Audit Scotland’s report into HIE’s management of Cairn Gorm since 2008 was published two weeks ago (see here). The first two parts, on the outsourcing of Cairngorm Mountain Ltd to Natural Retreats and subsequent management of the contract, are a disappointment but not a surprise They completely exonerate HIE.

Effectively Audit Scotland’s message is that if HIE were to follow exactly the same procurement processes in future and that resulted in the sale of Cairngorm Mountain Scotland Ltd to another company with as little experience or financial standing as “Natural Retreats” that would be fine. As would the way the contract was managed. Most people who know anything about what happened at Cairn Gorm 2014-18 should find that hard to swallow. It is very welcome therefore that Edward Mountain, one of the list MSPs for Highland, has asked for a further inquiry by the Scottish Parliament (see here).

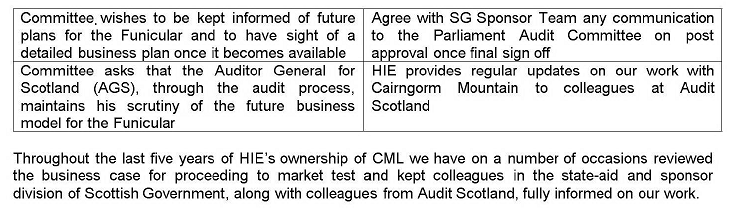

The third part of Audit Scotland’s Report is about what HIE has done since the closure of the funicular and its response to CML going into administration. It is much stronger, has resulted in most of the recommendations and was accompanied by a strongly worded news release “Tough decisions required at Cairngorm Mountain” (see here). It could still force HIE to change direction at Cairn Gorm.

Audit Scotland’s conflict of interest at Cairn Gorm

I am not sure when Audit Scotland started sitting on HIE’s Risk and Assurance Committee – it might have been after the 2009 Report on the funicular – but that Committee was involved in the decisions that led to the outsourcing of CML to Natural Retreats:

There is not a single acknowledgement in the report that Audit Scotland staff had any involvement in the procurement process. It shouldn’t suprise anyone that Audit Scotland didn’t investigate the role its staff played in the decision – that might have been deeply embarrassing – but it makes the whole report flawed and is why an independent inquiry is needed.

Underlying this failure is an even deeper issue. Audit Scotland has for a long time rightly been concerned about HIE’s mismanagement at Cairn Gorm and, as the final part of the report shows, they still are. However, the only solution they have been able to envisage to the problems that HIE have created is that responsibility for operating Cairngorm Mountain should be outsourced. The recommendations of their 2009 report into the funicular are contained as an appendix in the new report. They were founded on developing “a new business model for the funicular railway” and set out criteria for “assessing bids for the business“. Audit Scotland’s assumption was that the only solution to the problems at Cairn Gorm was to bring in a commercial operator. Hence the statement in the new report that: “HIE’s decision to transfer CML to a private operator was well founded”.

The idea that HIE might be unfit to own the land at Cairn Gorm or alternative approaches, such as the local community being supported to take over the operation or a staff buy-out, were both off Audit Scotland’s radar. As an organisation therefore Audit Scotland helped drive HIE’s decision to outsource Cairngorm Mountain Ltd through a procurement process.

The procurement process

The fundamental procurement question should have been how HIE ended up handing over the operation of Cairngorm Mountain Ltd to two companies that had very little track record, no expertise in running ski resorts and one of which was already effectively bankrupt?

To ask that question, however, you need to believe something has gone wrong. Despite the enormous cost to the public purse, the run down of the ski area and the consequences for people’s ability to enjoy Cairn Gorm under Natural Retreats, the Audit Scotland Report has not a single suggestion or recommendation for how of Natural Retreats at Cairn Gorm could have been avoided. Instead the Report concludes that: “HIE’s process for selecting a new operator was appropriate. It carried out due diligence and took steps to protect its decision to transfer CML to NAIL through financial guarantees.

On this logic, HIE could appoint Natural Retreats all over again and Audit Scotland would be happy!

The Report covers up Natural Retreat’s lack of expertise (para 18): “HIE recognised NAIL’s inexperience in the snow sports industry as a potential issue. But it took assurance that the existing technical expertise within CML would transfer to the new operator”. What the Report fails to mention is that the need to bring in external expertise was one of the main justifications for outsourcing CML: “the Authority is looking for an operator to drive the snowsports business, while providing a clear strategy for service diversification to wider non-snowsports activity” (OJEU notice – Office of the Journal of the European Union). That need for experience was confirmed in the very first sentence in the Invitation to Tender: “Highlands & Islands Enterprise (the Authority) is seeking to appoint a suitably qualified and experienced partner to run the Cairngorm funicular railway and resort operating facilities“.

When announcing,the appointment of “Natural Retreats” at the end of the tender process HIE implied they had all the experience one might wish for:

“Natural Retreats has the vision, ambition and experience to enable the resort to fulfil its potential as a world-class visitor destination” and that with “100 years of relevant international and regional leisure and tourism experience, Natural Retreats’ senior management in both Europe and the US bring a wealth of expertise to the Resort” (see here).

The truth, which has been completely avoided in the Report, is that Natural Retreats was basically a recently formed holidays lettings company which had got into partnership with a former hedge fund manager, David Michael Gorton, who operated through a company called Natural Assets Investment Ltd. Neither had any appropriate experience for running Cairn Gorm. Neither should ever have been considered as a potential operator. Unfortunately it appears Audit Scotland cannot say that as their staff were involved in the debacle. As a result the report simply ignores the flaws in the procurement process and the judgements of the staff involved that result in CML being sold to an operator without the necessary experience.

The Report also glosses over the failure of Natural Retreats to meet the financial requirements of the procurement evaluation process, which I have covered in detail on parkswatch (see here) and (here). It fails even to consider that in financial year to 31st March 2012 NAIL’s turnover was £326,233, well below the minimum £500k turnover threshold that had resulted in local company Cairngorm Snowsports being excluded from the tender process. It then accepts HIE’s argument that the c£36 million NAIL owed on 31st March 2012, which left the company with net liabilities of £2,886,549, wasn’t really debt at all but equity:

“NAIL did not meet the minimum financial standing threshold because of concerns over levels of debt and operating losses at the company and its subsidiaries. But under the qualitative moderation part of the test, NAIL submitted additional information that emphasised that the debt was mostly owed to its majority shareholder and should effectively be treated as equity. It claimed that the operating losses were due to the company being in an acquisitional phase as it looked to develop and grow. This additional information allowed NAIL to pass the minimum threshold and achieve an overall score that meant it could progress to the competitive dialogue stage. HIE obtained professional advice and concluded that the approach taken was appropriate”

Debt and equity are not the same and should never be treated as such. Part of the reason why has been demonstrated only too well at Cairn Gorm. Instead of investing equity in CML, NAIL lent it money, extracting interest in the process. Then, when it put CML into adminstration, it was able to recoup some of that money as CML’s largest creditor after HIE bought back the business. If NAIL had put equity into Cairn Gorm, they would have risked losing the lot, and the several dozen small local companies in the Highlands owed money by CML might not have been left out of pocket.

Both HIE and Audit Scotland should know that a standard element of investment and procurement decision-making is examination of debt-equity ratios. Generally where the debt/equity ratio is higher than 1:1 a company is viewed as high risk. In the 2012 accounts NAIL had share capital of £1000. Its debts were £36,232,123, i.e 36,000 times the share capital. Its tangible assets, mainly property owned through subsidiaries, were £21,596,636. These were inflated in the accounts through “goodwill” to £32,634,645. Instead of looking at what was really going, HIE simply decided to accept NAIL’s suggestion that debt should be treated as equity and the claim that the debt was only a temporary feature of the “acquisitional stage”. Those debts have increased by £5-6m a year and NAIL’s net liabilities in December 2018 had risen to £41,339,5171. It would be interesting to know if Audit Scotland believes there should be an limit to the amount of debt that they would be prepared to treat as equity.

Had Audit Scotland evaluated the procurement process against the excellent document it issued in October 2019, “Red Flags in procurement” (see here), the Report might have made interesting reading. One of those Red Flags is:

“Manipulation of tender scoring process and disqualifying bids for unjustified reasons. May indicate favouritism towards a bidder as well as breaking procurement regulations.”

Unfortunately, the Report makes no mention of the Red Flags document. It does, however, reveal something that has been kept secret up to now. HIE did recognise that selling CML to NAIL might create some financial risks and took action to mitigate them:

21. To mitigate this risk, HIE negotiated a parent company guarantee with NAIL and a personal guarantee with its majority shareholder. HIE expected that these guarantees would allow it to recover funds from NAIL or its majority shareholder if CML did not meet its contractual obligations. HIE satisfied itself that funds were available to support the guarantees. This demonstrates that HIE understood the risk that came with awarding the contract to NAIL and acted to protect itself from that risk.

Whether that safeguard was adequate is still to be shown. The Report states that HIE’s current legal action against NAIL is in respect to the guarantees it obtained:

“4. HIE is currently engaged in two legal cases connected with Cairngorm Mountain. One relates to financial guarantees provided by NAIL and its majority shareholder when CML transferred to NAIL in 2014” (The other legal action is about the design of the funicular).

It will be interesting to see how much, if anything, HIE gets back.

A major issue, which the Report fails to discuss, is why HIE breezed past a number of procurement “Red Flags” and failed to halt the procurement process? The Report confirms that when HIE’s advisers first tested the market, there were nine expressions of interest. How many of those organisations had the expertise and financial standing to operate CML is not explained but only four responded to the tender. HIE then excluded Cairngorm Snowsports while Nevis Range dropped out. Had HIE also excluded Natural Retreats, as they should have done, that would have left one bidder.

The fact that Natural Retreats, without relevant expertise and without financial standing, was then chosen ahead of the other bidder proves just how poor both bids were. At no stage did staff, led by Charlotte Wright who is now Chief Executive, appear to have considered returning to their Board with a recommendation to halt the process and think again. Instead, they were so keen to outsource CML that they pressed ahead, disregarding all the risks. They did, however, cover their backs and sought “independent” advice that it was acceptable to breach the rules.

And for what?

This section confirms that NAIL/Natural Retreats did not commit to investing any new money in CML, while HIE committed to investing £4m. NAIL only committed to invest if it made operating services on money paid by the public. NAIL’s promise to spend £1.4m on the Day Lodge was dependent on expenditure there exceeding £4m, something they could have prevented ever happening because HIE had handed them responsibility for designing the new building!

In summary, the Audit Scotland Report completely loses sight of the fundamental procurement principle that public authorities should not proceed with outsourcing a service where there are no clear benefits and only risks. That should be reason enough for the Scottish Parliament to conduct its own inquiry

I will consider parts two and three of the Report in further posts over the next few weeks.

West Dunbartonshire Council has just recently had a very shoddy service from Audit Scotland who gave us advice regarding our loan funds review which was wrong and ended up costing the Council £2m which has resulted in the budget for 2020/2021 not balancing.

Excellent write up – thanks Nick.

There isn’t the least doubt that the Audit Scotland Report was a ‘Whitewash’ Discussions were held in Aviemore with stakeholder groups and individuals and Audit Scotland were left in no doubt that HIE simply ignored the local Community and that the outcome on Cairngorm, due to their incompetence, had been disastrous. They were given detailed information about HIE’s failures to hold their tenant to the terms of the lease and it is clear that they ignored that irrefutable evidence which was omitted from their report. It’s of increasing concern to find that public bodies are increasingly self serving and do not serve the public interest.