After my post about the Cairngorm Hotel’s failure to pay the minimum wage to all their staff (see here), the court case this week about the fire at Cameron House provides further evidence that we need to take a far more critical approach to the tourist industry. Elements of it are far from benign and, in the case of Cameron House fire, resulted in the deaths of two people.

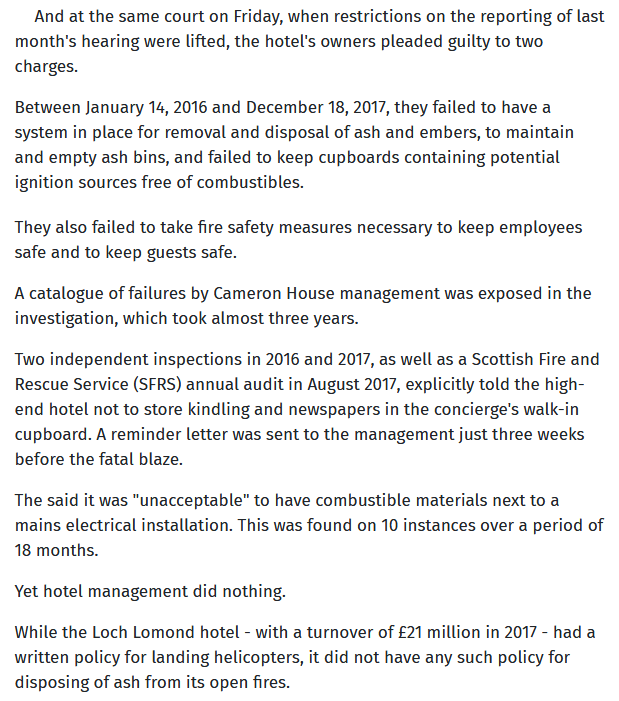

The Court Hearings at Dumbarton Sheriff Court before Xmas and this week have revealed a catalogue of management failures:

(See here for full report in the Dumbarton Reporter)

While both the Dumbarton Reporter and the Herald have revealed the name of the porter who put the hot ashes in a cupboard which caused the fire, they have not named the owners of the hotel who were responsible for the fire safety failures that led to this.

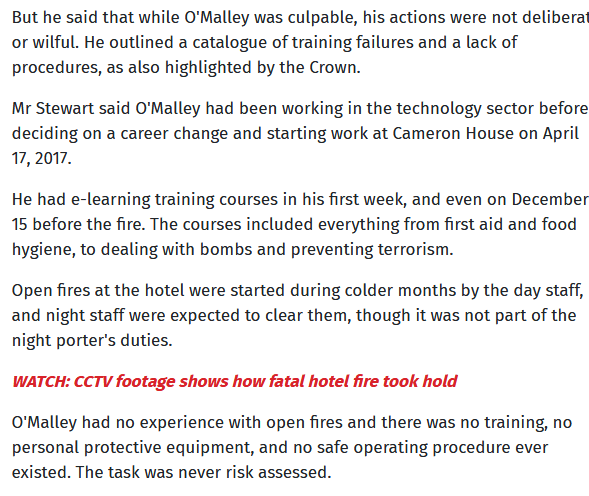

The issue at stake is that all of us are capable of doing things which in retrospect or from an outside perspective are stupid – like putting ashes in a cupboard. That is why the Scottish Parliament has passed a law, not yet implemented, requiring fire detectors to be installed in every home. It is why health and safety systems and fire training is so important. We need, as far as possible, to weed out human error. Yet, according to the Defence Counsel the porter whose actions led to the fire, Mr O’Malley, had received no such training. No-one had prepared him to think through the potential consequences of disposing of ash from fires or how to do so safely:

While not mentioned in the Court coverage, I think it is also relevant here to ask questions about Mr O’Malley’s pay and conditions of employment. Why is it that someone who is almost certainly poorly paid and working long hours is named, when the company’s owners are not?

While not mentioned in the Court coverage, I think it is also relevant here to ask questions about Mr O’Malley’s pay and conditions of employment. Why is it that someone who is almost certainly poorly paid and working long hours is named, when the company’s owners are not?

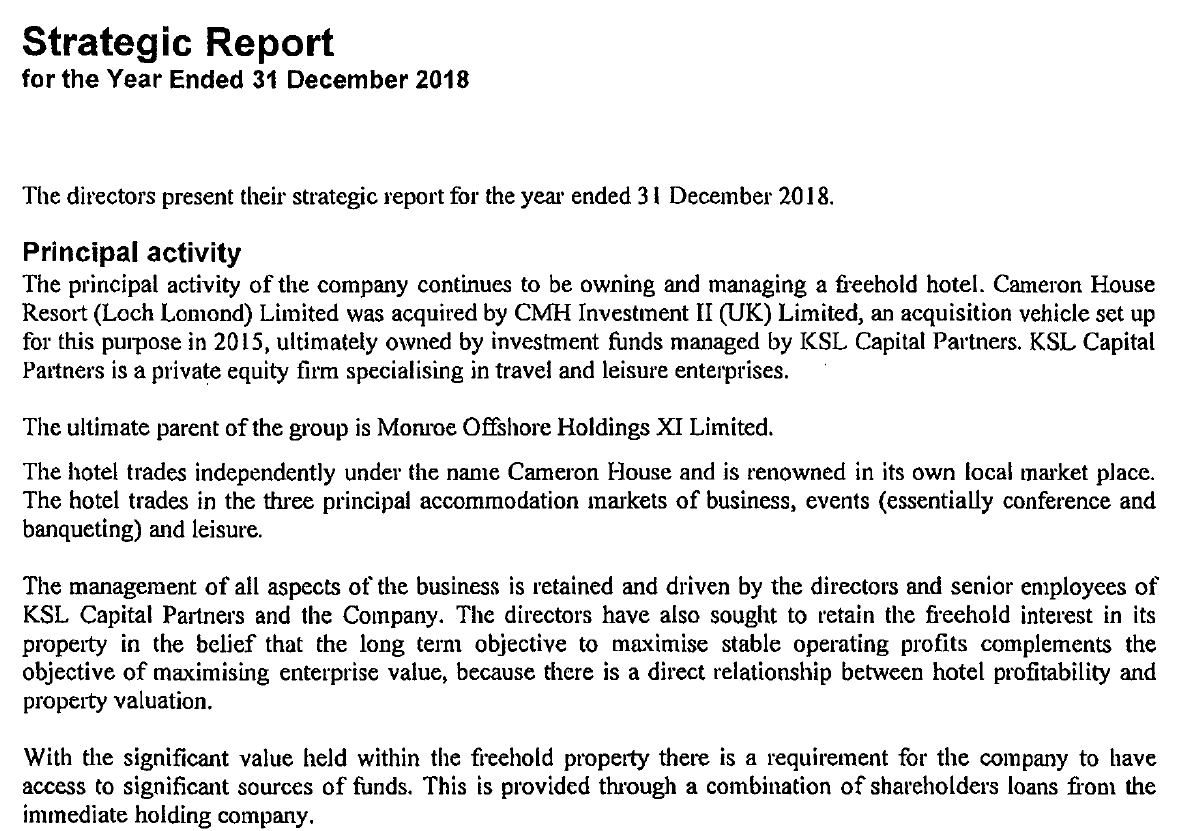

Cameron House is operated by a company called Cameron House Resort (Loch Lomond) Ltd. According to Companies House (see here) two men, James Coley Brenan and Richard Weissman, who is reported as being a resident of USA, have been Directors since Cameron House was bought by CMH Investment II Ltd in 2015. They are likely be the two unnamed “owners” referred to in the coverage of the case. The Accounts reveal that the Directors were involved in day to day management of the company and that it is ultimately owned by Monroe Offshore Holdings in the notorious tax haven, the Cayman Islands:

The accounts state that the Directors received fees through KSL Capital Partners, but how much does not appear to be publicly available. In the year to December 2019 CMH investments, which owns CMH Investments (II) Ltd, the owners of Cameron House paid £720,000 to VUR Swindon Ltd, of which Mr Brenan is a Director, for management services. More money funnelled out of Scotland. Again, VUR’s company accounts don’t reveal what Mr Brenan was paid, only noting that this was through another company and the structures of the companies he is involved in are so complex it is impractical to attribute what he earns from each.

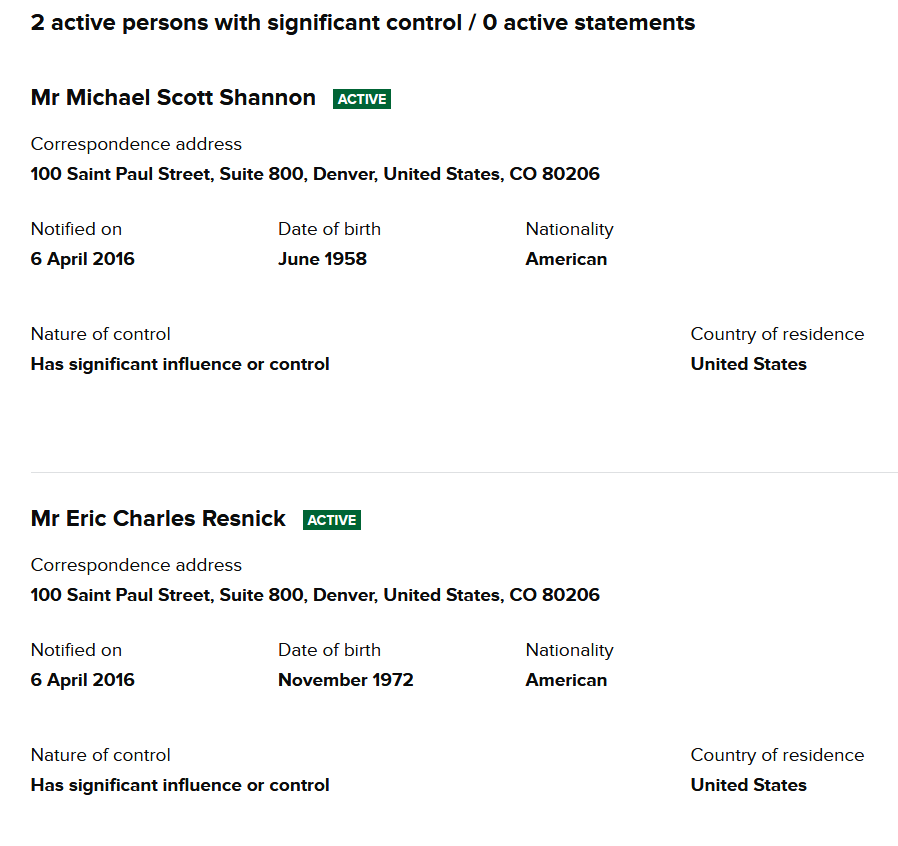

The two people named as having ultimate control of the companies through which Cameron House is owned both live in the USA:

Cameron House therefore appears to be another company designed to extract money out of the system – all quite legal of course – whose owners are allowed to put profits (reflected in the absence of fire training and failure to respond to recommendations from the fire service) before people. It will be interesting to see if the Sheriff Court makes any reference to the role that this company structure and business model played in causing the fire when sentencing takes place next week. But in my view accidents are the almost inevitable consequence and there has clearly been no learning from the sorry history of fires at Cameron House (2010 and 2012 under previous ownership).

What sticks in the craw, and must be most upsetting to the families of the two men who lost their lives as well as to all the people who lost their jobs, is that it has taken three years since the fire for there to be a hint of any consequences for the owners. That is not the fault of the police or the fire service – these investigations take time – and the fire service clearly doesn’t even have sufficient powers to force owners of buildings to respond to its recommendations.

But one has to question why our current system has allowed the owners of the Cameron House tourist business have been allowed to carry on and indeed use the fire as an opportunity to expand?

While it was in the public interest to rebuild Cameron House, the planning application (see here) for an expanded operation left a bad taste in the mouth. In a better world, these issues might have been avoided and the companies that own Cameron House and their Directors forced to transfer the operation into a more responsible form of ownership. Under its glitzy exterior, Cameron House appears to have been a rotten operation.

A transfer of the business could still happen if the Insurance Companies involved reconsider the vast bailout they handed to the company directors, not just to reinstate the building but to reimburse lost profits:

Whether the Insurance Companies actually re-consider may depend on how much responsibility the Courts attribute next week to the Directors of the Company, whether they rather than the humble porter takes the main rap. Whatever the Court decides, we need to start considering the tourism industry in our National Parks from a social justice perspective (the Air BnBs in Edinburgh are a good example of the need for this from elsewhere). It would be a good start if both our National Park Authorities started putting certain checks and conditions in place before uncritically promoting certain elements of the tourism industry.

Looking at the Companies House records for “Cameron House Resort (Loch Lomond) Ltd.”, I see that they have taken out six “charges” with Wells Fargo Bank (London Branch) since the 20th December 2019. Basically the whole property, lease agreements, etc., have been put up as collateral for the company of “Cameron House Resort (Loch Lomond) Ltd. to borrow against. In their accounts for the year ending 31st December on page 2 they state that reinstatement/rebuilding costs (due to the fire) will be circa £25.8million. They then state “the majority of which has been reimbursed through insurance proceeds”. Looking further down this page it appears that this company has borrowed circa £5.9million & a further £10.8million is set aside for a 68bed extension, monies from its ultimate parent company (Monroe Offshore Holdings XI Ltd.) However, in the accounts (year end 31st Dec 2019) for the immediate parent company (CMH Investment II UK Ltd.) on page 18 it states:- “Under the terms of the loan facility – between Wells Fargo & CMH Investment II (UK) Ltd. a charge exists aver all assets owned & operated by the Company. Total borrowings under the loan facility agreement as at 31st Dec 2019 amounted to £44,172,000.” – “The £44,172,000 loan amount is repayable in quarterly instalments of £250,000 to commence in December 2011, with final repayment in November 2023 on expiry of the loan” – “The rate of interest on the loan is the percentage rate per annum which is aggregate of the 2.75% margin & LIBOR”. So they have 2yrs & 10 months to pay back circa £45million!….Various investment/holdings companies, large borrowings against all assets, all legal, but not that financially secure in my view!

David, thank you very much for this – adds considerably to what I have said. The finances at Cameron House remind me of Natural Assets Investment Ltd/Natural Retreats at Cairn Gorm! We need a public discussion in Scotland about how companies and their operations should be monitored and regulated, banning companies that operate in tax havens etc. Nick

Nick, I did have a sense of deja vu when I was looking at these accounts! NAIL all over again!!

I posted above & note a typo correction, it should state “quarterly instalments of £250,000 to commence in December 2022, with final repayment in November 2023 on expiry of the loan”. This actually giving them one year to pay back the circa £44.1million!

This was such a sad event with loss of lives. It will be interesting to hear what sentences are passed. I believe this will take place on Friday 29th January 2021.