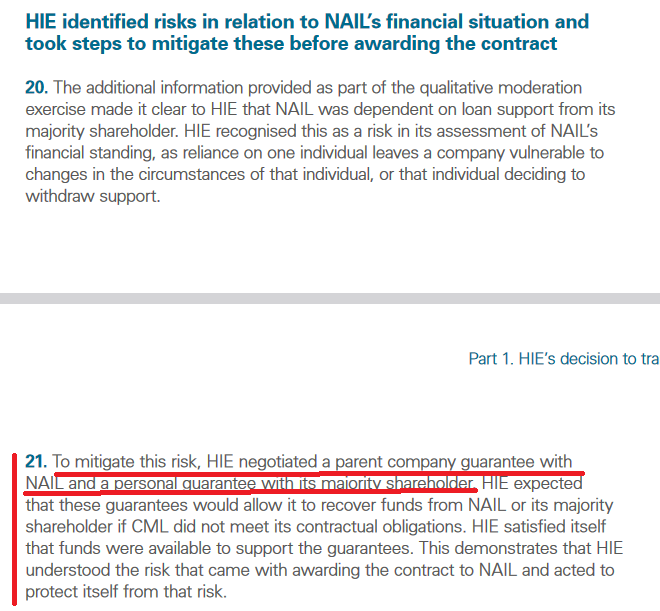

In the case of Cairn Gorm and in the light of NAIL’s settlement, it is worth re-visiting Audit Scotland’s whitewash report of 2020 (see here) on HIE’s management of the mountain businesses and funicular, The report found that while HIE had ignored the procurement rules about financial thresholds in NAIL’s case but this was acceptable because of the guarantees they had sought:

“17. NAIL did not meet the minimum financial standing threshold because

of concerns over levels of debt and operating losses at the company and

its subsidiaries. But under the qualitative moderation part of the test, NAIL

submitted additional information that emphasised that the debt was mostly owed

to its majority shareholder and should effectively be treated as equity. It claimed

that the operating losses were due to the company being in an acquisitional

phase as it looked to develop and grow. This additional information allowed NAIL

to pass the minimum threshold and achieve an overall score that meant it could

progress to the competitive dialogue stage. HIE obtained professional advice and

concluded that the approach taken was appropriate.”

It was evident well before Audit Scotland published their report, with liabilities increasing far more quickly than assets, that this was poppycock. Moreover, shares are not the same as debt, with dividends and interest payments governed by different rules and having different consequences (including for tax). HIE’s comment about NAIL being in “an acquisitional stage” is particularly interesting given the connections between HIE and NAIL elsewhere in the Highlands and the public subsidies being used to support NAIL’s growth. HIE clearly thought this zombie company was going to go places!

None of this mattered, however, because HIE took steps to mitigate its exposure to the risks:

How well HIE protected itself remains to be seen. We won’t know that until the total amount paid by NAIL and Gorton is revealed and how this compares to all the costs involved in first outsourcing CML and then taking it back into public ownership.

However, the much more important question which the Audit Scotland report failed to consider is whether the Public Sector’s flirtation with big finance and its zombie companies is in the public interest. Scotland has come to quite a place politically when everyone can see something is wrong except for the governing class who hide behind governance (“the professional advice” sought by HIE to cover their backs) and guarantees.

Dilapidations

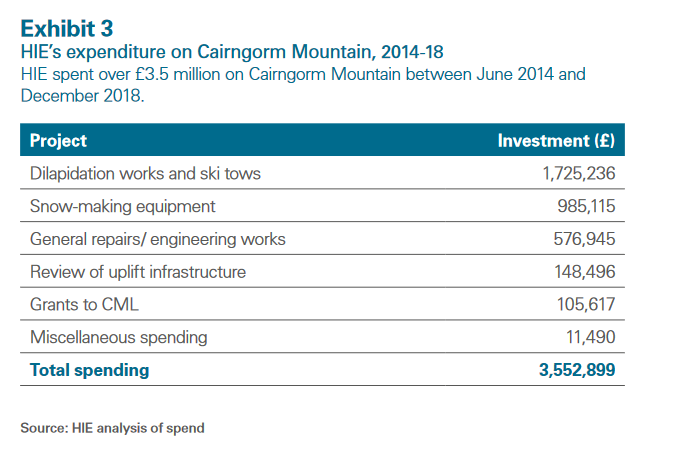

Re-reading the Audit Scotland report, it is more useful for understanding the money HIE may recovered for dilapidations and what this covered. Cairn Gorm was in a very dilapidated state at the point of sale and as a result “HIE committed to investing £1.7 million in the resort as part of the deal to transfer CML to NAIL”.

This suggests HIE invested c£600k on top of the dilapidation work and snow making equipment (and presumably covers additions like the new Shieling Rope tow (see here)).

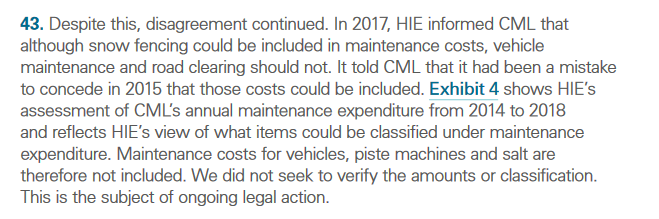

What NAIL/CML were required to invest under the terms of the sale of the company was set out in the lease for the ground and infrastructure. The Audit Scotland report, however, revealed that the lease was unclear and that what counted as maintenance was then disputed, e.g:

By the time they went into administration CML under NAIL should have paid c£2,165,000 but according to HIE had paid:

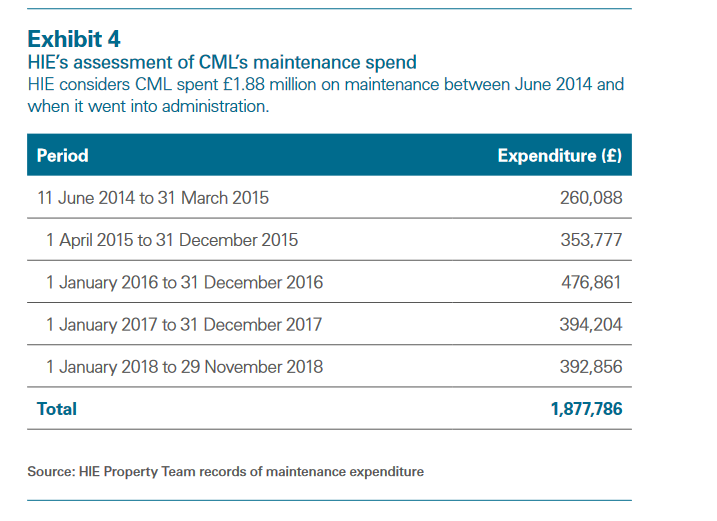

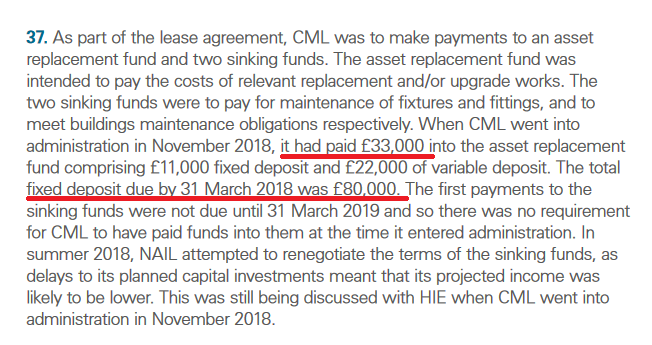

That is a shortfall of c£290k. In addition the Report showed that CML/NAIL had failed to pay the required amounts into the asset replacement fund.

That is a shortfall of c£290k. In addition the Report showed that CML/NAIL had failed to pay the required amounts into the asset replacement fund. The two shortfalls come to around £360k and are likely to form part of the £1m sum that was recovered. The rest remains to be explained.

The two shortfalls come to around £360k and are likely to form part of the £1m sum that was recovered. The rest remains to be explained.

It is important here, however, not to lose sight of the wood for the trees. Ever since the construction of the funicular, the rest of Cairngorm Mountain was being gradually run down and that process continued under Natural Retreats (as documented by many posts on this blog). One of the questions HIE should be made to answer in front of the Public Audit Committee is whether the £500k annual investment required was enough and how much they have had it invest in fixing dilapidations compared to the c£1m recovered from NAIL.

Thanks, Nick for this window into the mirky agreements and money transactions between CML/NAIL and HIE. What is clear is that these agreements were based on a naive assumption of success. Such contracts and agreements should always be worded to cover every thinkable, and even unthinkable, cause of failure. If everything goes well, the contract stays in the cupboard, but as we know virtually nothing went well, and even then there is plenty of evidence from the past that HIE were slow to try to enforce these poorly written contracts between CML/NAIL and HIE.

HIE were ‘rolled over’ in the negotiations for the ‘sale’ of the Cairngorm Mountain business to CML/NAIL. As you say, Nick, Audit Scotland did yet another cover up job. What is clear is that HIE is not a competent body to own any business. Giving them the benefit of the doubt, HIE might have some competence in distributing grants and funds for growing or critical businesses within the Highlands & Islands, but if HIE has any future (and that is a moot question) HIE should be legally prevented from owning or having a share in the operation of any business. Will the Scottish Government act on this recommendation? Even if they read this, or have thought about this before, they are so up to their necks in other disasters that they will not act.

I fully agree that HIE is not fit for purpose and should not have a future. However, in context of this discussion it needs to be documented that the SNP tried to do exactly that and abolish HIE in 2017. The opposition parties (Lab, Con and Lib-Dem)_all grouped together to ensure (by just x1 vote in Holyrood) that HIE would not be abolished. This was done under the guise of preventing “central belt centralisation”. As direct result of that vote HIE retained its independent board which remained unaccountable to the Scottish government.

https://www.bbc.co.uk/news/uk-scotland-highlands-islands-38677356

https://www.strathspey-herald.co.uk/news/accusations-fly-after-hie-board-vote-in-holyrood-145037/

https://www.highland.gov.uk/news/article/9955/council_leader_welcomes_outcome_of_holyrood_vote_to_retain_hie_board