This excellent article, about Natural Retreats’ failure to invest in Cairngorm and the possibility of a community run enterprise taking over the ski area, appeared in the Badenoch and Strathspey Advertiser last week. While I have been in close communication with the Save the Ciste group, some of whose members have kept me informed of the destruction that has been going on at Cairngorm, and whose public meeting in Aviemore on their alternative proposals for Cairngorm prompted the article, I had no idea they would get this coverage in the Strathie or that the finances of Natural Retreats would feature so centrally in it.

This excellent article, about Natural Retreats’ failure to invest in Cairngorm and the possibility of a community run enterprise taking over the ski area, appeared in the Badenoch and Strathspey Advertiser last week. While I have been in close communication with the Save the Ciste group, some of whose members have kept me informed of the destruction that has been going on at Cairngorm, and whose public meeting in Aviemore on their alternative proposals for Cairngorm prompted the article, I had no idea they would get this coverage in the Strathie or that the finances of Natural Retreats would feature so centrally in it.

In response to the claims of the Save the Ciste Group (see end of post), Ewan Kearney, who is a Director and Chief Operating Officer of Cairngorm Mountain Ltd (CML), denied any lack of investment. Mr Kearney is also a Director of Natural Assets Investment Ltd (NA) which owns CML and Natural Retreats UK Ltd which provides “services” to the companies owned by Natural Assets, including CML. Interestingly, the spokesperson for Highlands and Islands Enterprise avoided saying anything about what was actually being invested and simply said they are working with Natural Retreats on alternatives to the planned replacement of the Day Lodge which has now collapsed. I take this as a tacit acknowledgement from HIE that Alan Brattey and the rest of the Save the Ciste group are right. If, as Alan suggests, you take a look at the latest accounts for these three companies (cml-accounts-to-march-2015), (natural-assets-investments-financials to March 2015) and (nr-uk-ltd-accounts-dec-2015) you can get a good idea of where the money is going at Cairngorm and from this its not difficult to reach the conclusion that Natural Retreats are most unlikely to be the saviours of Cairngorm.

In summary, for people who dislike poring over financial information and wish to read no further:

- Natural Retreats cut costs at Cairngorm in the first year they owned it by over £400k

- At the same time administrative costs increased by over £300k sucking money out of Cairngorm into another company owned by the Natural Retreats group

- Natural Retreats, owners of CML, have huge debts to a hedge fund manager which are rapidly increasing – on paper its a financial basket case

I hope though its worth reading on to understand how this is happening. The general populace as well as our National Parks need to start using accounts to stop being conned. While I am not an accountant and there are all sorts of difficulties in interpreting the limited information which is available in the financial statements for the various companies, including that the different companies involved have different financial years and there is extensive internal “trading” between the companies controlled by Natural Assets, there is still a lot of interesting information about what investment is actually taking place and where the money is going. A further proviso on what I say next is that the last accounts available for CML are for the year April 2014 – March 2015 (the latest accounts are due by the end of January 2017 so more information will be available then) and since NA bought CML in March 2014 not all the financial transactions reflected in the accounts that are public can be attributed to them.

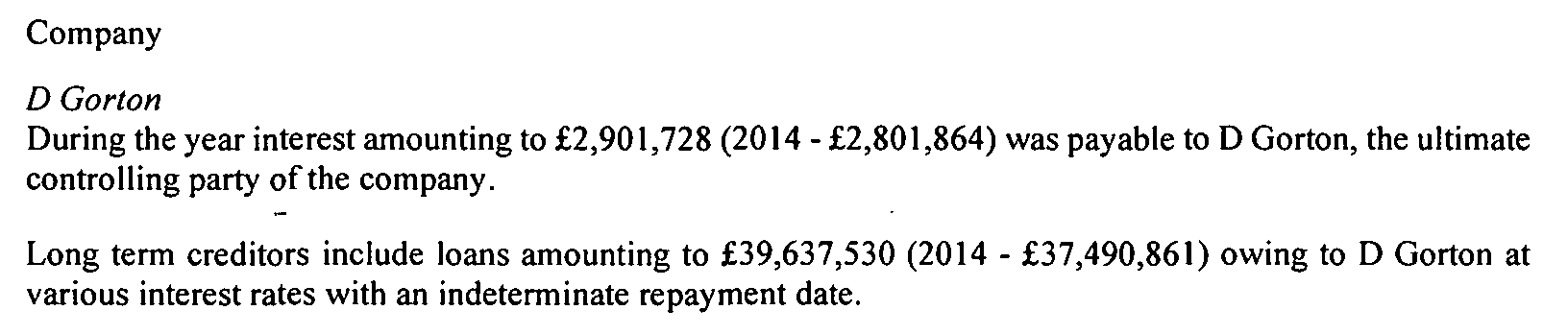

What is a constant behind the labyrinthine financial relationships of Natural Assets and Natural Retreats is the ultimate controlling interest is David Michael Gorton, (see here), a multi-millionaire hedge fund manager.

David Michael Gorton has appointed the same four Directors to run the businesses in his Natural Assets/Natural Retreats group. Ewan Kearney is the lead for Cairngorm.

While Ewan Kearney claimed in the Strathie that in 2016 Natural Assets had £30m of assets he said nothing about their liabilities. In March 2015 were over £45m and left a deficit at that time in the consolidated accounts for the Group of £17,764,703. Take away the subsidiary companies and the liabilities for Natural Assets exceeded assets by £20,715,910. The only way that Natural Assets will be able to invest in Cairngorm is if David Gorton decides to make more money available.

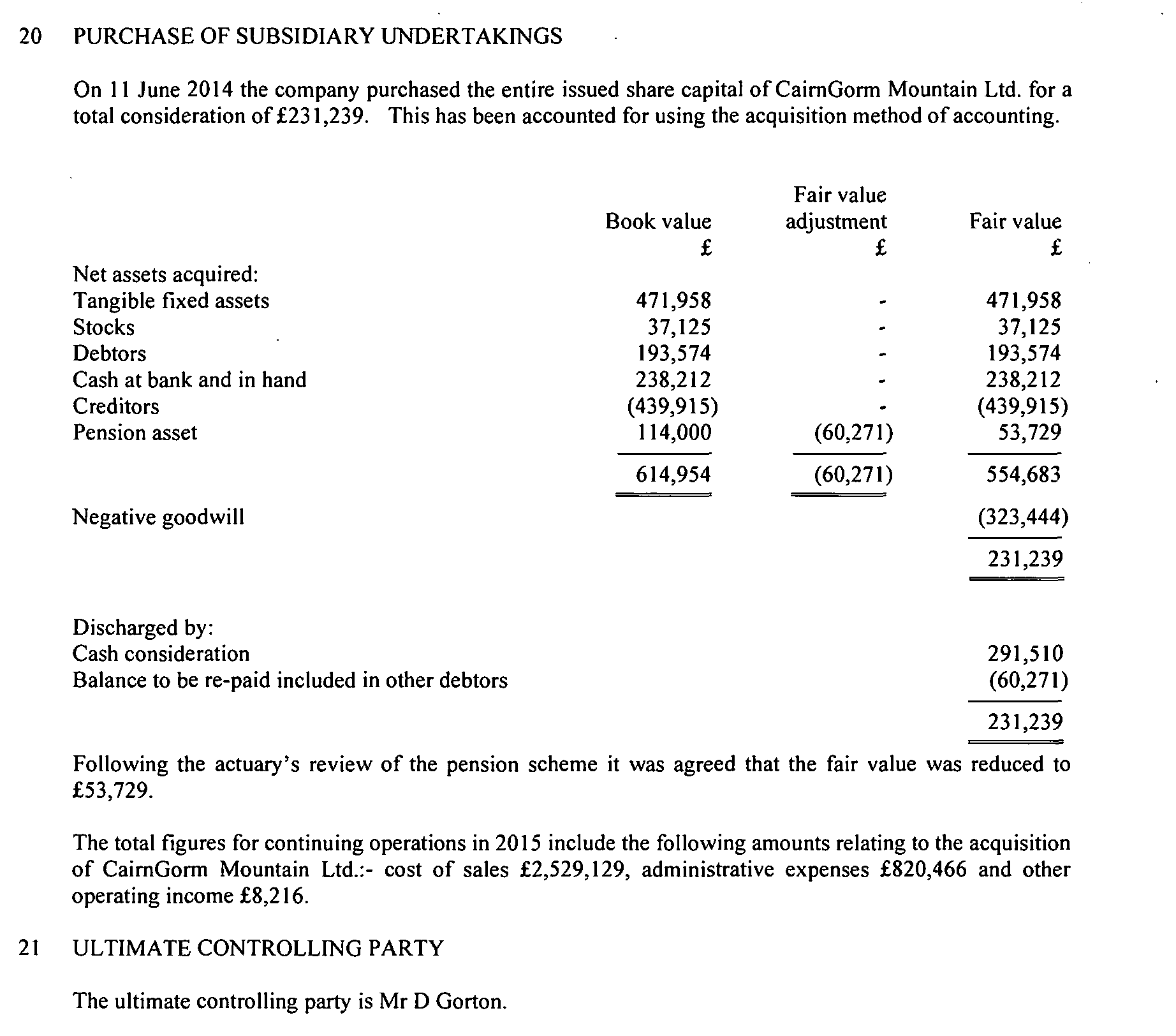

I did not follow the sale of CML to Natural Assets but Highlands and Islands Enterprise sold it for £231,239, a sum that could easily have been raised by a Community Enterprise (or even by crowdfunding). There is some interesting information in the Natural Assets accounts to March 2015 about this.

If you look at the subtotal 7 lines down, of the total assets purchased from HIE you can see their book value was £614,954 but this was reduced by “negative goodwill”. Now this is not about the value of the asset, which is calculated by depreciation of the original purchase cost, but about what use could be made of the asset (i.e the money that might be made from it). If an asset is productive, goodwill will add to the book value but if the reverse, it will reduce it. In agreeing the price it appears HIE accepted that there was a problem with the assets owned by CML which reduced their book value significantly. We do not know why this is and it could be anything from CML had previously purchased the wrong type of equipment to the likelihood of snowy winters enabling the new owners to make use of the asset.

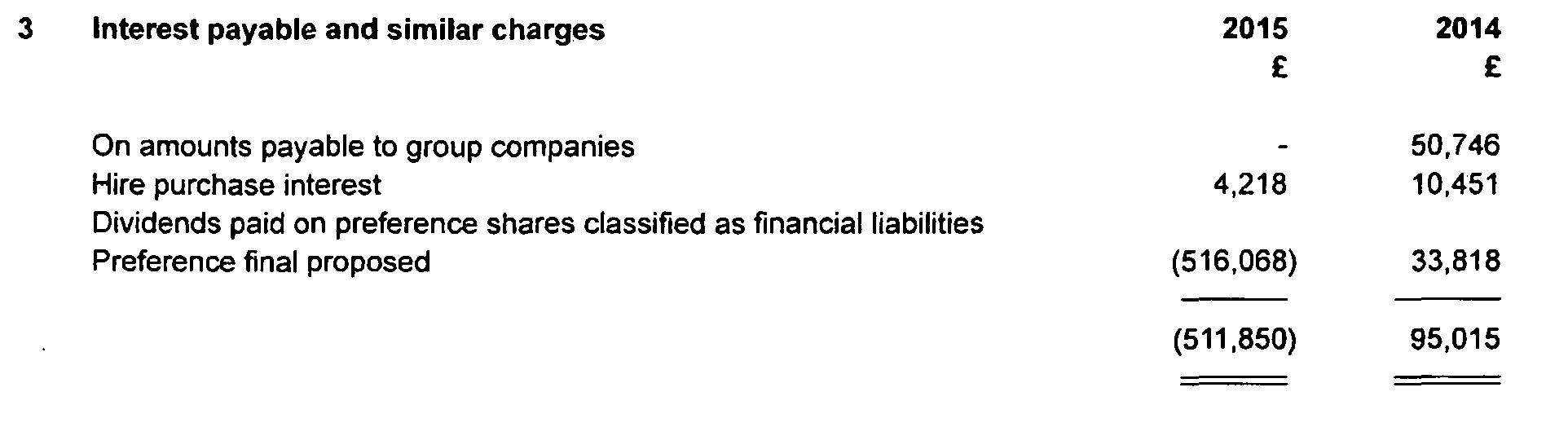

This however was not the only thing HIE did. The CML the accounts show they also wrote off £516,068 of dividends that were due to them from CML at the beginning of the 14/15 financial year.

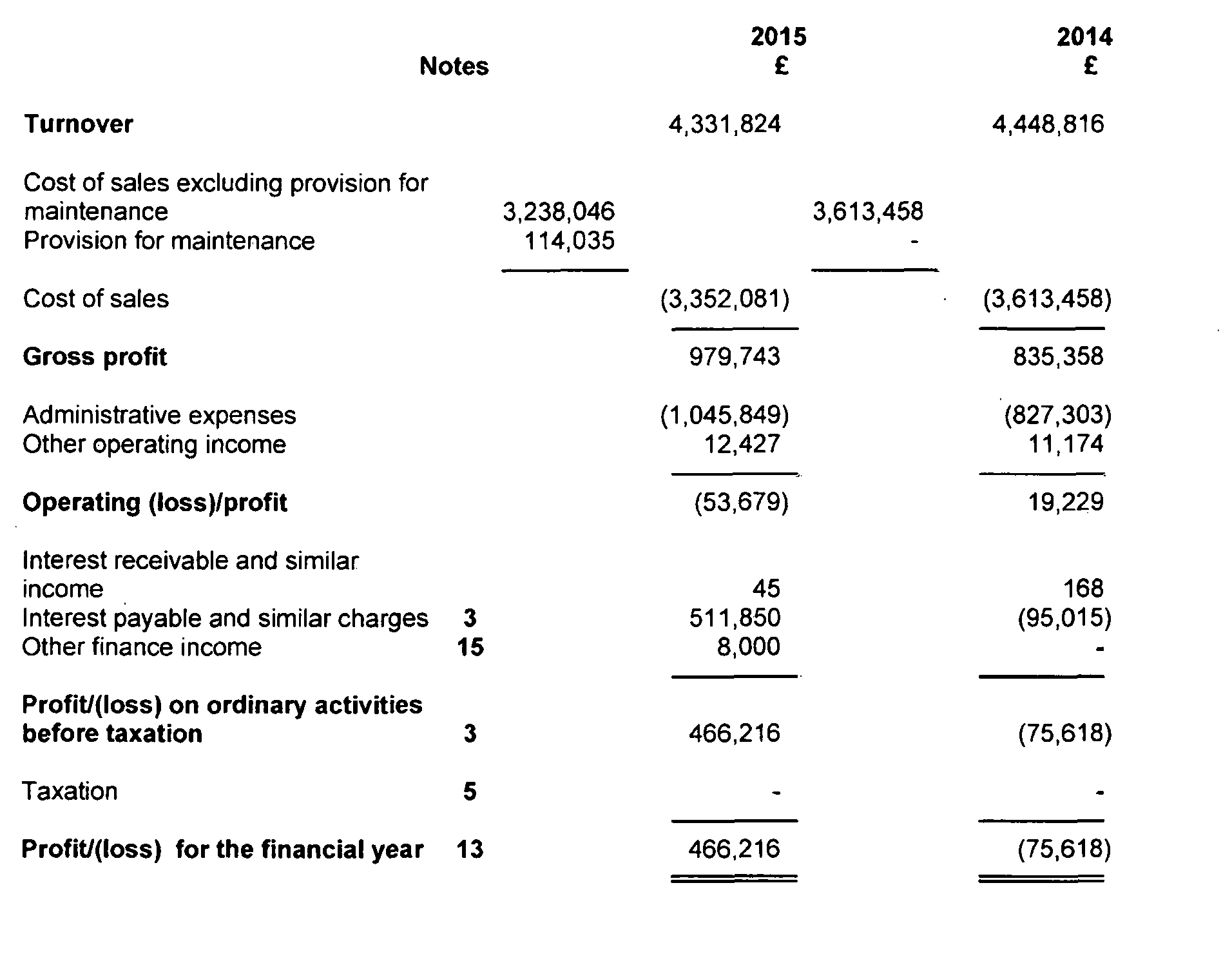

Without this write-off from HIE (which is treated as interest payable in the profit and loss section of the accounts pasted below – see entry with note 3 by it) CML would have made a significant loss in the year they were taken over by NA.

While the accounts provide no details of the operation at Cairngorm they do show turnover (income), which dropped by £115k, cost of sales, administrative expensive and Directors fees.

Cost of sales means the cost of the workforce at Cairngorm and all the costs such as fuel and power required to run the operation. This reduced to £3,352,081 or c£260k less than the previous financial year. So while Ewan Kearney is claiming there has been investment in Cairngorm actually in terms of operating expenses there have been cuts. This I believe helps explain the further drop in standards and lack of care that has been taking place at Cairngorm since Natural Retreats took over.

The position though is worse than it appears from the accounts. I have found out from HIE – and I appreciate their rapid response to my question on this – that CML now employ the ranger service previously funded by HIE to the tune of £55,658 and Natural Assets as the new owners have apparently maintained that level of service. Their strategy appears to have been to fund this extra commitment through paid guided walks (see here) but this was an additional cost which they can only have absorbed by a further £55,658 of saving/cuts. In addition, the notes to the accounts (see note below) shows that CML undertook £116, 026 of work for Natural Retreats which appears to be included in cost of sales and indicates staff employed at Cairngorm are now doing work for other companies in the Natural Assets/Natural Retreats Group. An indication that even less money is being spent on Cairngorm itself. In total it appears that there were c£430k in cuts at what CML spent on operating at Cairngorm the year NA bought it.

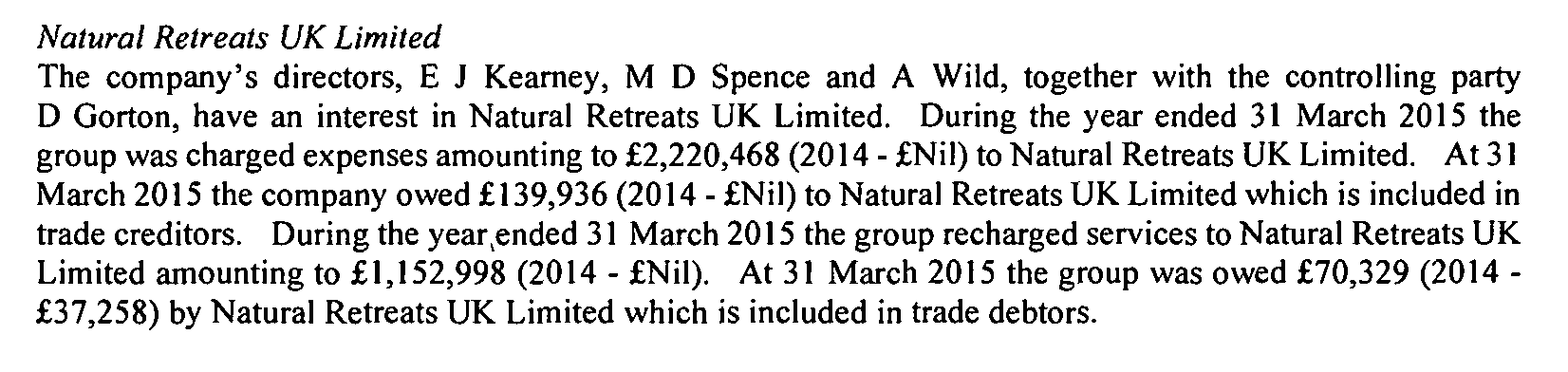

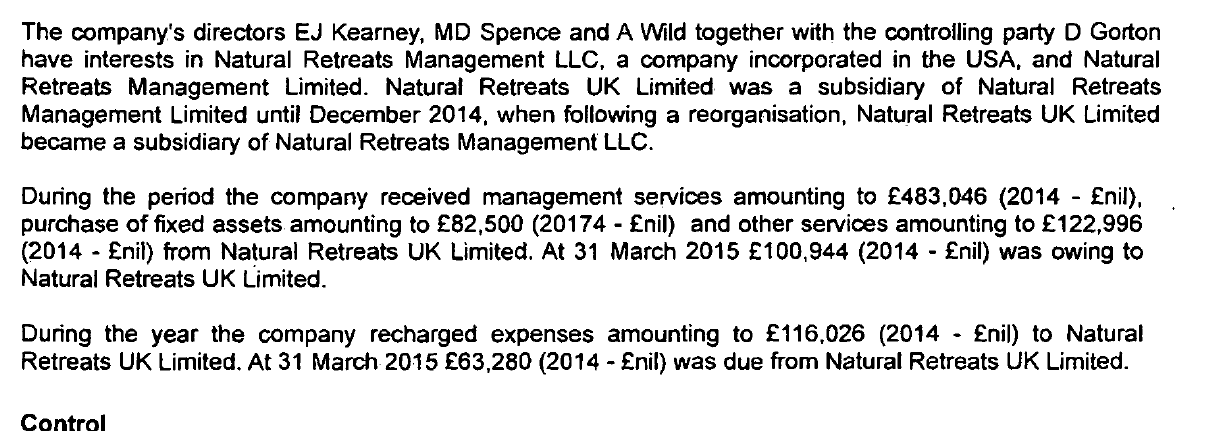

At the same time the administrative expenses recorded in the CML accounts increased by over £300k. There is no explanation of why this is. However, while some administrative expenses (eg designs for the new day lodge which is now off the agenda etc) may have been externally purchased, a large proportion of this administrative expenditure was for “services” purchased from Natural Retreats UK Ltd, with the same four Directors and whose parent company is now located in the USA.

The total services provided by Natural Retreats UK in the first part-year Natural Assets owned CML came to £483,046 management services plus £122,996 in other services – call it £600k or over half of all the administrative expenses. Since the Directors of the two companies are the same they can quite legally set internal charges between the two companies at whatever rate they want. One explanation for the increase in administrative expenses – strange that a company that was so quick to cut costs of sales did not also look at cutting administrative costs – is the Directors have set far higher charges than CML incurred previously for standard services such as bookkeeping. If so, this has had the effect of moving money out of CML to Natural Retreats UK Ltd.

In support of this theory is that while the fees of the Directors at CML decreased by just over £65k

the fees paid to Kearney, Dennis, Wild and Spence at Natural Retreats UK in the year till December 2015 increased by over £73k.

The apparent saving in Directors costs at Cairngorm appears to have been more than offset by increases in fees elswhere within the Natural Assets/Natural Retreats group of companies. And remember these same four directors may also be receiving salaries which do not appear in the accounts. The public should be very sceptical about this representing good value.

Now I have little doubt that what Mr Gorton and the Directors he appoints to carry out his wishes do is all quite legal (the Directors will be employed partly because of their skills in moving money to pay as little tax as legally possible and to extract money out of companies). It is not however good for Cairngorm Mountain, the economy of Speyside or our National Park. The scandal here is that a public agency, HIE, ever decided to sell CML to a company like Natural Assets.

I will cover in a further post about what Natural Assets has actually invested in Cairngorm – Mr Kearney claims this has been £1.3m to date – and their relationship with HIE.

What needs to happen

- The siphoning of money out of Cairngorm, as illustrated by the CML accounts, is not in the public interest and needs to be stopped. Nothing good is going to happen at Cairngorm while a company which is interested only in making money runs it.

- The simplest way of doing this is to terminate the lease with Natural Retreats at Cairngorm. There are a number of grounds for doing so.

- HIE, which is responsible for the knock down sale of CML to Natural Assets should be replaced as landowner of the Cairngorm Mountain Estate as part of the Government review into its future

My comment on your recent post about the enviromental damage to the ski area by Natural Retreats referred to the acccompanying “trashing of the ski-ing”. That was based on my recollections of the continuing declining attraction of Cairngorm as a place to ski. We used to go there a lot – but after our last visit about 4 years ago ) before Natural Retreats took over, it has to be said) decided “never again” – hardly any uplift left and some of it not running when there was no reason why it should. Natural Retreats have just let things continue to deteriorate.

As the article says, many people are now going to Glenshee for the reasons you’ve given. I would love to be able to return to Cairngorm one day, though.