The funicular railway at Cairngorm has always been a white elephant, HIE’s white elephant, but at least it brought some benefit to the local community. The latest accounts of the companies now involved in operating Cairngorm were published on the Companies House website at the beginning of October. These shows that the amount of money Cairngorm Mountain Ltd, the company that operates the ski area under the Natural Retreats brand, is paying to Natural Retreats UK Ltd for services has increased significantly while investment in the mountain has not.

Cairngorm Mountain Ltd (CML) accounts

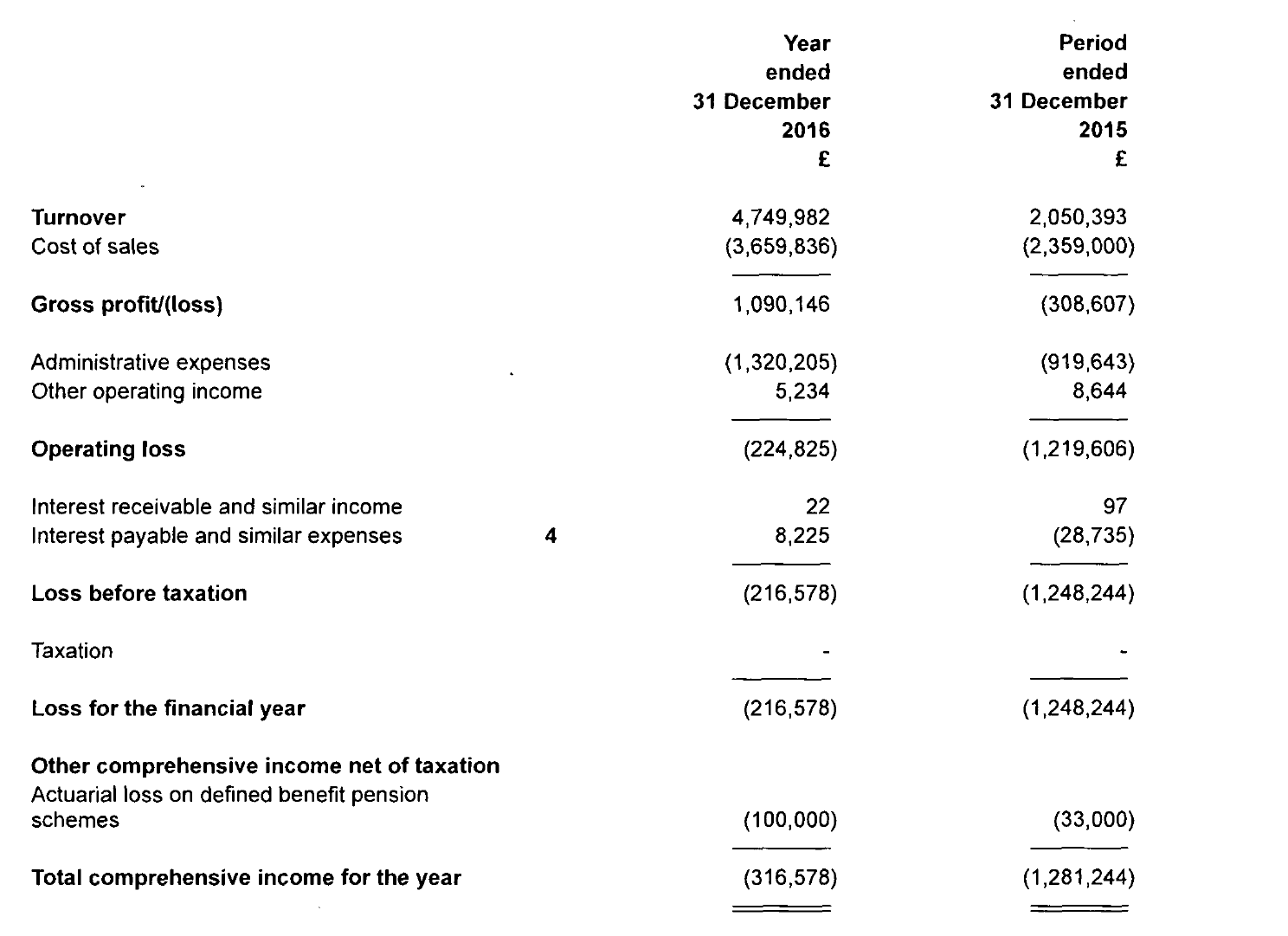

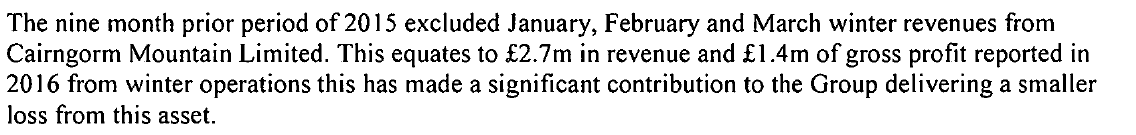

Its the first six lines of the accounts which are most important for understanding what is going on a Cairngorm. In comparing what has happened in the latest year to December 2016, its important to appreciate the previous financial year, was only 9 months, from April – December 2015, as Natural Retreats brought the financial years of all the companies it operates into line. For full accounts (see here).

The accounts show turnover was significantly up. This was because 2016 was a good ski season:

Natural Retreats’ Directors do not provide a commentary in the CML accounts on what is really happening at Cairngorm (as used to happen in the past – see below) but it appears likely that increase in the Cost of Sales line, by well over £1m, reflects recruitment of temporary staff to operate the ski tows. Nothing wrong with that – assuming they were properly paid. It appear too that it was the good ski season which was also responsible for the turnaround in gross profit to £1,090,146. Indeed because the previous financial year was only 9 months and excluded the ski season while making a loss of £308,607, it appears reasonable to conclude summer operations at Cairngorm have not been turned around since Natural Retreats took over and its still skiing which determines whether or not CML makes a gross profit. This is important for the debate on the future direction of Cairngorm.

Despite what appears a healthy operating profit, once you factor in administrative expenses, CML still made an operating loss in 2016, albeit a much smaller one of £224,825 compared to £1,219,606 in 2015. The question HIE needs to ask and answer publicly is why have administrative expenses risen so enormously at Cairngorm since Natural Retreats took over. Taking account of 2015 being a 9 month year, and making adjustments for that, real administrative costs increased by £100k. Perhaps that does not sound much until one considers where these administrative expenses go.

Under the Related Party transactions (Note 14) the CML accounts show that

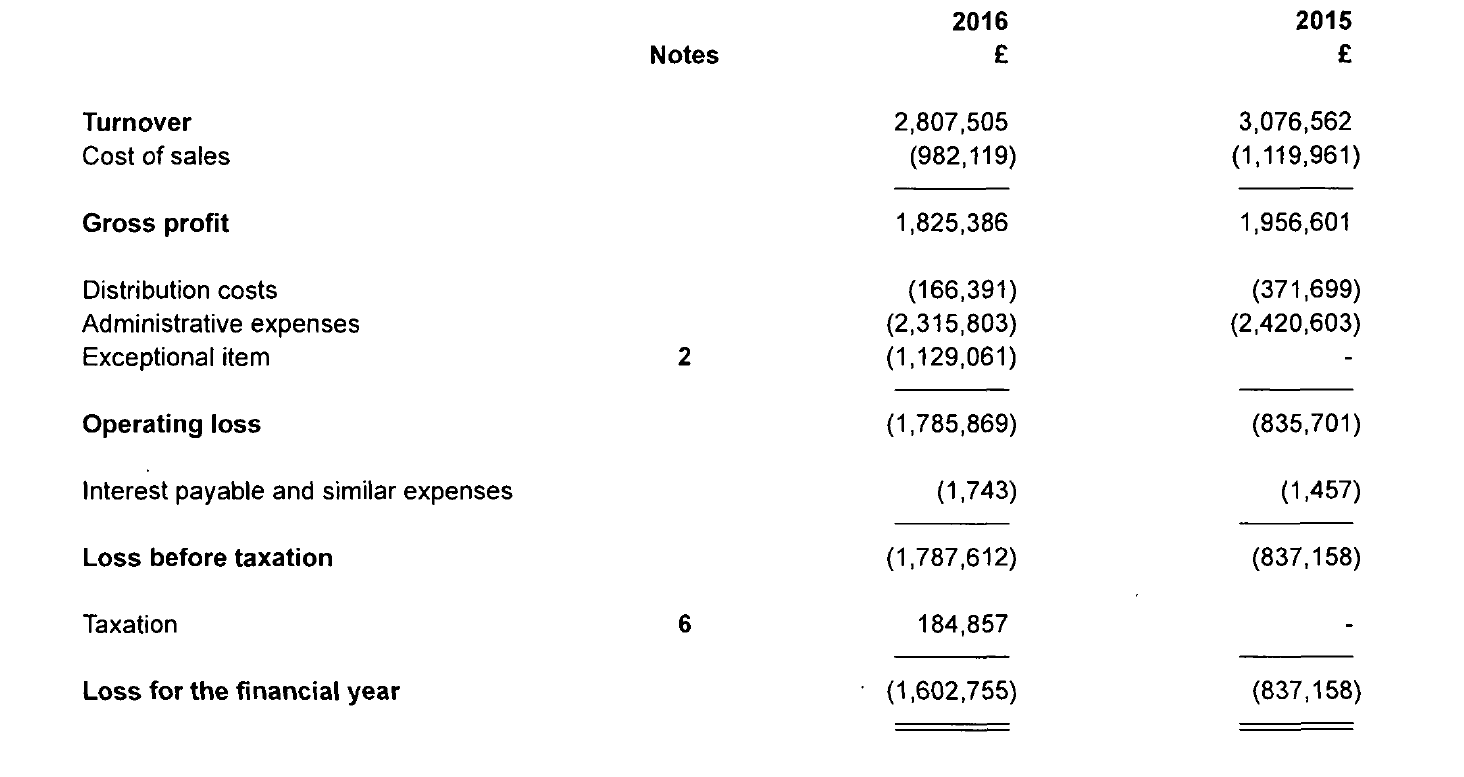

So that is over £800k going to Natural Retreats UK. Look at the NR UK accounts for 2016 and they state:

The accounts show that the cost of sales for Natural Retreats UK is just one third of the income generated which means that the gross profit on sales is c66%. So, unless CML is being treated differently to other Natural Assets Investment Ltd group of companies, it would appear that out of the £800k being paid for services, well over £500k of the administrative expenses charged at Cairngorm is contributing to the gross profit line of Natural Retreats UK. This is money that could be invested in Cairngorm.

What the NR accounts then show is that administrative expenses are almost as much as turnoever and just like at Cairngorm Mountain large amounts are being sucked out of the company leaving a net loss. Natural Retreats UK parent company is Natural Retreats LLC which is registered in Delaware in the USA. This is the US state notorious for its lack of tax transparency. The accounts do not indicate what transactions if any took place with the parent company or the reason for the administrative expenses.

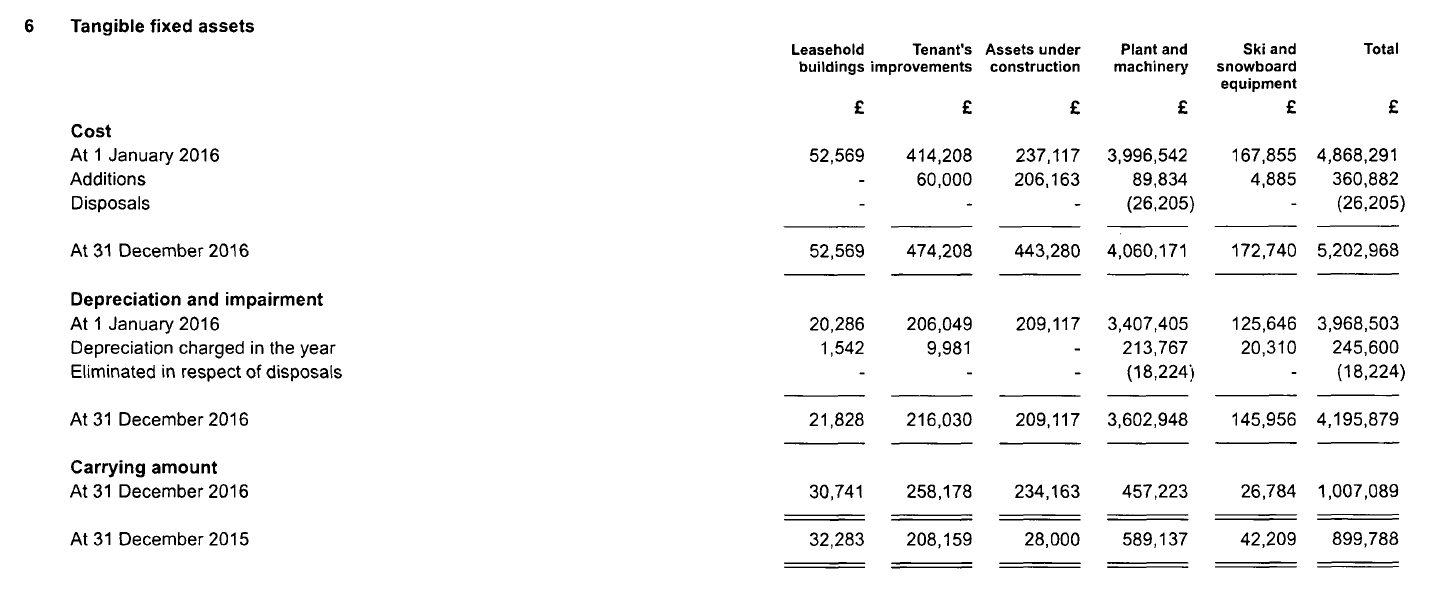

Meantime the CML accounts show the Natural Retreats invested very little in Cairngorm in 2016, certainly nothing like what is needed:

The additions column to the Tangible Fixed Assets gives an indication of levels of investment. It shows £360,882 was invested. Note how little was invested in ski equipment despite this being an excellent year for skiing. The important thing to remember though is NAIL purchased CML for £231,239 – far less than the assets are worth (see here) – and the only possible justification for this by HIE was that the cheap purchase price would enable NAIL to invest more in the mountain. The accounts show that has clearly not happened and what investment there has been appears to be linked to minimal contractual requirements. HIE’s line on this, according to the Susan Smith interview on Out of Doors (see here), is that it is still “early days”.

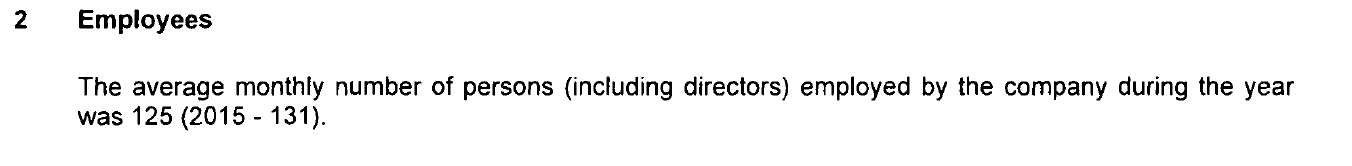

Not only that, despite the good ski season, average numbers of employees has gone down. I suspect this reflects a transfer of some basic administrative functions out of CML and thus out of Speyside to Natural Retreats headquarters down in Cheshire.

Not only that, despite the good ski season, average numbers of employees has gone down. I suspect this reflects a transfer of some basic administrative functions out of CML and thus out of Speyside to Natural Retreats headquarters down in Cheshire.

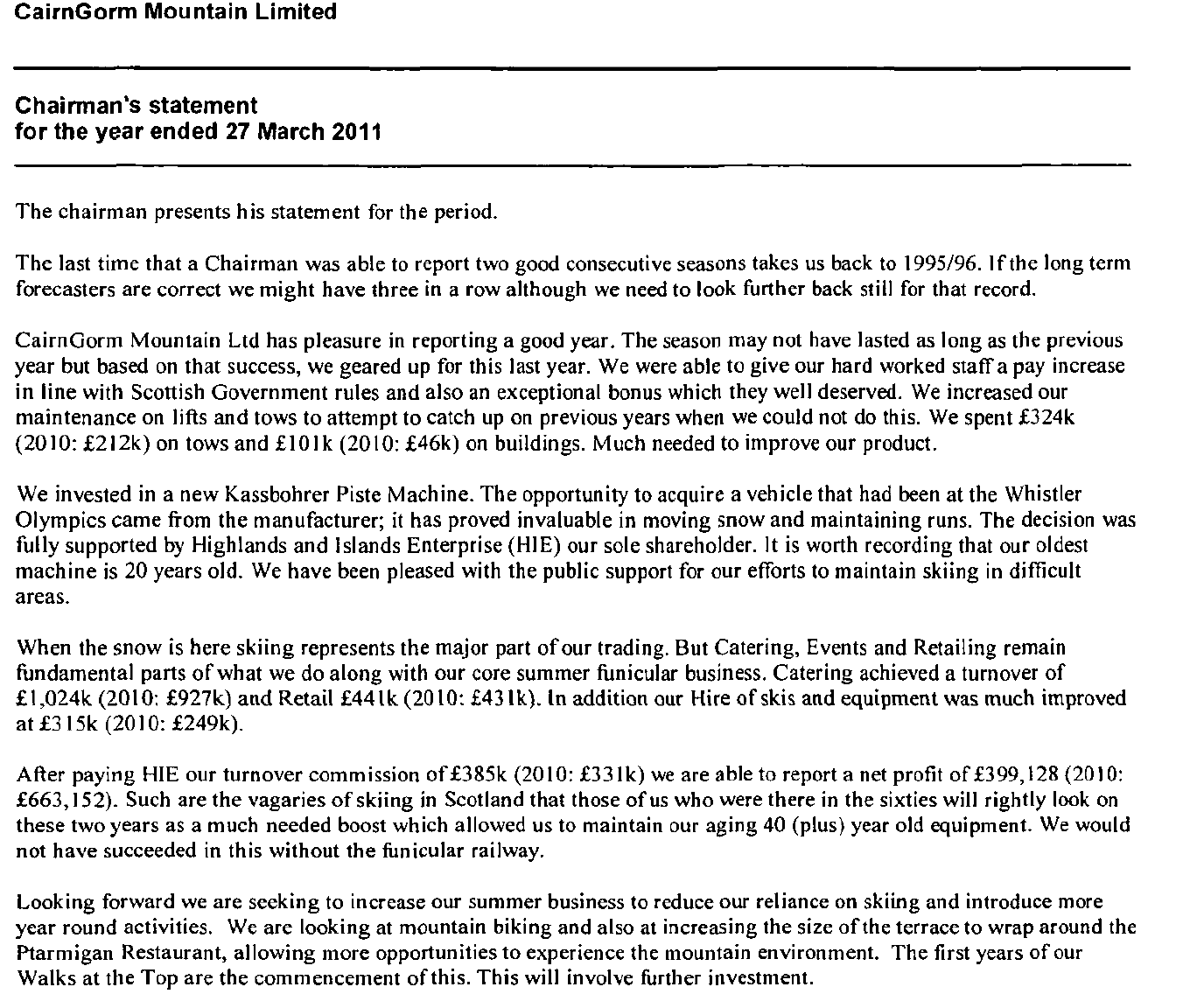

The CML accounts say nothing about what the company’s management at Cairngorm or about the Natural Retreats’ Group future plans, for example in relation to investment. This contrasts to the information which used to be provided in CML accounts which included transparent information about its relationship with HIE. For example, according to the 2011 accounts, CML paid a turnover commission of £385k (see below) to HIE. In the summer I asked HIE under FOI for information on all the payments HIE had received from CML for the lease of the Cairngorm but they refused:

It has been decided to withhold any details of the dates of all payments of turnover rent which have been made by Cairngorm Mountain Ltd to HIE since the date of entry in 2014 for the reasons set out below. Having also reflected on the public interest test, my decision is that the public interest does not favour the disclosure of this information.

HIE need to come clean about whether Natural Retreats have met the lease conditions or not.

CML, when publicly owned, also used to report on what was happening with staff, what they had invested, what they hoped to invest and what they had paid HIE.

What the CML accounts show is that Natural Retreats has ditched all of that soft information which is so important to help understand what is going on and now only reports the minimum it is is required to be law. This is not in the public interest but HIE unfortunately has been only too happy to go along with this, developing its plans for Cairngorm in secrecy and only coming clean about what its having to spend on the mountain as a result of FOI enquiries.

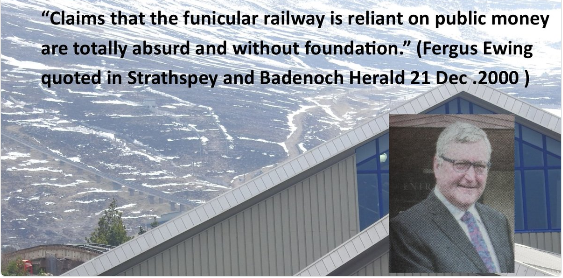

All of this provides yet more evidence of what is going wrong at Cairngorm and why both HIE and Natural Retreats are unfit to manage it. Cairngorm is now not just a white elephant but a milch cow – all courtesy of HIE. The question is when is Fergus Ewing, as the Government Minister responsible, is going to act and stop this? With the creation of a clear alternative, the Aviemore and Glenmore Community Trust, who are seeking that the management of Cairngorm be transferred to the local community, he has no excuse for not doing so.

In my next post on Cairngorm I will consider how the financial risks associated with Natural Retreats operation of the ski area are increasing day by day and why action is urgently needed.

Yet again another good investigative article, Nick.

HIE and/or the Scottish Government need to publish a point by point response to the issues raised, otherwise they condemn themselves by their silence.

I have been fighting to have the “closed system” removed from the Funicular Railway since it opened in 2001. The closed system has effectively sabotaged the Funicular and caused this financial disaster on Cairn Gorm. The Cairngorm National Park Authority (CNPA) is continuing to circumvent The Land Reform (Scotland) Act 2003. Remove the “closed system” and the Funicular can develop into a tourist facility that we can be proud of and probably go into profit.

Below are just a few notes I have made, over the years, about the ridiculous “closed system”.

1. The Funicular Railway has cost the taxpayer £34 million, so far, including a recent loan of £4 million to Natural Retreats.

2. The S50 signatories are not carrying out “their obligations under EU law” as is so often claimed, because it is not unlawful for people to leave the Ptarmigan station and CairnGorm Mountain Ltd (CML) have absolutely no legal authority to stop the public leaving the station. CML are relying on the fact that the passive public do as they are told. The “closed system” is part of a S50 planning agreement and applies to CML. It was brought about by pressure from SNH and the special interest groups. No public consultation took place about the closed system. It is the only time that a planning regulation has been brought in to control people. That alone must mean it is suspect. People can walk into the protected area 100 metres from the car park, while at the Ptarmigan station they have to walk over Cairn Gorm to reach the same protected area.

3. To put Natura 2000 sites into perspective. 39% of the Cairngorms National Park is covered by EU designations. In addition, there are 239 Special Areas of Conservation (SACs) in Scotland, and, with the exception of access being denied to certain sites on Military establishments, I am not aware of any which restrict walkers on the grounds of conservation.

4. The funicular railway is not built on a Natura 2000 site. The claim that the closed system protects the EU sites is unsustainable. Throughout the history of the chairlift any survey showed that between 8% and 15% of users went past the summit. 123,000 people used the chairlift in 1973.

5. Funicular users have decreased each year since 2004 and in fact there were c55000 fewer users in 2014 than 2004.

6. The “closed system” was a planning restriction imposed to protect the EU site and helped to obtain £2.7million of ERDF funding. There was no public consultation. There were anomalies in many projects that obtained structural funding between 1994 and 1999 when £32 million of EU funding was obtained. In fact the Scottish Government paid back £9.47 million in 2008 to stop further EU investigations. That must make any agreement worthless.

7. The Land Reform (Scotland) Act 2003 came into force in 2005. It can be clearly seen that the closed system, ticket conditions and various notices displayed at CML are in conflict with the act and Scottish Outdoor Access Code (SOAC). The public do not have a right of access. They pay. That does not mean that access rights do not apply when exiting the funicular. The claim that CML are not denying access rights because they allow access from the car park is flawed. The act does not indicate where access rights may be taken from.

8. The bottom line is CML allows egress from the Ptarmigan station in the ski season and brings in the closed system at other times. The closed system is therefore an intentional barrier to stop the public accessing land that has the statutory right of responsible access, and conflicts with the act. It has nothing to do with whether access rights apply to enter the railway.

9. To emphasise how ludicrous the restrictions are. The Tain Bombing range has the same EU designation has the Cairngorm Plateau. It would appear that we can bomb an SPA and SAC but need to restrict funicular passengers from entering an EU designated area.

10. Under the Land Reform Act (Scotland) 2003 SNH is only allowed to put up notices to protect designated areas.

Hi Ray, while the closed system may have contributed to the financial failure of the funicular, the current financial disaster is not about the funicular at all (responsibility for which still lies with HIE) but a consequence of HIE’s decision to sell Cairngorm Mountain to a company set up and owned by a hedge fund manager. You could open up the funicular tomorrow and it would not result in any additional investment in Cairngorm, simply increased income for Natural Retreats which then be taken out of the area.

While an open system may have attracted more visitors whether it would have attracted sufficient to make the funicular profitable is another matter. My view is that the funicular is in the wrong place, with the top station being in the cloud for much and subject to severe weather and it was never likely to have been attractive to summer tourists. Funiculars are also a pain in the neck for skiers, as you have to take off skis and wait for ages, and offered little advantage over chairlifts as when its too windy for chairlifts to run skiing is also pretty difficult. So, in my view, it was likely to become a white elephant closed system or not.

While you are quite right that if you walk out of the funicular building you have a right of access, that is not quite the same thing as saying you have a right to leave the ptarmigan. If all the doors were kept locked and you tried to challenge that in Court, I don’t think you would get anywhere. A possibly analogy is there is a supermarket with a nice green area at the back behind the fire exit. Its quite legal for you to be on the green area but if you kept trying to get out through the fire exit, the supermarket would have a right to stop you.

Interesting summary – looking at NR’s US/UK business activities CML stands out somewhat. All it’s other land assets appear to be focussed on its core business – i.e. holiday properties and rental, and selling holidays. NR in the UK seems to be primarily bank rolled by a hedge fund. Reading the various company reports they all appear to be simply financial returns – no narrative about the companies themselves whatsoever – and you won’t find any investor relations information on the web either. So a very opaque company with an overly complex group structure and funding arrangements, with CML as a non-strategic asset. Doesn’t bode well for investing in its future, does it? Looks like CML is just a land investment.

Nick,

I would not argue with some of your points. The “closed system” was an attempt by certain organisations to sabotage the success of the funicular. They have succeeded. If the top had been open since the word go I am convinced it could have been a successful tourist facility. Much more could have been done in the unprotect area of Coire Cas, Coire na Ciste and Coire Laogh Mor with sensible management by HIE. They among others have caused the shameful financial disaster on Cairn Gorm.

You might remember HIE spent 8 years trying to sell the ski area, emphasising that government agencies did not need to own land, but there were no takers. Why, because one of the stupid planning conditions was that if the Funicular closed for 3 years the owner would have to pay for the removal. They wouldn’t have to remove any redundant ski infrastructure.

Roy, you have been writing that for 20 odd years & its as untrue now as it was then. The Chairlift Company & developers wanted to get private funding so exagerrated the potential visitor numbers. If any thing like thosqe numbers had ever materialised the damage withou a controlled system would have been huge. So the developers agreed the restrictions but then never got the private funding they had wanted.

Just seen this link for the first-time today. An excellent summary, which exposes the deficiencies of the Contract between HIE and CML(NR).

Placing CML into administration gives NR a get out of jail free card, for which there is no provision in the contract , I assume.

What does the future hold. I want to support the community scheme but I remain sceptical. I have seen no provisional financial or cash flow projects , especially in the light of this week’s events.

It appears substantial injections of cash will be needed in the early months and years. What assets will the community trust own to underwrite initial loans or overdraft. Will the community trust directors take out personal loans or second mortgages or organise crowd funding.