. If you want to understand what is going wrong at Cairngorm (or indeed in National Parks or the wider economy), I believe you need some understanding of what is going on financially. If there is going to be any recovery of democratic control in Scotland, whether in our National Parks or outside, we need to start taking an interest in how money is created and used. I won’t apologise therefore for devoting this post to Natural Retreats’ accounts (as someone who is not an accountant) but if you can’t bear the thought, the headlines are that in the 9 months to 31st December 2015 Cairngorm Mountain made a significant operating loss, its liabilities are greater than its assets and its only kept afloat by guarantee from the owner of its parent company which is itself over £22,831,678 in the red. The implications of this for snowsports and the Speyside economy are briefly considered at the end of this post.

The accounts for Cairngorm Mountain Ltd CML Accounts to Dec 2015 application-pdf (1) and its parent company, Natural Assets Investment Ltd NAIL accounts to 31 December 2015AA-1487635200-1 (1)– which market themselves under the name Natural Retreats – were both due in January and both were published late, long after red warning signs had appeared on the Companies House website. HIE appointed Natural Retreats promising they were going to invest at Cairngorm – nirvana from the city – but what the accounts show is that there has been very little investment since Natural Retreats took over. Indeed, the accounts show appears no chance of this happening unless David Michael Gorton, the city financier who owns Natural Retreats, suddenly decides to splash out at Cairngorm. I personally don’t believe the future of an area should depend on the decisions of one person – its not a good way to do things, even if its the way our economy is run at the moment – the 1% have enormous power and people need to appreciate this extends to our National Parks.

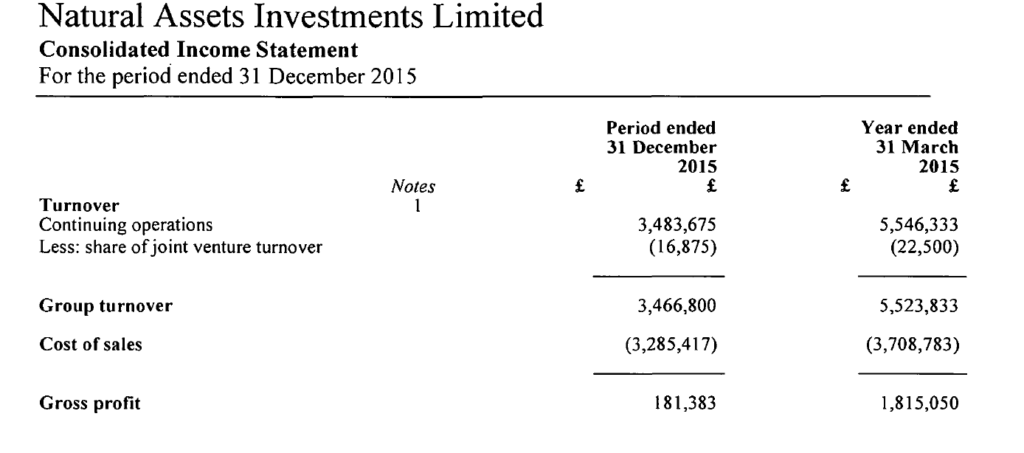

The accounting period for both Cairngorm Mountain Ltd and Natural Assets Investment Ltd was changed from April – March to January to December in the calendar year 2015 so both sets of accounts are only for 9 months. This needs to be kept in mind when comparing these accounts against those of the previous financial year to 31st March 2015 which was for 12 months. Its not unexpected that turnover is down because Cairngorm normally brings in more money in the winter months, January – March, and would employ more staff at this time (the cost of sales line) and that period is not covered in these accounts. What’s more, January – March 2016 was a good year for snowsports on Cairngorm – unlike this year – so the fact there is a much larger loss than the previous 12 month financial year is not surprising. What you cannot tell from the accounts is how well Natural Retreats were managing to increase business outside the winter season, which was one of reasons for their appointment – how to increase the summer use and make the funicular financially viable.

What may be significant though is that administrative expenses appear proportionately much higher for this nine month period compared to the previous financial year. If like for like – and they had gone up the previous year significantly – one might have expected them to be c£760k but they are almost £920k. This could be an indication that money is being siphoned out of Cairngorm: on the basis of these accounts HIE should be asking Natural Retreats why administrative expenses have increased so much, compared to expenditure on front-line staff, since they took over.

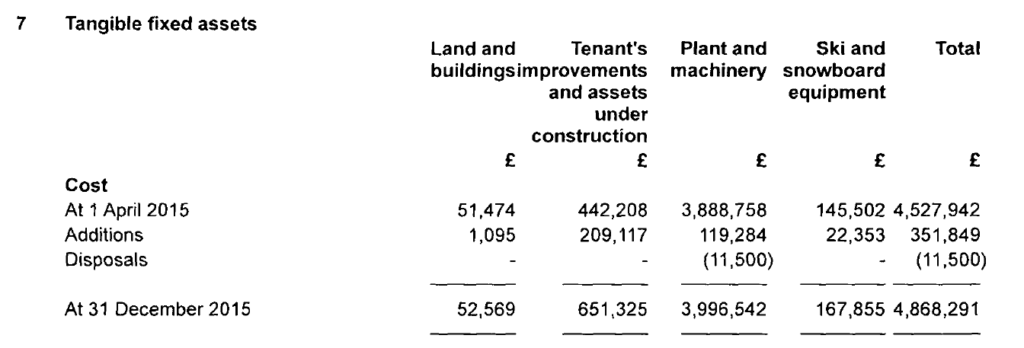

Natural Retreats certainly didn’t incur these additional admin costs overseeing a significant investment programme. Janette Janssen claimed in the Strathy (see above) that ”Natural Retreats is invested in CairnGorm Mountain and the surrounding community for the long term”. What the accounts show is that investment in assets at Cairngorm was only £351,849 compared to £616,514 the year before. So investment actually dropped.

I would expect levels of investment to increase in the next accounts for 2016 because Natural Retreats started, after public criticism, to replace the old chestnut fencing which it is paying for. This however followed the good ski season of 2016 and its reasonable to ask, given issues raised in the Strathy, whether Natural Retreats will be in a position to fund such work in future? Not, I would suggest, unless they reduce their administrative expenses and keep staff – who did this work – instead of talking about redeploying staff (to far off places like Lewis and John O’Groats where Natural Retreats is also working with HIE).

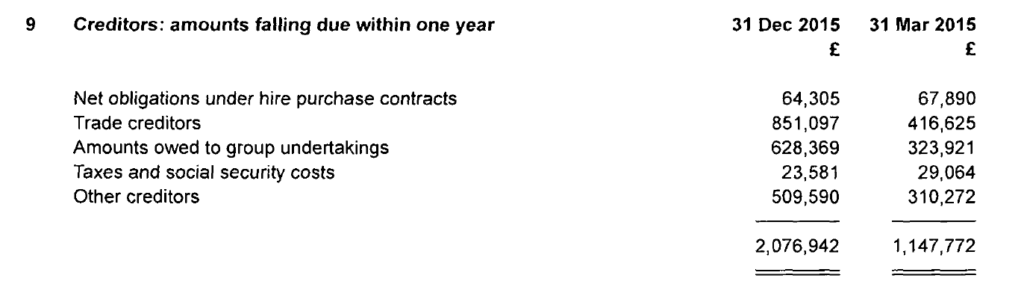

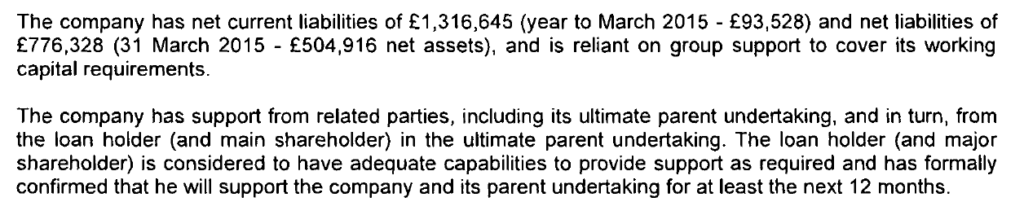

The notes on creditors shows the amounts owed to group undertakings, third line down, more than doubled – an indication that money is being taken out of Cairngorm – while the doubling of what was owed to trade creditors suggest other businesses on Speyside may be suffering through not being paid on time. Whatever the precise interpretation, the amount of money owed by Cairngorm Mountain almost doubled and at the end of the financial year Cairngorm Mountain Ltd was basically bust, having greater liabilities than assets.

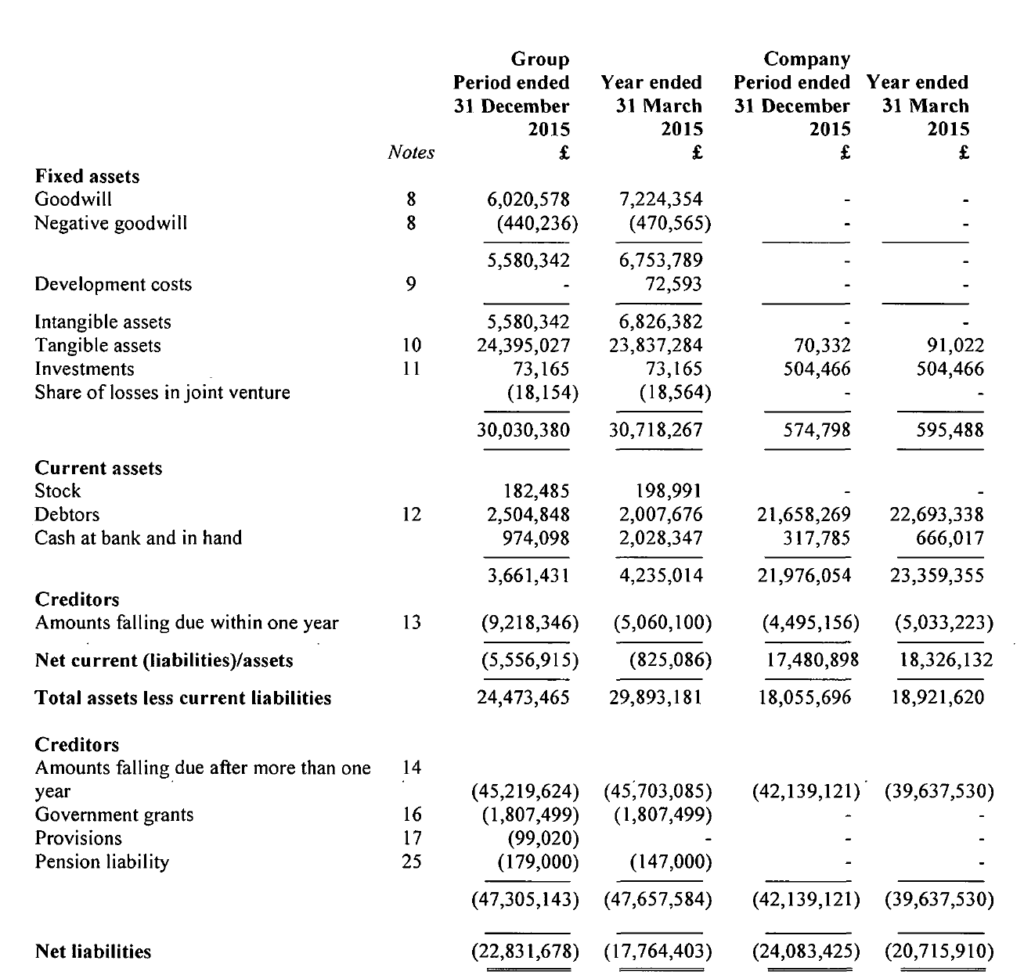

The position as expressed in the parent company, Natural Assets Investment Ltd’s, accounts is far worse. The accounts cover both the group as a whole (ie including Cairngorm Mountain Ltd) and the holding company itself. The bottom line of the extract below shows net liabilities have increased for the group by over £5m (left hand two columns) and for the company by over £3.25m).

Now look at turnover for the year (below). Its tiny compared to the group liabilities, less in fact than the increase in liabilities in the period, so the financial position of NAIL is getting worse. The group appears unable to generate sufficient income to pay off its liabilities.

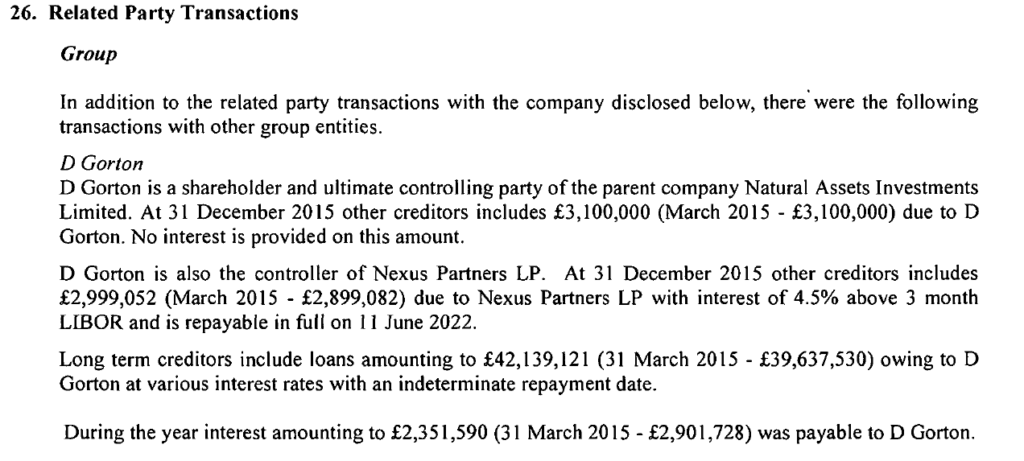

The only reason the group has not gone bust is because almost all of the money owed is to David Michael Gorton £42,139,121 – yes over £42 million – and he has said he will support the group for another year (this guarantee is from the date of the accounts were signed, i.e February 2017, not from December 2015). The same note to the accounts show he is also receiving lots of interest £2,351,590.

You might also note from this that the turnover of the Natural Assets Investment Ltd group is barely sufficient to pay the owner interest. It would need record snow years at Cairngorms for probably the next ten years to change this situation – the way our climate is changing at present makes that appear highly unlikely.

So, how did HIE ever agree to sell Cairngorm Mountain Ltd to such a group? In the tender process for Cairngorm HIE ruled out a local bid because it did not meet the pre-qualification criteria of £500,000 turnover for the previous three years. I will come back to this again but, instead of considering a local company which had relatively small turnover but which was sound financially, HIE sold CML to an untested holding company which, just three years later, appears to be a financial basket case.

What does this mean at Cairngorm?

A month or so ago, after I had discovered that HIE had paid for the unlawful works at Cairngorm and then asked Natural Retreats to pay £2000 back, I asked HIE who was going to pay for the new montane planting and the remedial work to the Shieling ski tow that was approved by the Cairngorms National Park Authority Planning Committee (see here). I was pleased to be told by HIE that Natural Retreats will pay for this. It will be interesting to see if this happens and how long it takes to complete the snow fencing and all the other remedial works and tidy up needed at Cairngorm.

The way Natural Retreats are running Cairngorm, they are totally dependent on public funds for all significant investments. I don’t think there will be any significant investment from David Michael Gorton unless there is a guaranteed income and its hard to see how the original plans for new buildings can deliver this. The introduction of parking charges look like the only alternative source of income and that will be met by public outcry. So, what that means is HIE will spend more public money, money which then ends up benefitting a few individuals rather than the people of Speyside.

There must be a better way of managing and spending public money at Cairngorm. In my view HIE should be planning to terminate its lease with Natural Retreats, before it completely implodes financially, and at the same time supporting the development of a community run organisation to operate Cairngorm alongside or with conservation and recreation interests.

I’m no Accountant either……but this serves to show the lack of Business Professionalism shown ……. or chosen to be shown …… by HIE !

If mere mortals like myself can access all the data that HIE should have investigated at the start of this sorry process, the question has to be tabled……what are the Scottish Government Ministers doing…… In the Past….. In the Present ….. and for the Future ?

Because the wider picture has to be studied, investigated and acted upon ! The effect on the Local and not so Local Businesses and Individuals as this shambles…….despite repeated Alarm calls and Pleas……..tilts even closer to the slope leading to Catastrophe !!