The Report in the Strathy last week was based on the proposals for winding up the former Cairngorm Mountain Ltd (CML) which the Administrator has lodged at Companies House (see here). This post takes a further look at what it reveals about the mismanagement of Cairngorm Mountain over the last five years.

Background note

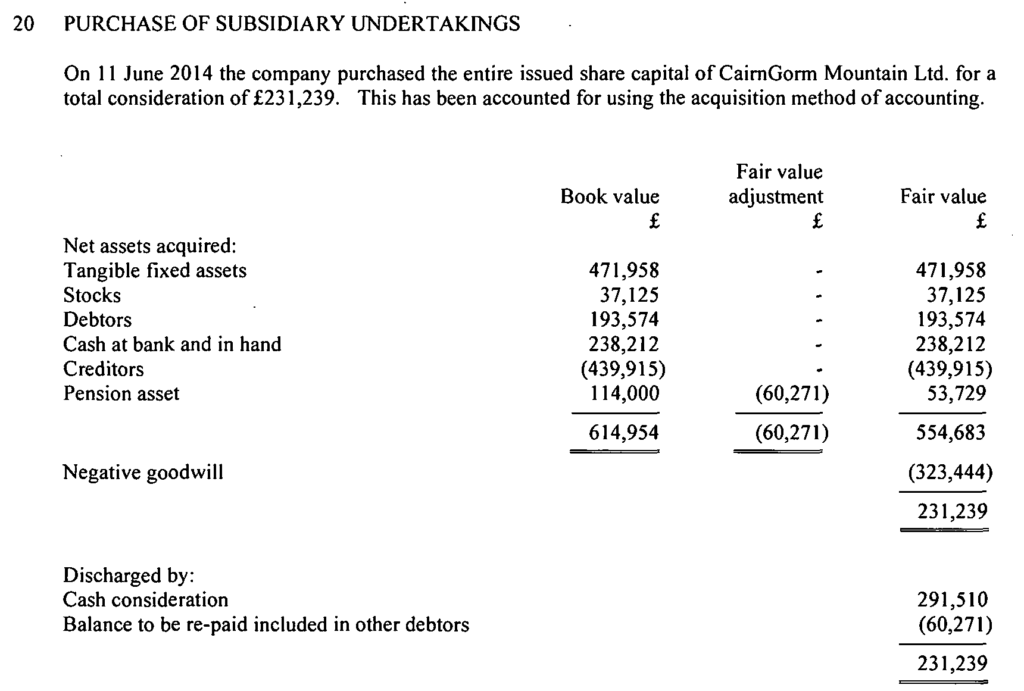

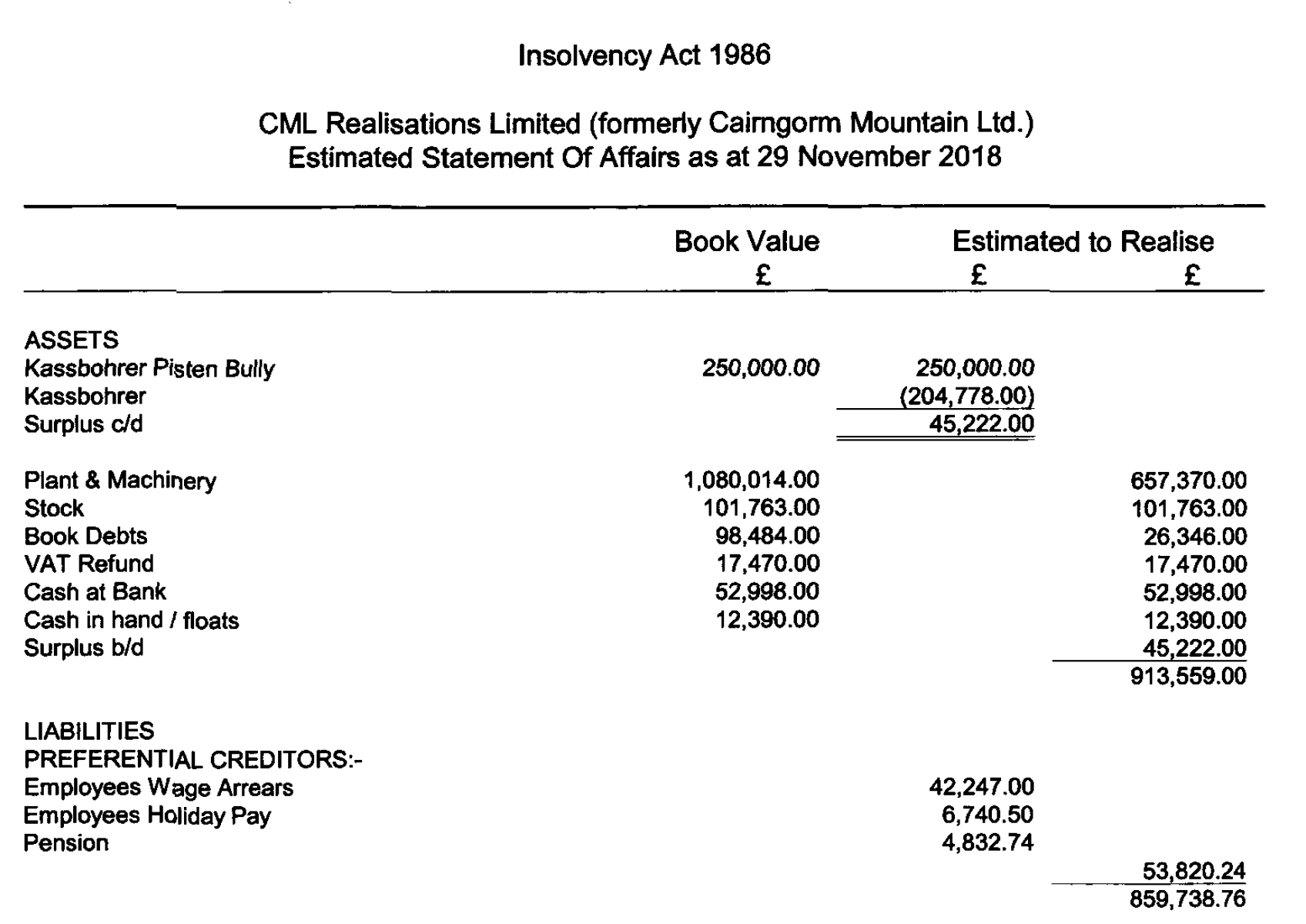

First, a brief explanation. The Administrators’s proposals document is primarily for the benefit of the creditors – the people and organisations owed money – of CML. This was the company which operated Cairngorm Mountain and which Highlands and Islands Enterprise sold to Natural Assets Investment Ltd (NAIL) in 2014. CML was “operated” by “Natural Retreats” for four years before it became insolvent and entered into administration on 29th November 2018. The Administrators then sold CML back to HIE on 14th December. The money from the sale, together with some other assets, will be used to pay the Adminstrators fees and the remainder distributed between the creditors listed in the document.

The name of the “rump” company, while it is being wound up, has been changed to CML Realisations Ltd. This is to enable HIE to use the name CML for their new subsidiary which now operates Cairngorm Mountain.

The cost to the public purse

Last month Parkswatch outlined some of the likely costs (see here) of HIE’s decision to outsource Cairngorm Mountain. The Administrator’s document helps fill in some of the gaps.

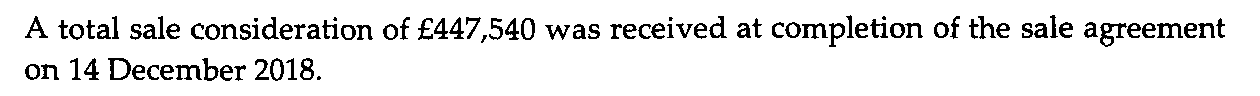

HIE sold CML to NAIL for just £231,239 in 2014 so has bought it back for almost double the price it sold it for. That alone deserves a public inquiry.

When HIE sold CML they agreed to pay £1.7m for delapidation works – ie the cost of returning the infrastructure at Cairngorm into a fit state for the new operator. HIE’s 25 year lease with CML then required it to maintain all those assets. That was fair enough except the evidence shows that during the four years that NAIL owned CML, they failed to do this. HIE’s new company, Cairngorm Mountain Scotland Ltd, have already had to start picking up the costs as is shown by HIE’s announcement yesterday of new “safety upgrades” (see here). That is spin for describing CML’s l failure to maintain infrastructure properly. What the total cost of all these maintenance failures, including the car park and the Day Lodge, will be remains to be seen.

A second element of the cost equation is the value of the assets belonging to CML, as opposed to those owned by HIE but operated by CML (buildings and lift infrastructure). On the face of it the assets owned by CML have increased in the four years since HIE sold CML and both HIE’s sale and repurchase were for knockdown prices:

According to this, HIE appears to have bought back CML for a bargain price as the estimated value of its assets (£859,738) are almost twice what it paid (£447, 540).

The first word of caution is that this Statement of Affairs comes from the Directors of CML and as the Administrator makes clear has NOT been audited. The second is that the last accounts of CML ( till December 2017) showed the value of plant and machinery as £614,055 so, if the Statement of Affairs is to believed, NAIL would have had to invest well over £400k (before depreciation) in new plant and machinery in the last 18 months. Maybe they did, maybe they didn’t (the snow making machines wre bought by HIE). To work this out properly, HIE should be required to provide a full list of assets belonging to CML at the time it was sold compared to the assets it has bought back and the cost of making up any shortfall.

Other information from the Administrator’s Proposals about the costs to be picked up by the public purse includes:

- The £140k, referred to in the Strathy article, which HIE paid upfront to meet the costs of staff wages and arrears during the period the company was in administration

- £20,240 owed to Highland Council

- The hole in the pension fund:

The document omits, however, the £118,374 of insurance and rent arrears owed to HIE (see here)

The document omits, however, the £118,374 of insurance and rent arrears owed to HIE (see here)

Wider costs

Besides the costs to the public sector, the bulk of which is being picked up by HIE, the Administrator’s document lists 154 creditors (apart from HIE) who appear to be owed (its illegible) around £650k. A significant proportion of these debts (c£150k) is owed to “Natural Retreats” related companies (see below) but the rest will have implications for the future operation of Cairngorm and the Speyside economy.

While the £447,450 HIE paid to rescue CML will be added to the cash already taken by the administrator to settle with creditors, a large chunk will go on the Adminstrator’s mouth watering fees (£277 an hour):

While far from familiar with most of the companies listed as creditors, they appear to fall into three main groups:

- General suppliers, including local suppliers (food, office equipment, fuel etc). Many of these are owed relatively small sums although its too soon to ascertain the impact on the organisations concerned.

- Contractors, including those involved in developing HIE’s new vision for Cairngorm (plans for the Ptarmigan etc). These sums vary from the large (£126,386 to Graham and Sibbald who are surveyors and property consultants) to the smaller (£4 438 to ADAC Structures whose very professional reports campaigners have used to expose the failures of maintenance at Cairngorm Mountain).

- Suppliers of ski infrastructure and equipment, with £48,116 being owed to Garaventa, £6, 809 to Techno Alpin (the snow making machine manufacturers) and £25,950 to Ski Data Scandinavia.

HIE has already stated it will NOT meet any money owing to creditors. It will be interesting to see what the knock on implications are for Cairngorm. Some companies may refuse to provide equipment or services in future, given what has happened, but others may decide to get their money back by hiking their prices – again with consequences for the public purse.

The central issue, however, is that all these creditors have been betrayed. In September 2018 the Directors of CML signed off the accounts that declared it a going concern for another year (even though the funicular had already broken down) with a guarantee from its ultimate owner David Michael Gorton. Because of this guarantee, the legitimate expectation of all these companies would have been that they should get paid, despite the parlous financial position at Cairngorm and NAIL whose net liabilities stood at £35,642,655.

I wrote to HIE before Xmas asking them to help hold to account the Company Directors for their statement that CML was a Going Concern. I have not had a response. Creditors, however, can take up this matter with the Administrator who has a legal responsibility to ensure that Company Directors have acted within the law:

The Creditors should now do so as HIE, it appears, have too much dirty washing to provide a lead on this.

The outsourcing debacle

This extract from the Adminstrator’s report provides most of what you need to know to understand what has gone wrong at Cairngorm.

- HIE sold CML to NAIL, a company which was already effectively bankrupt (and only certified as a Going Concern because of guarantees from its ultimate owner the hedge fund manager David Michael Gorton).

- HIE knew this at the time because, as part of the tender process they agreed to provide a £4m loan to cover the cost of NAIL’s – or was it Natural Retreats? – business plan. This is highly irregular. The tender documents say nothing I can see about a £4m loan being on the table for potential tenderers. Was this offer also made to them? Imagine what the local community could have done with that sort of financial assistance?

- Having sold CML and then entered a 25 year lease with the new owners, HIE had no bargaining chips left at Cairngorm. Had it tried to terminate its lease with CML, CML could have simply threatened to flog off the assets and HIE would have faced similar costs to what it has just had to pay to buy back CML. The arrangement meant “Natural Retreats” had HIE over a barrel. This helps explain why HIE failed to enforce the terms of its lease, despite numerous breaches. That in turn has led to the further rundown of assets at Cairngorm.

These disastrous arrangements were set up by Charlotte Wright, who is now HIE’s Chief Executive. What’s more they were fully approved by HIE’s Board:

So what was the legal basis for the HIE Board appointing Natural Retreats through the tender process but then selling CML to a separate company which, it appears, had not been subject to any due diligence procedures or party to the tender process?

The HIE Board appear fully implicated in what has gone wrong at Cairngorm and are therefore, unless there is political intervention, extremely unlikely to hold their Chief Executive to account.

Relationships between CML, the NAIL group of companies and “Natural Retreats”

As stated above, a significant number of the creditors listed by the Adminstrator come from companies associated with NAIL and “Natural Retreats”. Had the Directors of CML settled debts to those companies before those owing to others, they would of course opened themselves up to legal action. What is surprising therefore is not that money is owed to related companies, but the sheer extent of the transactions.

How, for example, did CML come to owe these sums to other companies owned by NAIL: NA Lews Castle £220.02; Yorkshire Dales Ltd £2,454 or £382 to Natural Outfitters who operated a shop at the Day Lodge?

Why did CML owe £3,243 to Natural Retreats US and £19,165 to the new Natural Retreats UK (a completely separate company to the former Natural Retreats UK which was set up AFTER the old Natural Retreats UK changed its name to the UK Great Travel Company). Was this for software or some similar service?

Interestingly, £85,462 is recorded “NR Manag Fee” and appears to refer to the management fees paid by CML to “Natural Retreats”/the UK Great Travel Company. That has been secret up till now but from the records it appears that CML was paying £41,527 each period. That’s basically £500k a year. HIE has always said that this was a matter for CML and the Natural Retreats – confirming that they had no contract with Natural Retreats – but it begs the question just how HIE decided outsourcing Cairngorm would provide good value.

Then there is the £12,555 which is recorded as owing to Gibson Lawson McKee. This appears to be the Gibbon Lawson and McKee in which NAIL purchased a shareholding back in 2012-13 but sold in 2016:

The picture is of a tangled web of financial interests and transactions. There may be nothing unlawful in any of it but there is enough to suggest that HIE should have been asking some difficult questions and it would be in the public interest now to do so.

What needs to happen?

Clearly, something has gone very wrong at Cairngorm and the Administrator’s proposals adds to the evidence for this and what the final cost to the public purse of HIE’s disastrous outsourcing is likely to be. The HIE Chief Executive and Board appear to bear significant responsibility for what has gone wrong and because of this are unlikely to ever come clean. Fergus Ewing, the Cabinet Secretary responsible, has also given no public acknowledgement as yet of the need to take action. It is for that reason therefore that I and others have been calling on MSPs to initiate an independent inquiry into what has gone wrong (I am pleased to say that some are responding).

Such an inquiry is needed to understand the full costs of the debacle, learn lessons and to hold those responsible to account. Its also essential to prepare the ground for a fresh start at Cairngorm, with the land transferred from HIE’s ownership and the facilities operated by the local community (and any other interests they wish to involve). Without an accurate list of assets, schedule of delapidations etc it will be impossible to cost a new plan at Cairngorm and any new community venture will be set up to fail.

While the staff at Cairngorm will be most relieved that HIE has, rightly, come to their rescue, every penny spent on rescuing Cairngorm is likely to be a penny less available for future investment. For that reason alone HIE should as a matter of urgency ask the Company Regulator to pursue the former Directors of CML for signing off the company as a going concern in September.

Strangely the above omits the amount due to NAIL of £2.3million which equates to the amount they have pumped into CML since 2014. Presumably a similar amount will need to be pumped into over the next 4 years by HIE.

Hi Derek, I would be very interested to know where you got the figure that NAIL pumped £2.3m into CML from and why you think this sum is due to them? The Administrator’s report does list NAIL as one of CML’s creditors (I failed to say this in the post) and that £23,374 is owed. I agree with you that significant investment will be needed at Cairngorm over the next four years, Nick

Nick Kempe,

I will be very interested to learn –

‘What was the legal basis for HIE Board appointing Natural Retreats through the tender process but then selling CML to a separate company which, it appears, had not been subject to any due diligence procedures or party to the tender process?’

After all that has happened HIE must now show some humility and be forthcoming with answers. The public has a right to know.

Further investigations are ongoing and will cover these in due course

John Finnie MSP asked the CabSec with responsibility for HIE, Fergus Ewing MSP if he would hold an enquiry into the shambles at CairnGorm. FE replied that he ‘wouldn’t do that’ That shouldn’t come as a surprise to anyone because FE is complicit in the shambles by virtue of having done nothing, over a period of several years, to intervene and sort out HIE. An enquiry is most certainly required because HIE have failed to obtain fair value for the fairly considerable sums of public money put into CairnGorm over the last few years. For example, the input of 1.1m pounds into upgrades to uplift in 2014 only to then fail to monitor that their tenant was complying with the lease term in respect of maintenance. That led to a build up of maintenance issues that HIE are having to address now via their subsidiary, CairnGorm Mountain [Scotland] Ltd.

Purely speculating but why would a firm like G&S have £125k of fees for work for CML. Great firm, but what possibly could be their role on the mountain. We’re NR using CML as a means for employing firms on other matters knowing that it was a dead duck? I have no knowledge at all but it all seems a bit strange….

A very good question – the only way we will get answers I suspect is through a parliamentary inquiry

I think Derek is referring to the figure on page 39 of the pdf. It’s the Appendix II section on state of affairs and lists assets and liabilities. The assets would exceed liabilities were it not for a figure of £2,294,561.00 listed as a “Loan from Natural Assets Investments Ltd”.

I think it’s safe to assume the money wasn’t used for maintaining the car park or uplift. Could it have been used for the “extensive refurbishment” of the Day Lodge? Or was it used to pay for the “Administrative expenses”? These totaled over £2.5m for 2016 & 2017.

Brian, well spotted – and Derek my apologies for not having realised what you were referring to. I think Brian you have identified a major issue. How and for what did this loan materialise? The CML accounts for 2017 indicate that £1,890,777 was owed to group undertakings and related party transactions shows a small part of this was to “Natural Retreats” but does not spell out what was owed to NAIL. Its possible HIE will know so I will FOI them but also seek expert advice

Well done, Nick, in providing this analysis of the disgraceful financial position that HIE has got itself into. As you say, an inquiry is needed to understand the full costs of the debacle, learn lessons and to hold those responsible to account.

Regarding learning lessons, it’s not just making sure that the same or similar mistakes are not repeated in any future investment, but options for scaling down operations and even removing all infrastructure need to be seriously considered. Have you seen Cameron McNeish’s blog on Walk Highlands? – see http://www.walkhighlands.co.uk/news/the-long-walk-in/0019243/. Cameron puts forward some interesting ideas, but has been criticised – see http://www.pressandjournal.co.uk/fp/news/highlands/1678711/row-as-climber-says-cairngorm-should-return-to-its-wild-state/ – even it appears by Glenmore & Aviemore Community Trust.

The HIE is run by people. People make up the fiction called Highland and Islands Enterprise. The people who are paid to run HIE. in a professional manner made a mess of things. They acted unprofessionally. They should be held accountable for their actions.

Who the hell gave our public servants the right to sell our land to a private group called Natural assets investments??

I believe our government should hold a hearing as to why the members of natural assets made such a mess of things. This is very much in the public interest.

I also believe that our government is doing what it wants because it is assuming that we are citizens when in fact we are sovereign people, way above our public servants.

Our public servants must work for us.